Beijing’s Big Bad Banks, Part II

On Wednesday, we compared the performance of China’s Shanghai Composite Index with the US S&P 500 over the seven years to December 2013 (see here). China’s investment-driven, debt-fuelled strategy has seen poor performance from several listed companies, many of which are controlled by the state. And the threat of rising bad debts, particularly in the so-called shadow-banking sector, is yet to play out.

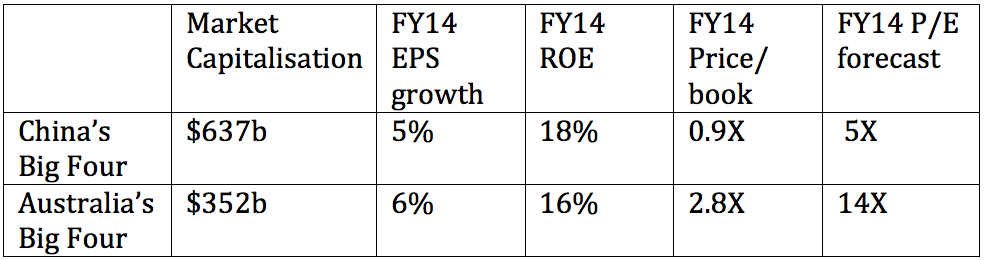

As discussed yesterday, China’s four major listed banks – Agricultural Bank of China, Bank of China, China Construction Bank and ICBC – have a combined market capitalisation of US$637 billion, forecast a 5 per cent growth in earnings per share and an 18 per cent return on equity for FY14. They sell at a forecast 0.9 times book value; have 5 times the prospective price-earnings ratio and a 6.2 per cent dividend yield.

For context, I thought it would be useful to compare these fundamentals with those of Australia’s four major banks. ANZ, Commonwealth Bank, National Australia Bank and Westpac have a combined market capitalisation of US$352 billion, forecast a 6 per cent growth in earnings per share and a 16 per cent return on equity for FY14. Selling at a forecast 2.8 times book value and 14 times the prospective price-earnings ratio.

Table 1: China’s four major listed banks V Australia’s four major listed banks

The Chinese banks are selling on an average dividend yield of 6.2 per cent, while the average dividend yield for the four major Australian banks is 5.4 per cent.

Interestingly, the major Australian banks are selling at an approximate 3:1 ratio in terms of the forecast FY14 price by book value, and the prospective FY14 price-earnings multiple. This is relative to the Chinese banks – despite the fact that projected earnings per share growth and forecast return on equity is similar.

Hi David, that’s very interesting. Thank you.

Are you saying that Chinese banks are a buy?

Kind regards,

Kelvin

Hi Kelvin,

assuming China’s major banks have the same or better return on equity, EPS growth and dividend yield, then they appear cheap given Australia’s major banks are selling on a 3 times ratio in terms of price/NTA and PE.

David