A random walk, a pattern in the making or businesses as usual?

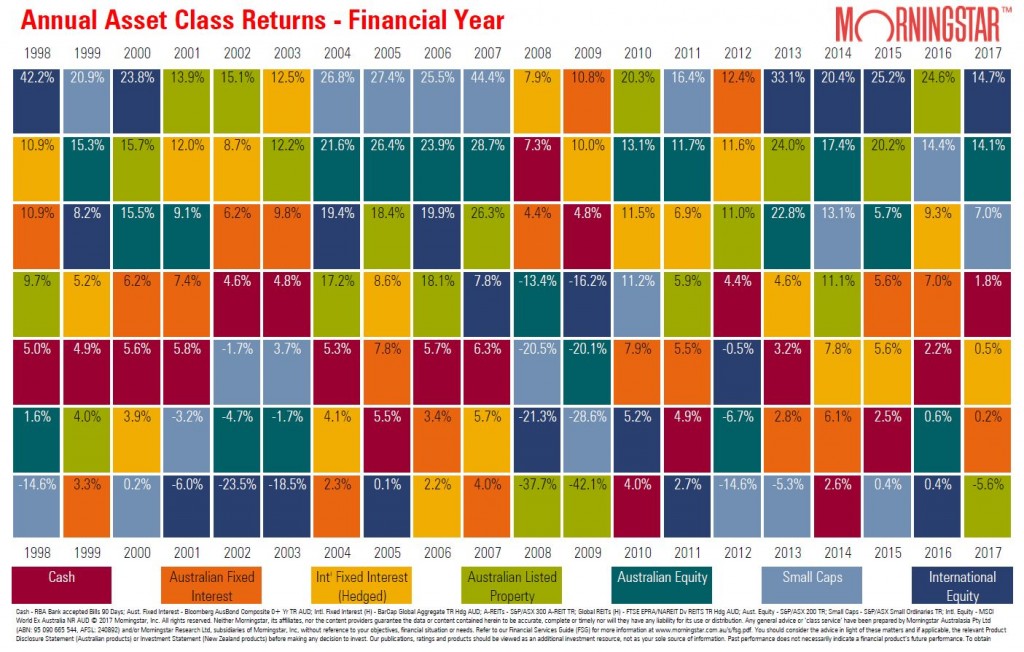

As we pass through another financial year we can stop, record the data and reflect on what has transpired to try make sense of it. Reflecting on this financial year just past, it may be helpful to look at the returns of the major asset classes over this year and then for the last 20. Morningstar produce a neat checker board visual (Chart 1) for each of the major asset classes that Australian investors typically invest in. The glaringly obvious admission here is direct residential property but let’s not let that stop us.

Chart 1

Equity markets were the best performers over the FY 17 with Global equities and Australian equities posting 14.7% and 14.1% respectively. Australian Listed Property Trusts and Australian Fixed Interest on the other hand were the laggards returning -5.6% and 0.2% respectively.

If we take a deeper dive in the Australian equity return of 14.1% and compare it to the last 20 years of returns, then we can make the following observations:

Australian equity return FY17 14.1%

Ave. return over last 20 yrs. 9.0%

Median return over last 20 yrs. 12.4%

Worst 1 yr. return over last 20 yrs. -20.1%

Best 1 yr. return over last 20 yrs. 28.7%

Percentage of negative years 25%

If we do the same comparison for global equities we observe the following:

Global equity return FY17 14.7%

Ave. return over last 20 yrs. 6.85%

Median return over last 20 yrs. 6.50%

Worst 1 yr. return over last 20 yrs. -23.5%

Best 1 yr. return over last 20 yrs. 42.2%

Percentage of negative years 30%

So, under this brief analysis we observe that the FY17 period was a slightly above average period for Australian equities, but noticeably higher from Global equity markets. However, even looking at these averages over a 20 year period may not be a good indication as to what investors can expect going forward.

As I blog here today, valuations across equity markets look somewhat expensive and warrants some level of caution, hence the elevated level of cash holdings within our portfolios. But Australian investors investing off-shore have the current benefit of a strong AUD which allows them the opportunity to buying high quality businesses at lower prices. As value investors we know that prices move more wildly than underlying value, so from year to year it can be a bit of a lottery as to which asset class will be the year’s best and worst performer.

The statement about Australian bonds is, with permission, simply absurd. It does not seem to include corporate bonds, which have in fact done very well. Time and again Australian commentators seem to be unaware of that asset class, but it exists, even in this country, although strangely disregarded and largely unknown to investors here, in contrast to those in more sophisticated markets. In many countries, corporate bonds are a staple of retirement funds, as they are far less risky and volatile than shares. A classic view would be that if you are 75 you should have no more than 25% in equities, and the remainder in fixed interest, notably bonds, amongst which corporate bonds produce the highest return, though with slightly higher risk than “treasuries”, but still much less risk than shares. That is why this kind of formula is so often – and successfully – adopted outside Australia.