Swing at something, ya mug!

You’ve got to give full marks for effort, and love the enduring ability of some people in our industry to come up with reasons for you to trade. I couldn’t contain myself when I read late last week, one pundit’s arguments for “rotating” out of banks and into resources.

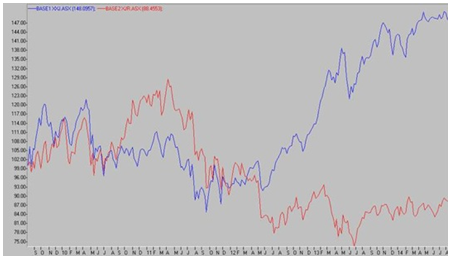

Using the following chart displaying the relative performance of the bank index against the resources index, and citing a strategy of focusing on “multi-year laggards”, the belief was shared that the gap would simply narrow.

It may of course end up proving to be a profitable trade, but it is not one based on any real logic or rational fundamental approach. It is merely another example of A guessing what B, C and D are going to do next – with B, C and D trying to do the same.

Betting on laggards simply because they’ve lagged is tantamount to betting on a Volkswagen Kombi winning a race against a Ferrari, simply because the Kombi hasn’t won any races yet. It’s the purest form of betting on short-term popularity and the farthest thing from long-term business-like investing that I have seen in the last… oh, I don’t know – day or two!

Last week in our Video Insight series, Andy Macken noted that each of the world’s major iron ore producers released their June quarter production numbers, which revealed very strong supply-side growth rates. Vale and Rio were up 12 per cent on the same period the year before. BHP grew production 19 per cent, and FMG grew production by 82 per cent (admittedly off a relatively lower base). Meanwhile, demand is growing by about 2 per cent. When supply growth outstrips demand growth (which it has done all year) the commodity price falls (again, as it has done all year). These dynamics are unlikely to change any time soon.

The banks are expensive, no doubt, but rotating into businesses with few valuable competitive advantages or those without the ability to charge higher prices in the face of excess supply is not making your money work harder, it’s just attempting to earn danger money.

Hi Roger,

Kudos for calling out this shonky research/spruiking for what it really is. Mind boggling when you consider the complete lack of thought process at play. Keep up the good work.

Tim

Hi Roger

Just been reading Matthew Kidman’s book Bulls, Bears and a Croupier. When you realise there are so many different types of market participants playing so many different games, it is not hard to understand why prices, movements and trends can be so skittishly unpredictable. You just have to adopt a philosophy or game that resonates with you and only change if it is not producing the results you want. Margin of safety seems so important at the end of the day, but it’s not of concern to so many participants.

Thanks Jim, Pages pp173-176 are useful. For those who haven’t purchased the book you can read the extract from those pages (with permission) here: http://rogermontgomery.com/another-aussie-investing-classic/