The Australian Based Gas Exporters

There are seven Australian based LNG projects coming on stream over the next five years, which have a combined capacity of 83.2 billion cubic metres (bcm) and account for around 60 per cent of the 138 bcm under construction worldwide. These are:

| Project | Million Metric Tonnes | Billion Cubic Metres | Number of Trains | Major Owners | Expected to Commence |

| Queensland Curtis CSG to LNG | 8.5 | 11.6 | 2 | BG, CNOOC, Tokyo Gas | 2014/2015 |

| Gorgon LNG | 15.6 | 20.4 | 3 | Chevron, Shell, Exxon Mobil | 2015/2016 |

| Gladstone CSG to LNG | 7.8 | 10.6 | 2 | Santos, Petronas, Total, Kogas | 2015/2016 |

| Australia Pacific CSG to LNG | 9.0 | 12.2 | 2 | Conoco Phillips, Origin, Sinopec | 2015/2016 |

| Wheatstone | 8.9 | 12.1 | 2 | Chevron, Apache, KUFPEC, Shell | 2016/2017 |

| Prelude Floating | 3.6 | 4.9 | 1 | Shell, Inpex, Kogas, PCP | 2017 |

| Ichthys | 8.4 | 11.4 | 2 | Inpex, Total | 2017/2018 |

| TOTAL | 61.8 | 83.2 |

The current crop of LNG projects under construction represents a combined $188b in investment, and aggregate revenue from LNG is expected to increase five fold over the next five years to at least $60 billion per annum.

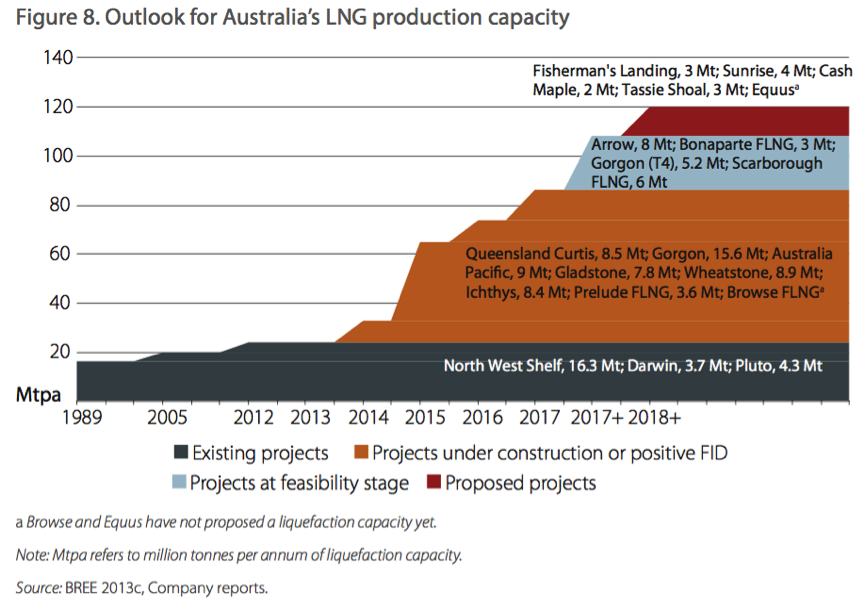

As illustrated below, The Bureau of Resources and Energy Economics believes Australia’s LNG production could jump from 20 mtpa currently to 100-110 mtpa by 2020. Asian buyers realise Australia and Qatar could each represent 20 per cent of LNG exports by the end of this decade and are encouraging greater supply from the US, Canada and Russia.

Australian LNG projects are now costing close to US$1,500/tonne of capacity, compared to US$200/tonne in the year 2000 and US$600-$900/tonne in the US. The total cost estimate for Gorgon has increased from US$37b in September 2009 to US$65.6b now. Unless the industry cost structure changes and productivity improves, there are unlikely to be any new offshore “green field” LNG projects, except for Floating LNG facilities.

For example, the Arrow joint venture between Shell and PetroChina, which was proposing an 18mtpa facility costing $24 billion at Queensland’s Curtis Island, is now unlikely to proceed – and instead the partners will probably look to share the processing facility at Australia Pacific (see above table) in return for surety of gas supply and possible equity.