A good deal?

Insurance Australia Group (ASX: IAG) has offered Wesfarmers (ASX: WES) $1.845 billion to acquire its insurance division. Wesfarmers expects to record a pre-tax profit of $700 million on the transaction, but is the purchase just as lucrative for IAG?

For background, IAG specialises in direct and intermediated insurance with the brands NRMA, RACV and CGU (Intermediated insurance refers to policies sold by brokers). Wesfarmers Insurance has a focus on intermediated insurance, primarily in regional and rural areas, and also distributes motor insurance policies through Coles supermarkets.

The division is a natural fit for IAG. It will increase the company’s Gross Written Premium (GWP) by 18 per cent, and management estimate that $140 million of synergies can be realised. But there are two important factors to consider, which may provide more downside, rather than the upside, risk to the acquirers.

The first consideration is the motivation of IAG to acquire Wesfarmers Insurance. The Australian insurance market is mature and dominated by three major players: IAG, QBE and Suncorp. This means that growth, both organic and acquisitive, is hard to come by.

In recent years, Woolworths and Wesfarmers have enjoyed considerable success with motor and home insurance policies offered through their supermarkets. While taking out a growing competitor places IAG in a stronger position, it is important to note that Wesfarmers Insurance was gaining market share at the expense of IAG. This means that the equity that IAG has raised to acquire Wesfarmers Insurance will not be invested at the same rate of return due to cannibalisation. It was a prudent move for IAG management to insulate the company from this threat, but it was an expensive price to pay.

The second thing to consider is the fundamentals of the industry. After several years of headwinds, the insurance industry has experienced more favourable conditions in the 2013 financial year. Natural perils subsided, and IAG released more reserves than expected (insurers must hold reserves against potential claims, and if the claims are less than expected, these reserves are released and realised as profit). These factors contributed to IAG increasing its profit from $207 million in 2012 to $776 million in 2013.

But the sector may normalise in coming years, given that IAG flagged pressures across its core business divisions in its latest annual report:

— Intermediated (Commercial): “The improving business fundamentals are, however, expected to be tempered by strong competition and a flattening of rates across most segments.”

— New Zealand: “Like-for-like GWP growth is expected to continue in FY14, albeit at a lower rate than FY13 as commercial rates flatten and competition remains strong in both commercial and personal lines.”

From most accounts, this appears to be a deal that has been coordinated at the top of the cycle, and, while positive for IAG, the deal may be more about protecting existing value than delivering new value for IAG shareholders.

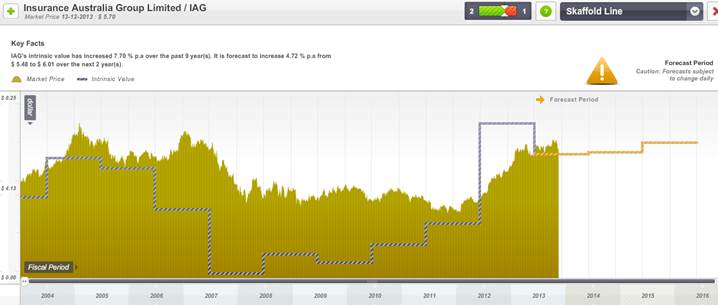

What does this all mean for intrinsic value? To help us answer that question we turn to Skaffold.com which attributes an A2 Quality & Performance score to the company. Prior to the acquisition, Skaffold estimated that the company’s intrinsic value was $5.48, and that it would remain around this level for the next three years. This is another possible indication that IAG is approaching a mature state of growth. As discussed above, while the acquisition of Wesfarmers Insurance is a positive for IAG, it is unlikely to provide sufficient growth to warrant investment at current prices.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Hi Ben,

I’m surprised you didn’t mention anything about the profit of Wesfarmers insurance division over the last few years.

The division had been making losses and only marginally profitable in 2012. 2013 was a good year where profit was around $200m. But given the cyclical and risk nature of insurance, this is hardly a good track record to pay near $2b.

If you discount the 2013 result, what is it worth?? Well south of $1.84 one would think.

I’m hoping the ACCC doesn’t allow it because as an IAG shareholder, I think it is a poor deal.

You should make your thoughts known to IAG management.