Artificial Intelligence is reshaping investment portfolios

With a new financial year comes the chance to reset and consider if there’s any reason to expect forces shaping the previous year to fade away. The process might even throw up a completely new interpretation of what’s going on, as it has for me.

This article was first published in The Australian on 3 July 2025.

Between bipolar U.S. foreign and domestic policy shifts, trade tensions and geopolitical upheaval, investors might feel the world’s been turned upside down. But let’s take a step back and ask, is this chaos persistent, or is there a more important structural shift occurring behind all the noise?

Perhaps more importantly, does the first and second stage of artificial intelligence’s rollout represent a force that might replace – or at least upset – the role of conventional macroeconomic indicators such as inflation and Gross Domestic Product (GDP) as the appropriate guides for portfolio construction and expected returns?

When thinking strategically, as opposed to tactically (that’s where quality, growth and value come in), I for one have used a combination of inflation, GDP and liquidity as a guide to what might happen next. Those anchors offered a sense of where markets were headed. But just because something often works doesn’t mean it always works.

Inflation is no longer tethered to that 2 per cent sweet spot, fiscal restraint is looking like a distant memory, and even the U.S. Federal Reserve’s independence feels less certain as Donald Trump jawbones the need for a chair sympathetic to his desires. Indeed, the U.S. President’s wish for lower rates now and higher rates later, if needed, points to a future defined by more volatility.

Add in U.S. tariffs and geopolitical fragmentation and realignment, such as the ongoing Ukraine war and Middle East tensions, and you’ve got a recipe for uncertainty.

Yet, here’s the thing: Markets haven’t tanked. U.S. equities are holding up, at least for now, and risk assets are shrugging off the headlines. Why? One reason is that the global economy doesn’t flip overnight – well, not usually. Economic laws, like gravity, still hold, keeping policy shifts from upending everything immediately. That’s probably why many investors are bullish on risk assets, especially stocks, for the near term. But long term? That’s where influences like Artificial Intelligence (AI) might be shifting the bedrock of modern portfolio and economic theories.

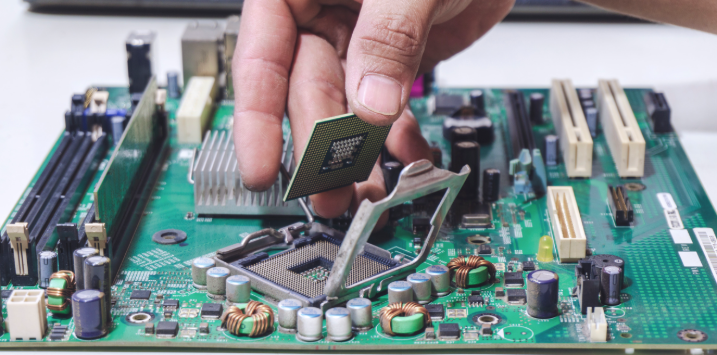

If traditional macro anchors are fading in influence, it may be because AI is stepping in with a shiny new promise of higher returns. And what if AI isn’t just the latest tech, but a megatrend reshaping the economy, how we power cities, and how we secure our way of life? The AI build-out is currently in overdrive, with Big Tech “hyperscalers” pouring billions of dollars into data centres, R&D and infrastructure. Meanwhile, first-quarter earnings for the S&P 500 in 2025 blew past expectations, with tech leading the pack. Even the “Magnificent Seven” tech giants (Alphabet, Apple, Microsoft, Nvidia, Amazon, Tesla and Meta), despite recent dips, are bouncing back as investors reward their hefty AI investments.

Admittedly, there’s potentially some exuberance creeping in. Companies such as nLight, Aeva Tech and Ouster in the US have rallied by at least 200 per cent since the April 9 lows, despite the fact they’re unprofitable.

But AI doesn’t work in a vacuum. The demand for AI infrastructure is pushing power grids to their limits, sparking investment in utilities and even nuclear energy. Meanwhile, governments are steering capital towards critical tech and energy security, especially as US policies tighten controls on AI-related tech. This may not just be a tech story, it could genuinely be a portfolio game-changer.

Admittedly, navigating markets currently feels like paddling up a creek without a paddle. Buying a 60/40 stock and bond portfolio and waiting for bonds to cushion equity dips may not cut it any more. Markets are more volatile, and static bets on growth or value will probably backfire, too. And for those who want to eschew volatility completely, there’s now private credit to consider.

So, where do we go from here? Private markets will become an even more important feature of portfolios in the future. Did you know only about 20 per cent of U.S. companies are publicly listed? That’s a drop of 35 per cent since 2000. Consequently, public markets are more concentrated, which is another reason to expect more volatility there. Private equity, however, comes with its own liquidity challenges, and the need to balance factor exposures carefully, but private assets – whether that’s private equity or private credit or both – are fast becoming a critical piece of the portfolio pie.

Meanwhile, the economic transformation fuelled by AI, energy needs, and geopolitical shifts isn’t slowing down. Inflation’s sticky, due to tariffs and a still tight U.S. labour market, which means those hoping solely for rate cuts to fuel broad equity market gains might be waiting a while. But the beauty of this current regime is the opportunity it creates. And keeping an eye on AI’s evolution, capital spending trends, and policy shifts will be necessary to capitalise on that opportunity. AI is increasingly looking like a structural shift, rather than a blip. It could just be a new compass for investors, as well as a source of returns that will be costly to ignore.

This article was first published in The Australian on 3 July 2025.

Disclaimer:

The Polen Capital Global Growth Fund owns shares in Amazon, Alphabet and Microsoft. This article was prepared 3 July 2025 with the information we have today, and our view may change. It does not constitute formal advice or professional investment advice. If you wish to trade any of these companies you should seek financial advice.

Hello Roger

People get excited by new technology. Today it’s AI. Through history we’ve had air travel, automobiles and the internet, to name a few examples. It has been pointed out at times that just because we’ve got exciting new technology, it doesn’t automatically follow as investors we can make money from it.

Investors always need to be aware valuations matter and when markets move to speculation, there invariably will be a reckoning day. Share prices can never, over the long-term, divorce themselves from the underlying fundamentals. We know in the short-term though strange things can happen!

I use Pro Medicus as an example, which is now an established company. All the fundamentals point to this being a great company. Its margins have expanded. It still appears to be growing at a very high rate. However, its PE has been driven through the roof. What room does it have to move? I wish I’d been on board for the ride, but as an investor I just have to admit I missed it and have to leave it. It’s not to say it’s going to collapse, but you would suspect there’s going to be an extended period where it will level out or fall back, and therefore difficult to make gains for shareholders. Valuations matter.

Rgds, Wes Horn.

Thanks Wes, That has indeed been our message here for 15 years. Your Pro Mediucs example is a good one.

We started here with the term “game Changer” in 2013: https://rogermontgomery.com/what-is-a-game-changer/

And this 2015 article in the OZ, explains the risk of investing in history-making tech, referring to TVs, Cars and Commercial air travel: https://rogermontgomery.com/wp-content/uploads/2018/04/The-Australian_07-04-2018_Main_Australian_p33.pdf

Investors in AI may yet find their returns hobbled by ubiquity and commoditisation.