The Australian based gas exporters (Part 3)

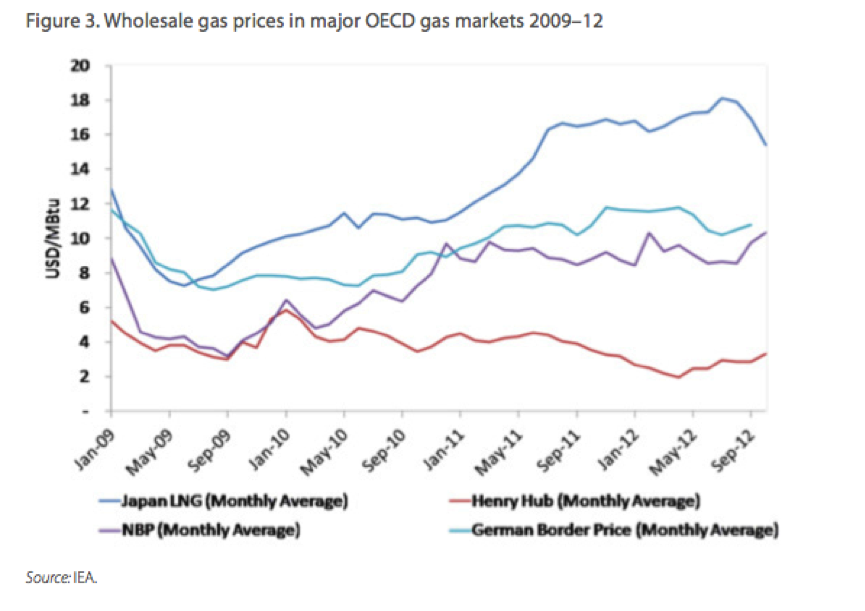

The Fukushima nuclear disaster in March 2011 has seen Japan become the world’s largest LNG buyer, with its gas demand boosted by nearly 25 per cent after shutdown of all nuclear power generating capacity. As the chart below shows, this has seen the Japanese LNG monthly average price move up to around US$16-$18 per million British thermal units (MBtu).

While Australia has benefited, Japan is about to sign with three LNG handling terminals in the US to start shale exports of almost 20 million tonnes per annum (mtpa) from 2017. This means the US, traditionally an energy importer, will soon become a competitor in the export LNG market. For context, Japan and South Korea combined import 120 mtpa.

The Japanese are trying to change the pricing model for LNG. Rather than being linked to the oil price index, they instead want to base it partly on the US domestic gas price – as measured by the so-called Henry Hub price. This has fallen to multi year lows at around US$3.50 per MBtu – see chart below – as the US shale gas boom has opened up vast reserves of LNG. Even adding the cost of liquefaction, shipping and regasification, the US landed price could potentially arrive at a significant discount to the current Japanese import price.

So what is the Henry Hub price? The Henry Hub itself is located in Louisiana, near the US Gulf Coast, and is the site where a number of major interstate gas pipelines converge and large storage facilities are close at hand. It is a major trading point for the physical delivery of gas and the major marker price for North American gas.

The Henry Hub price is the major reference for the NYMEX gas futures market. BP Singapore is currently negotiating to supply a Japanese customer at a gas price linked to the Henry Hub price, even though the gas may not be supplied from the USA.

Asian LNG buyers are naturally encouraging greater supply from the US, Canada and Russia. Australian producers, which currently sell 70 per cent of their LNG exports to Japan, will be watching this space with interest.

Click the following links to read Part 1 and Part 2 of this series on Australian gas exports.

The us price is 25% of the Aus export price, this has the potential to hit Govt tax receipts in the future. It will help to make US Busines more competitive.