A pleasing two years for The Montgomery Fund

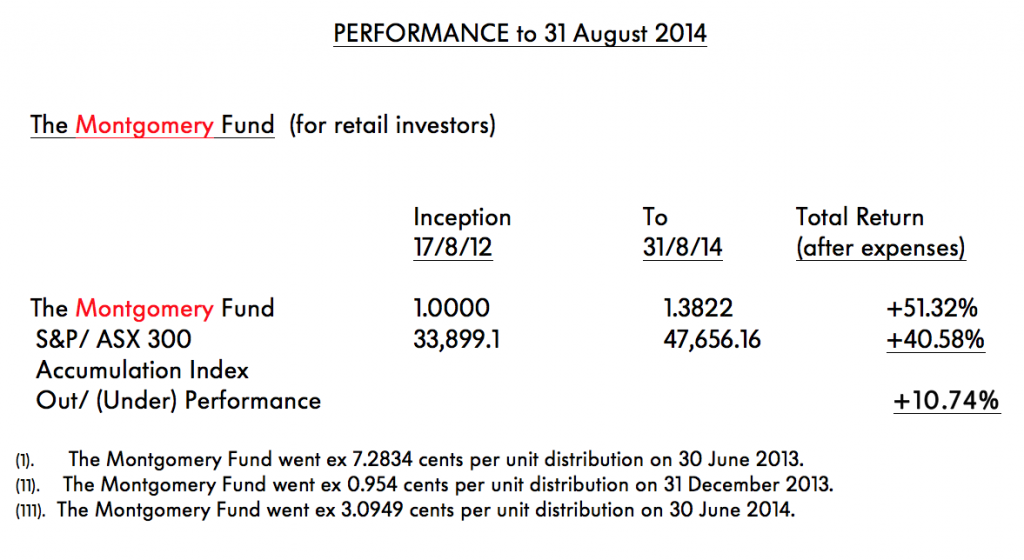

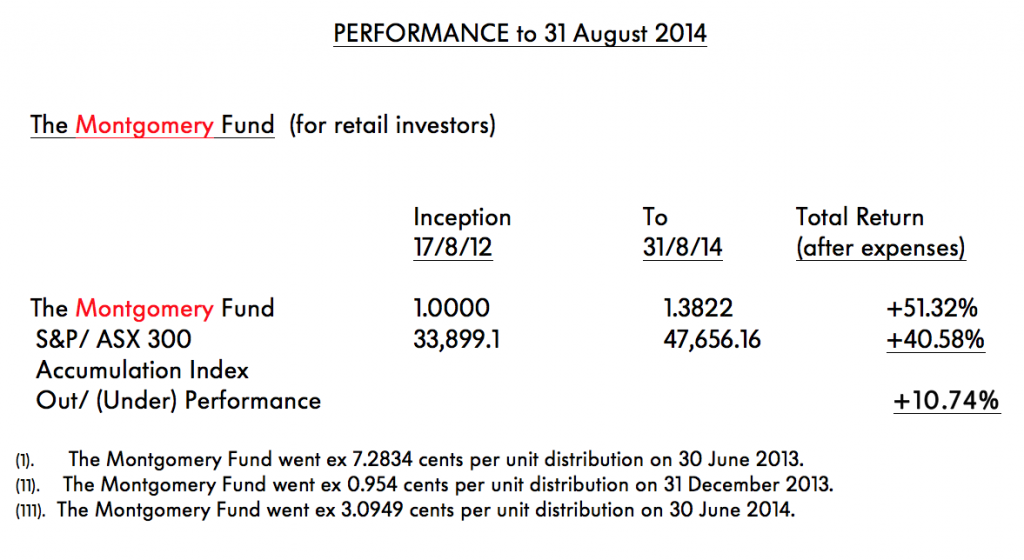

The Montgomery Fund was launched on 17 August 2012, with a minimum initial investment of $25,000, and has just celebrated its second anniversary. In the period to 31 August 2014, The Fund has delivered an absolute return of 51.32 per cent, after expenses.

Over the same period, the S&P/ASX 300 Accumulation Index has delivered a return of 40.58 per cent. The compound annual return from The Montgomery Fund between 17 August 2012 and 31 August 2014 is 22.0 per cent (after expenses), with an outperformance of 4.24 per cent per annum. This has been achieved with The Fund typically holding 20-25 per cent cash.

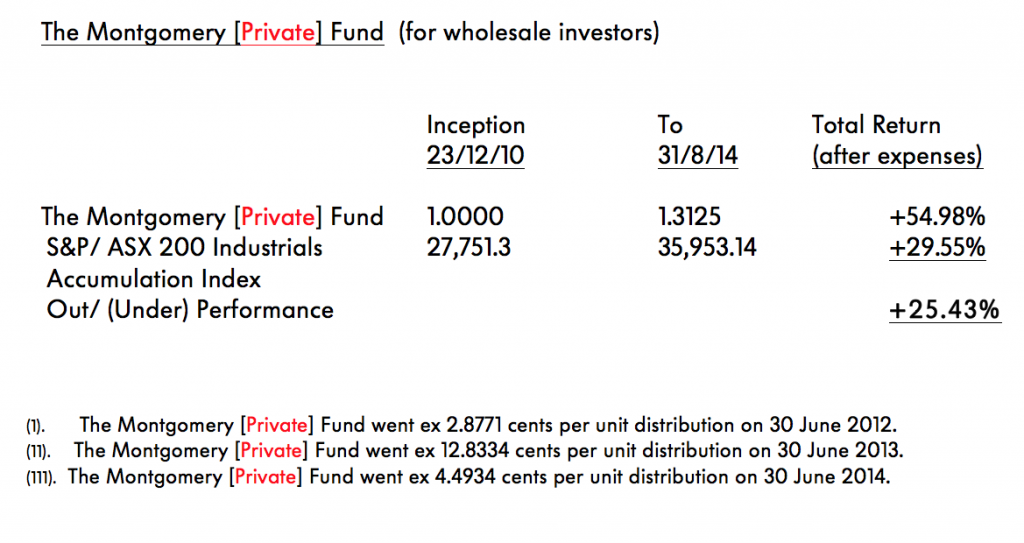

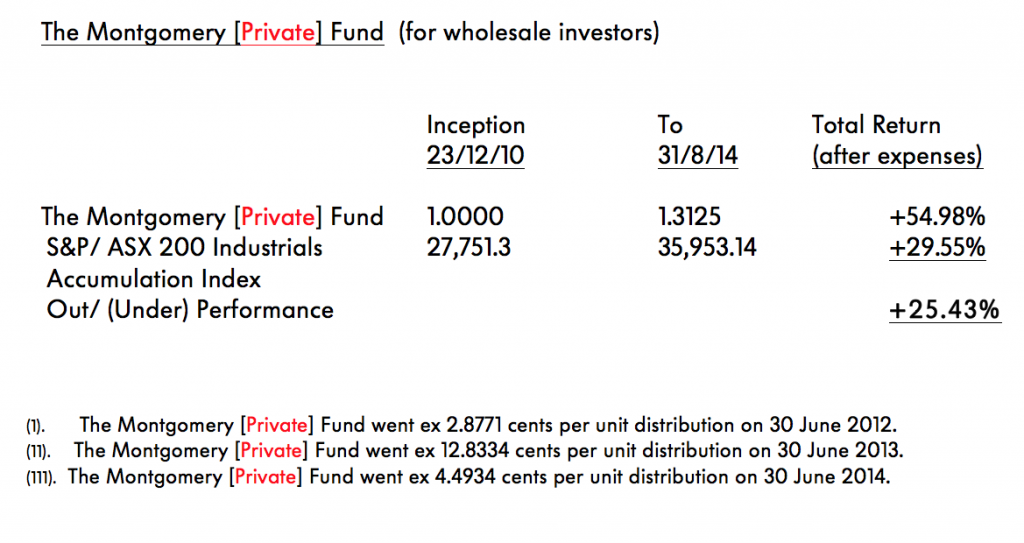

The Montgomery [Private] Fund – launched 23 December 2010 – has returned 54.98 per cent since inception (after expenses). The Fund has outperformed its benchmark, the S&P/ASX 200 Industrials Accumulation Index, by 25.43 per cent – or 5.34 per cent per annum.

MORE BY DavidINVEST WITH MONTGOMERY

Chief Executive Officer of Montgomery Investment Management, David Buckland has over 40 years of industry experience.

David is a deeply knowledgeable and highly experienced financial services executive. Prior to joining Montgomery in 2012, David was CEO and Executive Director of Hunter Hall for 11 years, as well as a Director at JP Morgan in Sydney and London for eight years.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

All looks good Roger.

4 questions from a Perth selfie pensioner working part time:

1. Over similar time frame how much better has the M Private Fund done compared to the M Fund ?

2. Your strategies don’t seem to chase franking credits as much as I have, ever since being told by my anaesthetist colleague in 1987 “It’ll take decades for investors to twig the implications of this”

3. Is there an advantage to starting a LIC along the same lines as the M Fund?

4. When you or one of your team make it over here in person, are you able to let us M Fund investors know where and when you are speaking ?

(one of my fave bands is the M People)

G’day John,

Thanks for the questions. We’ll send you a personal reply.

Hi Roger,

Although not an M fund investor, it would be great to know if there were plans for an LIC and indeed if/when your team might be speaking in Perth. Congratulations also on a great result over the last four years.

Nick.

Thanks Nick. The right time for an LIC to float is rarely if ever the right time for a LIC investor to invest, and so we are unlikely to head down the LIC path any time soon. And there are those attached options….

Congratulations Roger and team. I was late to get in but very happy with the return in what must be tough times for a value investor.

Tony

Fantastic result, Roger…you and your team (and clients!) should be well pleased! May it continue on in such fashion for you guys :)

Thanks Steve.

Thank you to everyone in the Montgomery team, you have all restored a lot of confidence and stability in my investment plans, thank you very much.

Colin Benson

Delighted to be part of your investment journey Colin.

congratulations on the outstanding performances so far in an up market.

really interested to know how the fund performs in a down market.

Thanks ANdy, Take a look at the chart of performance for the Montgomery Private Fund over the last four years. You can see the chart at the top of the blog home page. You will notice the market as had two positive years and two negative years since the inception of the fund, but The Montgomery Private Fund has recorded four positive years. Hope that helps but keep in mind that historical performance is not a reliable guide to the future. ANd don’t forget these performance funds are after fees and with a very high average weighting to cash.

Congratulations. This cannot be achieved without good luck or lots of concerted efforts. Of course, its the later. Pat yourselves on the back. Your endeavours are appreciated.

I am sure all successes have an element of happenstance contributed David. Nevertheless your encouraging words are appreciated.

For pensioners like me, my hearty congratulations to you Roger and your colleagues for exceptional service and absolute honesty to those you serve as Fund manager to the Montgomery Fund. In this climate of dubious advice by some of our banks here, and remembering those inadequate banking staff in the US and the UK. Its a pleasure to have you all looking after us.

Absolutely delighted you have noticed Paul. Thanks for taking the time to write.

From a recently retired worker living off SMSF

A big congratulations to Roger and all of you for the hard work put in to achieve such a great result.

I really appreciate the ongoing education and market updates you send

Thank you all

Regards

Trevor

Thanks for those encouraging words Trevor.