Shadows from the Chinese property market

Representatives from Deutsche Bank recently visited several companies in China, and concerns over the slowing property market dominated discussions with the predominately bearish outlook for steel consumption and production.

There was a view as much as 40 million tonnes of Chinese steel production was under-reported in 2013; pushing the actual production to 820 million tonnes, or just over 50 per cent of global steel production.

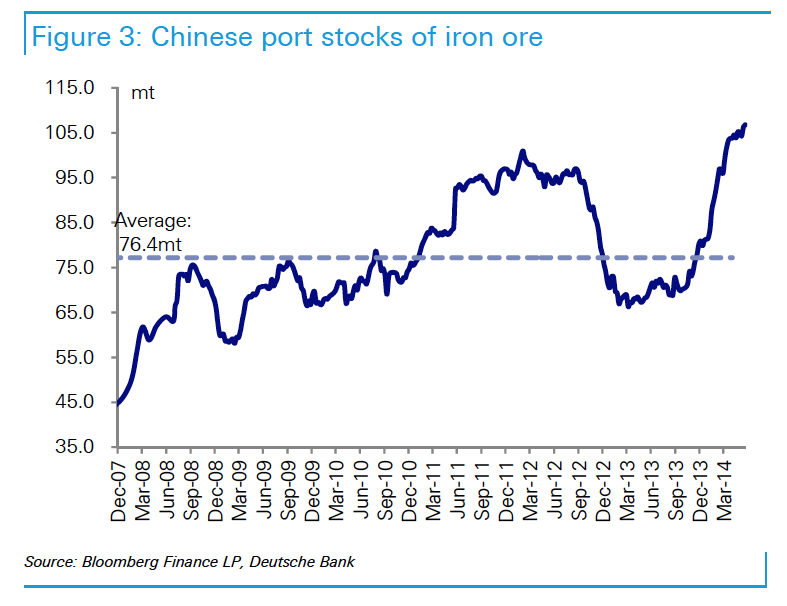

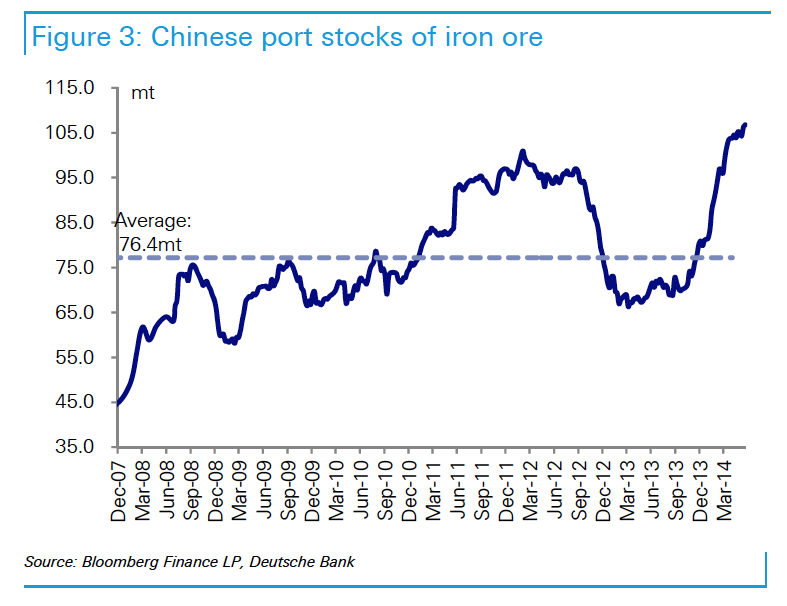

This view helps to explain the decline in the Chinese port stocks of iron ore in 2013, as illustrated below, as well as the bounce in the iron ore price to average US$131/tonne for the year.

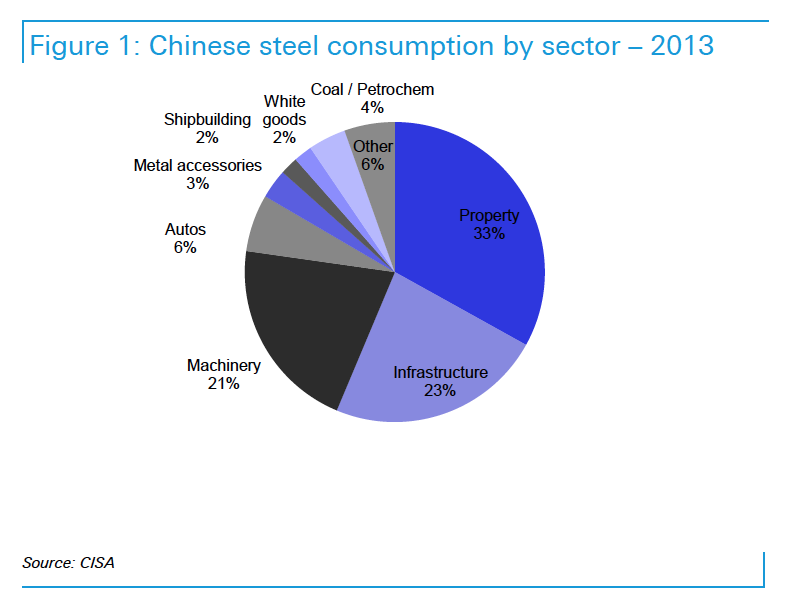

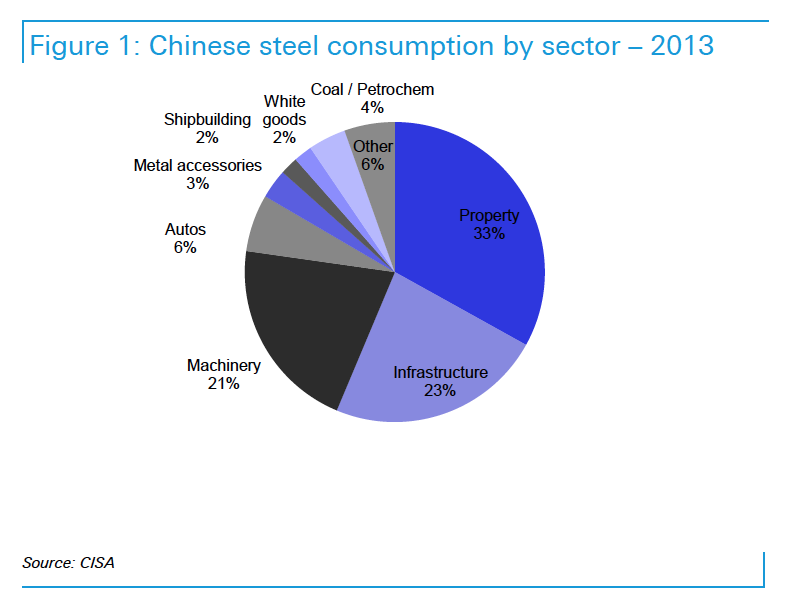

With 33 per cent of China’s steel going to the property sector, it’s unsurprising inventory levels of iron ore at Chinese ports have risen dramatically in recent months.

And in all likelihood, as inventory levels continue to rise, we at Montgomery Investment Management expect the iron ore price to challenge the September 2012 low of US$87/tonne in the near future.

MORE BY DavidINVEST WITH MONTGOMERY

Chief Executive Officer of Montgomery Investment Management, David Buckland has over 40 years of industry experience.

David is a deeply knowledgeable and highly experienced financial services executive. Prior to joining Montgomery in 2012, David was CEO and Executive Director of Hunter Hall for 11 years, as well as a Director at JP Morgan in Sydney and London for eight years.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

Roger, I am not sure does China produce or inport its steel

It produces plenty Paul.