A closer look at distributions

It is everyone’s favourite time of year, and for those not in financial services, I am not referring to the peak of winter, I am referring to 30 June. Across the Montgomery suite of strategies, some of our actively managed equity funds will look to pay a distribution come 30 June. Here I summarise some of the finer points to be mindful of as a unit holder in a managed fund, and what this may mean for you.

The basics: what is a distribution?

The distribution of a managed fund refers to the income, or yield, the strategy provides. A vast majority of managed funds in Australia are required to pay out realised earnings to their unit holders, they just choose how often they do so.

So, what do realised earnings consist of? If we look at The Montgomery Fund, our flagship Australian equity strategy, which invests in listed Australian and New Zealand companies, plus cash (0 to 30 per cent), this can include:

- Dividends from the companies we own, both local and foreign. Some of the dividends will of course have a franked component attached.

- Realised gains verses losses. This is inherently more attached to our trading activity. At Montgomery as value investors, we tend to take a medium to longer-term view on our underlying investments. However, things can change in markets as a company reports its earning, as new information is announced or as the share price moves (and the value equation changes), any of which may lead us to unwind a position at a gain or sometimes at a loss. These gains verse losses are accumulated within the trust until the distribution payment period (whether it be quarterly, biannual or annual).

- Finally, the distribution could also include interest accumulated on the cash that the underlying strategy might hold. In the example of The Montgomery Fund, we tend to hold our cash in some liquid cash ETF’s and a rolling range of term deposits (3, 6 or 9 months, as an example). As such, the interest paid on this cash also can be ‘realised’ (or paid to the trust) over the distribution period.

An example of the underlying components of the distribution within The Montgomery Fund

Sourced from Fundhost

| Domestic Income | Australian unfranked dividends |

| Conduit foreign income | |

| Australian franked dividends | |

| Australian interest | |

| Australian other income | |

| Foreign | Foreign dividends |

| Foreign interest | |

| Foreign other income | |

| Capital Gain | Capital gains – non-discount (TARP) |

| Capital gains – non-discount (NTARP) | |

| Capital gains – discount (TARP) | |

| Capital gains – non-discount (NTARP) | |

| Capital gains – concessional (TARP) | |

| Capital gains – concessional (NTARP) | |

The various underlying components, as above in the case of The Montgomery Fund, are represented on a percentage basis so they can be easily reconciled by the unit holders from a tax perspective.

The final distribution is the sum of these underlying components, and is expressed on a cents per unit basis. Like a company listed on the ASX, once the managed fund goes “ex” distribution, the managed fund’s unit price will fall by exactly the amount of the distribution paid.

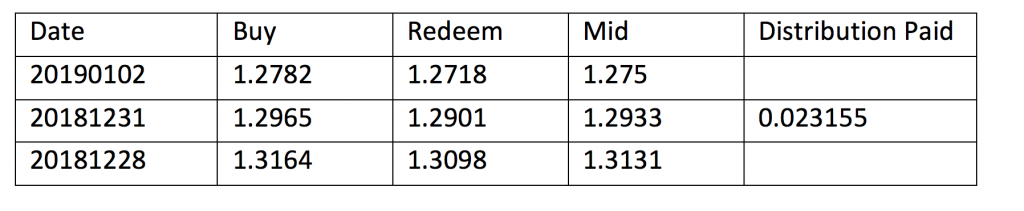

An example of The Montgomery Fund going “ex” distribution

It is important to note there is not pro-rata of the distribution for unit holders, if you were to invest in The Montgomery Fund two days before it goes ex-distribution (say Friday 28 June as an example which is the last working day before 30 June being the next distribution payment date), you would be entitled to the full distribution for the six month period. Conversely, if you sold units prior to 30 June and the underling unit trust was “pregnant” with a franked component, like also for a company listed on the ASX, you would not be entitled to the franking credits given you sold prior to the ex-date.

Below is a list of some of the more frequently asked questions that have come up closer to the distribution ex-date:

Why do the distributions in a managed fund vary so much year to year?

Inherently this is an easy question to answer. As the distribution is the sum of many parts as outlined above, and each part is highly variable, the distribution can therefore vary periodically. Probably the strongest influence on the payment of the distribution is the periodic performance of the underlying investments and trading activity. In the case of The Montgomery Fund, if Australian equities and/or our portfolio is performing negatively over a six-month period, it can mean that there may be no realised earnings to be paid out of the unit trust over the same period (or the next) and therefore no distribution.

Is an investment in a managed fund a poor one if it doesn’t pay a distribution over a given period?

When comparing the performance of any investment, it really should be done in conjunction with the managed funds objective. For an example, the long-only equity managed funds that Montgomery offer look to provide returns (income and growth) above their various benchmarks on an after-fee basis over a five-year period.

As such, if the said investment doesn’t provide one distribution over a six-month period, it may not necessarily warrant a “sell” in this context alone. Also, it is important to note that although the strategy may not pay an income (or yield) over a said period, there still could be corresponding growth attached (i.e. the unit value has appreciated over the same period which would form part of your total return). Investors, of course, could then sell some units to pay themselves an income if needed.

Should I wait until a distribution is paid before adding to my investment?

This would largely depend on your tax circumstances. For individuals or entities that are still assessable from a tax perspective, they may choose to wait until the fund goes ex distribution if the distribution date is close as the income would be taxable in their hands. The opportunity costs here tend to be time out of the market, which in the short-term could work in or against your favour. For retirees, this may not be as much of a consideration. You can read more about the tax treatment of distributions in a managed fund on the ATO website here.

Hi Dean, thanks for writing this article. One thing I am curious about is “deferred income” or “tax deferred amounts” as a line item which appears on many tax statements from managed funds. I think I understand the basic mechanics from a taxpayer point of view, in that although the amount of taxable income reduces in the year that the distribution notice refers to, the tax deferred amount reduces the cost base of the underlying investment, and therefore the CGT will increase when the units are eventually sold?

My main question is where do these tax deferred amounts come from? In my experience from direct investment on the ASX, the companies that deliver returns of capital to shareholders are quite rare: the only example I can think of is Wesfarmers. Are capital returns from the managed fund portfolio the only way that generates deferred income, or are there other mechanisms?

Hi Mark, thanks for taking the time to comment. Your understanding around deferred income is correct. In fact, managed funds don’t create deferred income themselves, it typically comes through an investment in another trust structure (say a property trust, as an example). In the case of The Montgomery Fund, our Australian equity strategy, the deferred income (which is a very small component of the distribution) actually comes from an investment in the Betashares AAA cash ETF which is where we invest a proportion of our cash that we require to be liquid. I have also copied the link to the ATO website which discusses deferred income in more detail below, but sounds as though you’re already all over it! https://www.ato.gov.au/Forms/Personal-investors-guide-to-capital-gains-tax-2018/?page=11. Kind regards, Dean.

Notable by its omission is any mention of CFC income. This is of particular importance to Montaka unitholders as it appears to be taxed at the full rate (ie. no imputation or discount capital gain benefits) and in 2017/18 made up over 90% of the Access fund’s large distribution. It also is the only international fund I’ve ever had that has such a distribution. How about an explanation.

As we have no idea whether an increased unit price of any fund contains realised or unrealised gains, it would be appreciated that when this increase is significant, a rough idea of quantum and type of an upcoming distribution could be made prior to 30 June. While in the minority, other funds have done this in the past.

Hey Graeme, thanks for your comment. CFC income was a deliberate omission as the discussion above relates to The Montgomery Fund, as opposed to Montaka. In the case of Montaka which is very unique in its structure, given the “master fund” is a Cayman Island or offshore trust with primarily Australian investors, CFC rules apply. To quote the Information Memorandum, “If the Montaka Global Offshore Fund is a CFC and the Fund is an attributable taxpayer, then the CFC rules provide that the taxable income of the Fund may include realised gains and undistributed income attributable to investments held by the Montaka Global Offshore Fund.”

In addition to your comment, being a global strategy imputation credits are really miniscule as the strategy has a very slim net exposure to Australian companies in which such credits apply. The delay in the calculation of the distribution more comes down to the complexity of the structure, as above it is not your regular unit trust structure so a more rigorous audit process is applied (which is the same each year). You can read a little more about CFC and the Foreign Investment Fund (FIF) rules via the ATO website below:https://www.ato.gov.au/Forms/Foreign-income-return-form-guide-2018/?page=11.

Otherwise please contact me directly for any further questions. Thanks, Graeme.