Cracks in the foundation – Australia’s growing housing crisis

Last week, I attended an Australian housing market update from Eliza Owen, Head of Research at Cotality (formerly Core Logic). Below are some key insights that I thought were worth highlighting.

High property values but deepening mortgage pressure

Australia’s residential real estate is currently valued at around A$11.5 trillion. There are 11.3 million dwellings, with an average value of just over A$1.0 million each. Outstanding mortgage debt is A$2.4 trillion, a sector debt to value ratio of only 21 per cent. However, given Australian household debt is elevated, there are many individual mortgage holders that are struggling.

Real estate towering over superannuation and stocks

The current value of Australia’s residential real estste (A$11.5 trillion) is 2.8x the Australian Superannuation pool (of A$4.1 trillion) and 3.4x the value of Australian listed companies (of A$3.4 trillion) – which goes to show Australia’s obsession with house prices.

Sales volatility and the impact of interest rates

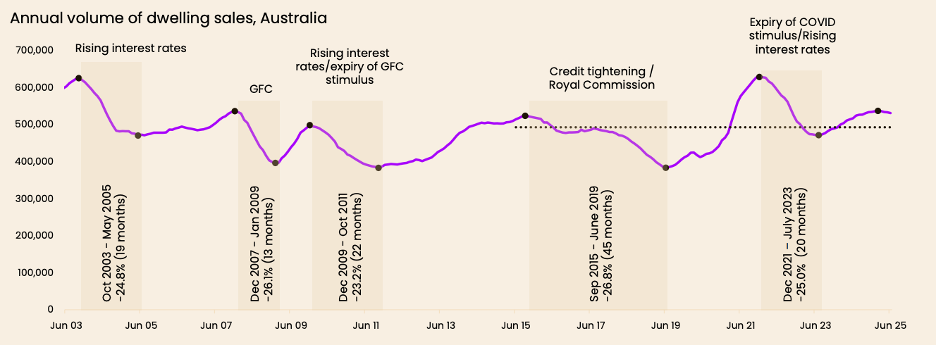

Total dwelling sales are around an annual 530,000, or 4.7 per cent of the stock of residential properties. There have been five periods of peaking to trough sales volume declines of around 25 per cent over the past 25 years. Apart from the 2007-2009 Global Financial Crisis (GFC) and the 2015-2019 credit tightening period on the back of the Hayne Royal Commission, the volume declines typically coincide with solidly rising interest rates.

Graph 1. Annual volume of dwelling sales, Australia

Source: Coality

Vacancies tighten, rent growth slows

Vacancy rates in Australia’s capital cities at 1.5 per cent compare with the 10-year average of 2.6 per cent, and the enormous rental growth of around 8-10 per cent per annum from 2020-2024 is now starting to decelerate to 3-4 per cent per annum. This is coinciding with net immigration to Australia easing a little.

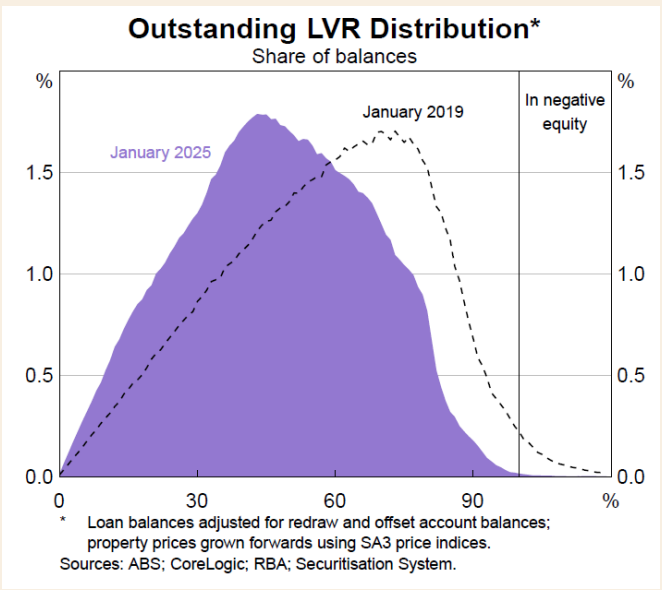

A look at mortgage arrears and negative equity positions

Mortgage arrears are low with 1.7 per cent of loans either nonperforming (1.1 per cent) or 30+days past due (0.7 per cent). Currently, less than one percent of households is in a negative equity position, where their loans exceed the value of their residence. Back in 2019, this figure was above 6 per cent, and this shift largely reflects the solid rising residential property values and relatively low unemployment rate.

Graph 2: Only a small percentage of loans are in negative equity

Source: Cotality, RBA Financial Stability Review

Rate cuts set to ease affordability pressures

With the Reserve Bank of Australia’s (RBA) cash rate expected to decline by 1.25 per cent to 3.1 per cent over the year to February 2026 (0.25 per cent in each of February and May 2025, and 0.25 per cent forecast to come in each of August 2025, November 2025 and February 2026), housing will become more affordable.

Auction clearance rates rise, but affordability is still a challenge

Auction clearance rates picked up after the May 2025 rate cut (0.25 per cent to 3.85 percent) and at around 70 per cent it is now tracking above the ten-year average of 64 per cent. Unfortunately, the extraordinarily high prices relative to income mean housing remains unaffordable for many.

Final thoughts

Australia’s housing market remains a pillar of national wealth, but its foundations are cracking. Unless deeper structural issues are addressed, the gap between property wealth and accessibility will worsen.