Decoys and lame ducks – why EV incentives miss the emissions problem

Having returned to work after a little rest and respite, I was recently confronted, nay, berated, by headlines about Labor’s deal to slash borrowing costs for electric vehicles (EVs) as it scrambles to meet climate targets.

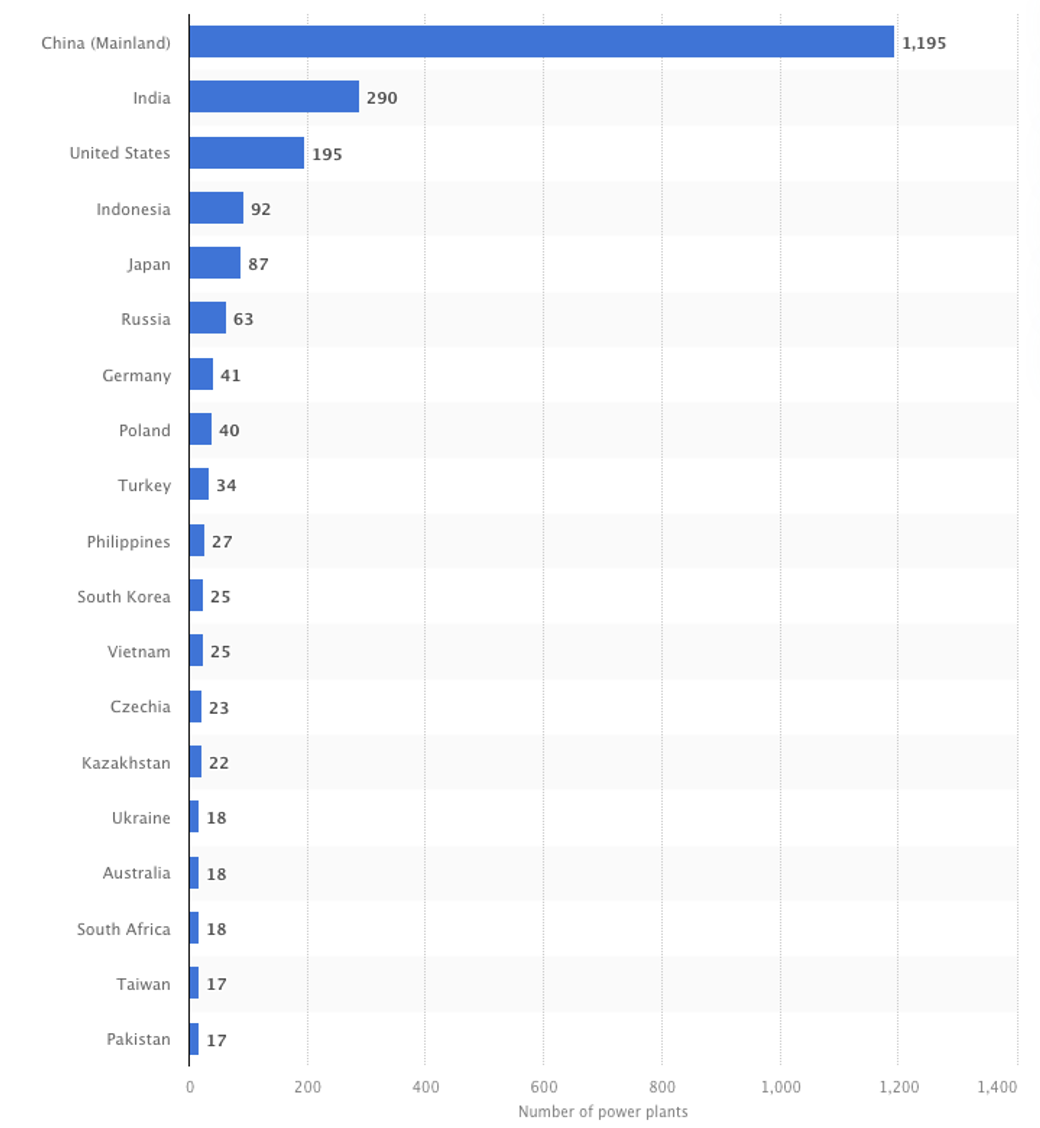

While I was away, I saw the chart in Figure 1 and immediately realised the futility of our efforts to influence the global climate, concluding that Labor’s schemes appear to be driven by ideology rather than evidence.

Figure 1. Operational coal-fired power plants as at July 2025

Source: Statista

I could be wrong, but it’s hard to be convinced that a loan scheme to make a maximum of 30,000 financed Hyundai and Kia vehicles, about $1,900 cheaper, will make any difference to global climate change.

There are about 20 million registered vehicles on Australia’s roads, and just more than 72 per cent are petrol, 26 per cent are diesel, and only two per cent are electric, so the scheme will make little if any contribution anytime soon to the emissions by Australia’s vehicle fleet.

And then, just 17-18 per cent of Australia’s emissions come from transport.

Electricity production in Australia is the biggest emission contributor, responsible for 50 per cent of emissions (and Labor’s funding more electric vehicles!), but our coal-fired power plants represent just 0.8 per cent (less than 1 per cent) of the total 19 countries in Figure 1. – and an even smaller percentage of the global total.

So, Labor’s scheme does really seem infinitesimally minute in terms of impact on global climate change. I’m not sure why so much is being made of it.