A quality business worth consideration

If you’re searching for an undervalued but high quality stock, Henderson Group PLC (ASX: HGG/LN: HGG) may be worth consideration.

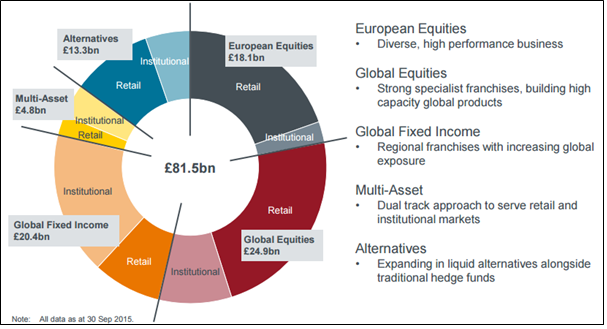

Henderson is a UK based fund manager with 115 strategies in operation and over £81.5b under management. The firm’s products encompass a broad range of investment strategies such as long equities, fixed income (corporate, government etc), private equity and other alternatives. The table below provides an overview of the groups combined portfolio.

Fund managers primarily generate revenue through charging management fees on funds under management (FUM) contributed by investors – hence market moves tend to create volatility in future earnings. By holding a diversified portfolio such as the above, a manager can reduce some of this volatility.

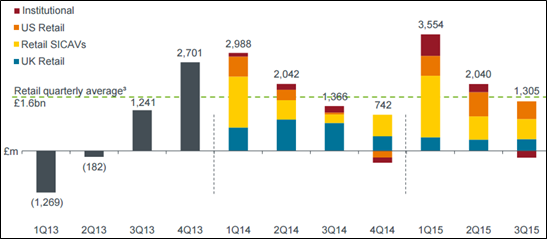

The firm’s earnings power over the last decade has grown significantly as its mix of FUM has moved from being sourced from large institutions to more so UK & European retail investors. The latter party typically pay higher management fees but require little additional expenditure to serve – hence driving up earnings for the manager.

As a funds management business, its intrinsic value rises as FUM rises. This can be driven both via market returns on increased flows of investor capital, a consistent theme for some time now. Flows have increased via Henderson’s expansion of its distribution network in the UK (i.e. relationships with wealth managers, discretionary fund managers and retail platforms) in addition to strong equity market performance.

Of course, this latter variable can be cyclic and hence we value Henderson on the basis of a fraction of its current flows – even this presents its stock trading at a steep discount to its intrinsic value. There are several other drivers of increased net flows both now and on the horizon which are worthy of note. As a UK based funds management firm with a specialisation in European investment, the firm stands to benefit from higher stock and bond prices as a result of the European Central Bank’s quantitative easing program.

There are several other drivers of increased net flows both now and on the horizon which are worthy of note. As a UK based funds management firm with a specialisation in European investment, the firm stands to benefit from higher stock and bond prices as a result of the European Central Bank’s quantitative easing program.

The firm has also invested heavily in an expansion to the US over the last decade. Expansions such as this take time as new funds need to be established, develop strong track records and obtain high ratings by research houses (such as Morning Star) before they can hope to attract flows. Relationships between the new funds, networks of financial planners/advisors must also be established.

As previously noted, our assessment of Henderson indicates that it is trading at a steep discount to its intrinsic value. Despite this, we expect that our shareholding in Henderson over time will likely be more volatile than some of our other investments – as a firm with earnings levered to market performance, this is not unusual. However, its prospects are compelling and financials high quality enough for a place amongst our holdings.

Scott Shuttleworth is an analyst at Montgomery Investment Management. To invest with Montgomery domestically and globally, find out more.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Hi Scott. Thank you for your great article. Is HGG still a quality business and a possible bargain after referendum? Is it still worth consideration while there is no bright view for England ‘ future?

If you believe the issues confronting a company are temporary and yet the price is reflecting the market’s view that they are permanent, an opportunity may indeed be presented.

What did the Montgomery team think of last week’s results from Henderson? Will you be buying more with the stock now trading significantly lower than in recent weeks?

Hi Nathan,

We simply don’t discuss our trading activity.

HGG ,Hi Scott and Roger ,your comment on last nights results would really ,really, really be appreciated . We mere mortals find it hard to navigate through their complicated report. Cheers

We’ll do our best to get some items published here on the blog. Keep in mind our first priority to to you as investors in our funds.

Do you invest in HGG on the ASX, or in GBP?

ASX mike

Hi Scott, thanks for the post.

I just want to say that QE by the ECB is not the same as QE in the US. The ironic thing is that the more QE the ECB does, the higher the US dollar, and the more the USD carry trade to emerging markets (including China) and loans to emerging markets denominated in USD need to be unwound.

Stronger USD has and will have a deflationary effect on world markets.

Kelvin

Hi Kelvin

No QE in European isn’t exactly the same as QE in the US however it is stimulative for stock and bond markets which is the relevant feature for Henderson’s earnings. That’s our thesis however perhaps you have a different view?

I might add that we have a baseline expectation for Henderson which doesn’t include the effects of QE. It’s more of a ‘nice to have’.

Thanks Scott.

I do have a different view about the effect of European QE on stocks – I think it’ll be counterproductive, for the reason explained. The performance of the European banks in the last year bears this out.

Its good to know that your baseline expectation for HGG doesn’t include the effects of QE!

Thanks very much.

Kelvin

Hi Roger, 2 posts as recent as Aug 12 last year and Mar 10 seem to reflect a positive light on Ansell. Are currency movements the only factor in the funds decision to not hold Ansell now?

When we enter a position we do so with the intention of holding for a long period of time. To maintain a position however we require our criteria to also be maintained. As we are looking for quality economics, bright prospects and a rational price, these are the factors that must be maintained in order to continue to hold a position. If any of those three factors change or new information comes to light that changes our view, we will reflect on the holdings and put it up for review. A holding also must be justified against the safety of cash or an alternative investment so if another opportunity presents itself as more attractive, an existing holding may be swapped out. I hope that helps provide some insights into the logic.

Does the Fund still like Ansell?

Hasn’t liked it for a while Richard. So, no.

The position must have been exited post the positive updated provided in August last year given the movement in the USD in isolation against the Euro? But the underlying business you still like?

Skaffold has the intrinsic value at only a small margin above current value in UK, so not sure where the steep discount is? (£2.67 market price to Skaffold value of £2.84).

Can you explain further?

Hi Damien, thanks for your question.

Skaffold is a useful tool but it’s important to note that it uses consensus numbers in it’s valuation. If we disagree with consensus (which we do here) and use different numbers, we get a different result.

Of course, our analysis extends much further than just the valuation. There’s much to Henderson’s prospects which you might find interesting in your analysis.