G8 Education Update

Since we wrote our first post here, G8 Education (ASX: GEM) has continued to be very active on the financing and acquisition front. We have adjusted our timeline of events for 2013 below to incorporate the new developments:

2013

6 February – raised $35m in equity @ $1.45 to fund more acquisitions

19 February – bought 12 centres for $18.7m @ 4xEBIT

8 March – bought 5 centres for $6.4m @ 4xEBIT

15 April – bought 2 centres for $4.8m @ 4xEBIT

30 April – bought 3 centres for $3.3m @ 4xEBIT

11 June – bought 17 centres for $24m @ 4xEBIT

7 August – raised $70m senior unsecured notes to fund more acquisitions

26 August – bought 5 centres for $4.6m @ 4xEBIT

27 September – bought 29 centres for $42.6m @ 4xEBIT

1 October – raised $80.6m in equity @ $3.10 to fund more acquisitions

So far in 2013, GEM has raised $185.6m in debt and equity, and has acquired 73 education centres – spending $104.4m. This level of investment is a record for the business in any one financial period, and as we can see below, the trend in recent years is accelerating.

• 2011 calendar year – estimated incremental investment totalled $23.8m

• 2012 calendar year – estimated incremental investment totalled $67.8m

• 2013 calendar year (to date) – estimated incremental investment totalled $104.4m

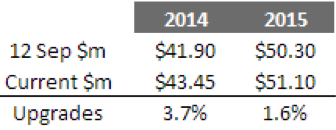

In 2011, 2012 and 2013 combined, we estimate that GEM has made $196m in childcare centre purchases. If we now apply our 20.87 per cent after tax return equity assumption (based on a calculation we detailed previously here) this equates to an NPAT run-rate of $40.9m ($196m*20.87%). Let’s compare this to consensus estimates as they stand today:

The past few weeks have seen small earnings upgrades and the 2014 forecast shown above is effectively only assuming that $2.55m ($43.45m-$40.9m) in additional NPAT will be generated on top of what has already been acquired. We believe this is conservative.

Let’s consider the simple facts for a moment.

We note that the trend in centre acquisitions is accelerating. Furthermore, the current balance sheet has ~$50-$100m of available funding for additional acquisitions, given the recent financing activities and internally generated cash flows. Management has stated future deployed capital will range from $65m as a “floor” to $100m as “not unrealistic”.

With less than 4% market share, GEM’s roll up prospectus remains intact.

Whether or not analysts are unwilling to incorporate additional acquisitions into their future assumptions is a question worth asking. Based on the above however, we believe future upgrades will likely be a regular feature of GEM’s earnings forecasts in the periods ahead.

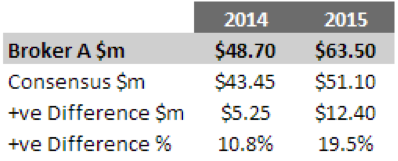

A sign those regular upgrades will flow came from a recent broker report (we will call them broker A) which landed in our inbox this week with the following assumptions modelled:

As shown, and based on a similar scenario analysis to ours, the market is recognising GEM’s ability to deploy incremental capital.

And given management is diligent in only paying 4xEBIT, as it stands we are confident that time will continue to be a friend to a strongly growing business such as GEM.

We continue to be supportive of management by way of a large holding in our portfolios at Montgomery Investment Management and will continue to provide updates on the business as and when new information comes to hand.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

hi Roger,

I refer you to there last 2 announcements 11/12 and 13/12 , 14c divvy and payout is no more then 65% of NPAT , so does that mean EPS will be 21c , given us a npat of about 62m ? , just going along with g8 asx announcements.

Big difference to the broker consensus.

Hi Eddie

G8’s payout ratio can actually be expected to be around 86.7%. They are taking into account a theoretical 25% participation in the dividend reinvestment plan when they state a 65% policy of cash distributions. This is consistent with NPAT around the $49-$50m mark for FY14, although as Roger suggests, there is upside potential.

Hi Roger , affinity education (AFJ) just listed today , very similar company to g8 ,what’s your thoughts on AFJ ,

Prefer G8

I know you were critical of ABC paying too much for acquisitions. And G8 have much more strict acquisition rules.

I’ve been giving this a bit more thought, wearing my (retired) real estate project manager’s hat.

At 25% nett ROI, these are clearly leasehold, not freehold, concerns or possibly not even that. Perhaps they are “management rights” or “licensee”contracts and presumably with one or many individuals or companies on the other side of these agreements. In which case the entire company has its security and future tied to the strength of these agreements, the circumstances under which they may be altered or terminated, and the future beyond their nominal expiry dates.

It is these questions that have me eyebrow-raising. .

Sure, its not an asset deal. They need a clean deal so a purchase of the business rather than the premises seems logical.

Hi Roger,

Been following G8 becoz of comments from your team. Confused as to why Skaf’s IV is $1.65 while you guys says it still has value at 3.35 with prospects of $4.00.

B’rgds . Ron

Thats a simple one to answer Ron; Ignoring even the most optimistic brokers forecasts and being much more bullish about earnings growth, produces higher valuation estimates. Please be aware we could be wrong or the US defaults and share prices around the world halve and you might be glad you went with a more conservative estimate.

Considering that this blog is open for all to read and is not just for Skaffold owners might the author have been wise to include a small additional sentence along the lines of: “Whilst we’re excited about this company, and have made a significant investment of our funds in it, we have to state that at current prices it is trading, on our estimates, very significantly above its intrinsic value – so some caution and your own detailed investigation is warranted and advised.”

Well said Kim.

thanks again for your informative analysis, GEM is one of my largest holdings since getting onboard in Jan 2013 at $1.59.

Also pleasing to know as an investor in Mont. Funds that I have a duplicate holding.

Did Mont. Funds only get in on the capital raising or did you already have them?

Very interested to hear that you like BGL.

Regards

Thanks for your comments Jeff. Removed a reference that I didn’t follow.

One thing I don’t understand is your calculations base earnings forecasts on NPAT for the company but due to managements conservative methods they have engaged in numerous capital raisings, so whilst NPAT is increasing rapidly, will EPS growth not be much slow due to the dilutive effects of these capital raisings?

Also what is your opinion on G8 paying a quarterly dividend yet engaging in capital raisings? Wouldn’t it be much simpler if G8 didn’t pay these dividends and didn’t engage in as many raisings, especially from a non institutional point of view where we are not able to partake in these raisings and purchase shares at a discount to market price.

You raise some valid points Matthew that are worth factoring in to the time horizon question…

It’s hard to beat a good roll up story I think Russell.

Let’s hope the management team has a better grasp of this kind of business than did a certain Eddie Groves. To procure 73 centres in 7 or 8 months at claimed returns of 25% sounds extremely eyebrow-raising to me. Are all the expenses carefully factored in? Is the company’s admin truly up to the task? Let’s hope so.

Good comments David. Thank you.