A breakdown of the Polen Capital Global Small and Mid Cap Fund

Last week, Scott Phillips and I held a webinar introducing the proposed Polen Capital Global Small and Mid Cap Fund. We were joined by three members from Polen Capital, Paul Williams, Troy Renauld CFA and Rob Forker. Based in Boston, the Polen Capital Small and Mid Cap Growth team is focused on populating the portfolio with the best 25-35 global stocks.

The model portfolio currently has 11 countries of domicile, a weighted average market capitalisation of around US$8 billion (similar size to Seek and Tabcorp Holdings), a market capitalisation which ranges from US$1 billion to US$28 billion, long-term forecast average annual earnings per share growth exceeding 20 per cent, a return on equity of 26 per cent, and superb balance sheets with Net Cash/ EBITDA of 0.6X.

Apart from an excellent 32-year track record, other attributes which help Polen Capital stand out from its competitors includes the very low portfolio turnover, typically less than 20 per cent per annum and their ESG overlay. As was mentioned, the Polen Capital Global Growth Strategy, for example, ranks in the top 5th percentile out of 6,775 Funds in its category ranked by Morningstar.

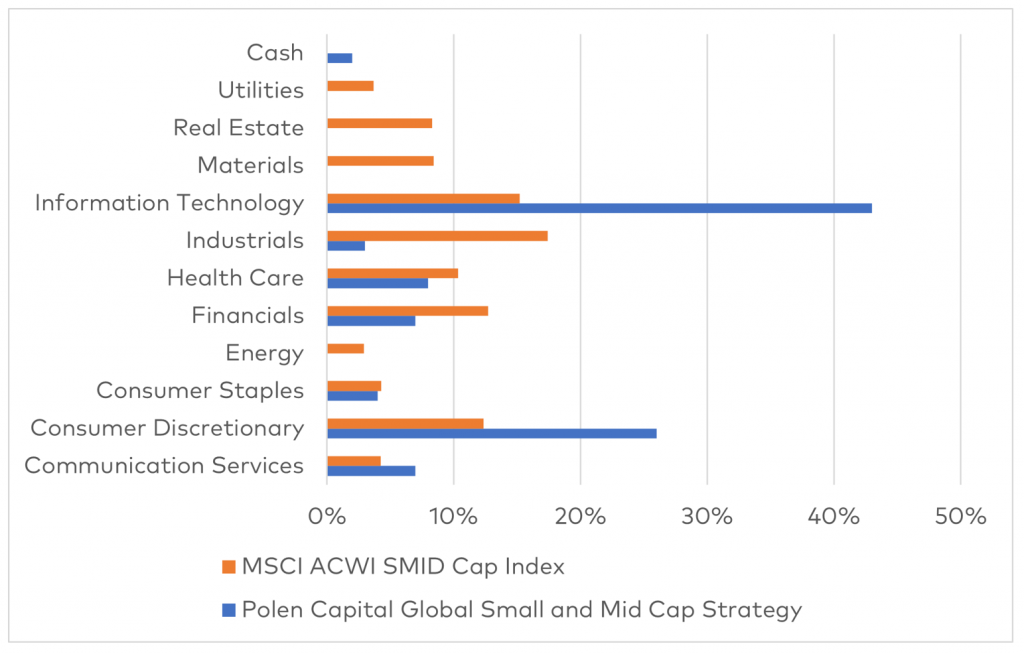

Further analysis of the Polen Capital Global Small and Mid Cap strategy reveals a strong over-weight to Information Technology, Consumer Discretionary and Communications Services. Conversely, the strategy is severely under-weight Industrials, Financials, Real Estate, Energy Materials and Utilities.

Polen Capital Global Small and Mid Cap Strategy sector weights vs MSCI ACWI SMID Cap Index

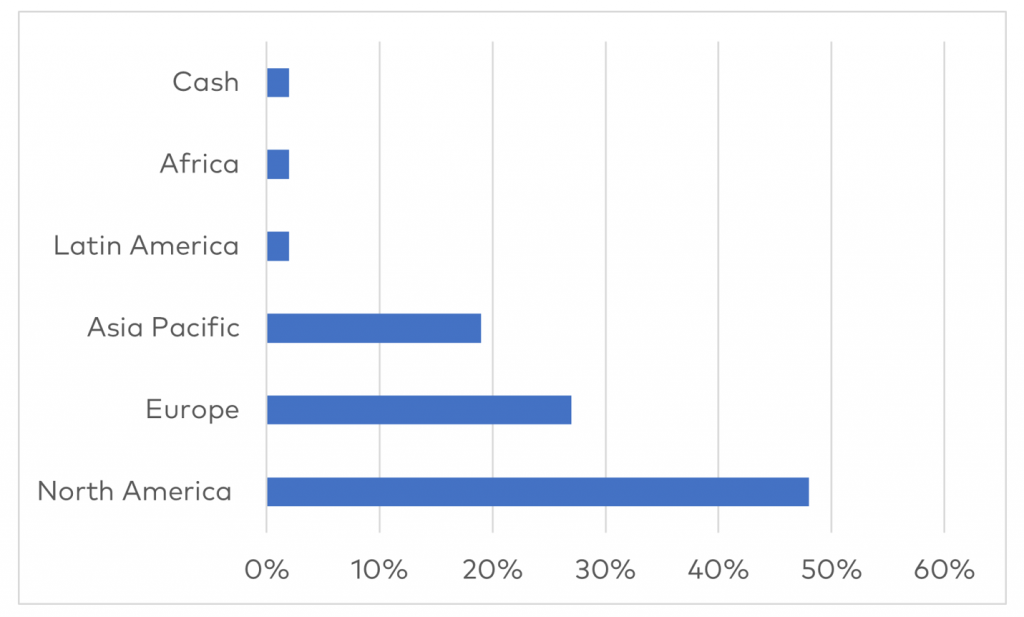

Geographically, nearly half the Fund’s revenue comes from North America, 27 per cent come from Europe and 19 per cent comes from Asia Pacific, including Japan. Around 2 per cent comes from each of Latin America and Africa, and the balance is generally a small cash weighting.

Polen Capital Global Small and Mid Cap Strategy geographic exposure

Readers should be aware there are more than 7,800 stocks across 50 markets in the benchmark, the MSCI All Country World Index SMID Cap, and due the large active “bets” by the Fund there will be periods of relative under-performance, and like all share market investments there will be periods of negative investment returns.

The Portfolio Manager of the Strategy, Rob Forker, stressed that Polen Capital are taking a 5-7 year view on the stocks in the portfolio, and hence only those investors with a longer-term time horizon should consider the Polen Capital Global Small and Mid Cap Fund.

Information packs, including the Product Disclosure Statement and how to apply, will be sent via email with notice of the fund opening. Please register your details if you would like to be updated: Express interest in Polen Capital Small and Mid Cap Fund

You can watch the webinar here:

Introduction to the Polen Capital Global Small and Mid Cap Fund

The issuer of units in the Polen Capital Global Small and Mid Cap Fund (ARSN: 652 035 642) is the Fund’s responsible entity Fundhost Limited (ABN 69 092 517 087) (AFSL: 233045). The Product Disclosure Statement (PDS) contains all of the details of the offer and is expected to be available around 30 September 2021. Copies of the PDS and Target Market Definition (TMD) will be available from Montgomery Investment Management, contactable on (02) 8046 5000 or at www.montinvest.com.

An investment in the Fund must be through a valid paper or online application form accompanying the PDS. Before making any decision to make or hold any investment in the Fund you should consider the PDS and TMD in full. The information provided does not take into account your investment objectives, financial situation or particular needs. You should consider your own investment objectives, financial situation and particular needs before acting upon any information provided and consider seeking advice from a financial advisor if necessary.