The need to differentiate between the severity of recessions

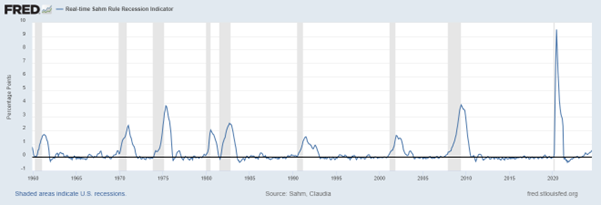

The Sahm Recession Indicator has signalled nine of the previous U.S. recessions over the past 65 years, and the move to 0.53 per cent in July 2024 is now pointing to the tenth. The indicator signals the start of a recession when the three-month moving average of the U.S. national unemployment rate (U-3) rises by 0.50 per cent or more relative to the minimum of the three-month average from the preceding 12 months.

For example, the minimum U.S. unemployment rate for the three-month average during the year to June 2024 was 3.67 per cent (recorded in the three months to January 2024). The figure for three-month moving average to July 2024 was 4.20 per cent, a difference of 0.53 per cent.

The Bureau of Labour Statistics (BLS) has just announced 818,000 fewer jobs than previously stated for the year to March 2024, a 0.5 per cent downward revision, the largest since 2009.

Apart from the COVID-19 related scare when the Sahm Recession Indicator shot up in April 2020, the last time the indicator passed above 0.50 was in April 2008 over 16 years ago – the ensuing period became known as the Global Financial Crisis.

If we were to use the same indicator for a recession in Australia, a spike in the unemployment rate from the current 4.2 per cent to 4.4 per cent would be sufficient to start ringing the bells. I suspect this will occur over the next few months given the recently reported weakness from the NAB Business Survey, particularly within the retail and hospitality sectors, as well as the softer recent data from Seek.

That said, investors should be aware that relatively shallow recessions (as distinct from deep recessions) don’t necessarily spell trouble for share market performance, especially if Central Banks become focused, as they now are, on easing interest rates.

|

Country |

Official Cash Rate Peak (per cent) |

Date(s) of Easing |

Current Official Cash Rate (per cent) |

|

Switzerland |

1.75 |

21/3/24, 20/6/24 |

1.25 |

|

Sweden |

4.00 |

8/5/24 |

3.75 |

|

ECB |

4.50 |

6/6/24 |

4.25 |

|

UK |

5.25 |

1/8/24 |

5.00 |

|

Canada |

5.00 |

5/6/24, 24/7/24 |

4.50 |

|

New Zealand |

5.50 |

14/8/25 |

5.25 |

And as members of the US Federal Reserve send strong signals, they will commence cutting interest rates from the current 5.25% to 5.50% range at their next meeting in four weeks, it is unsurprising some stock market indexes are challenging their record highs.

It is important to remind readers the “recession we had to have” in the early-1990s saw the Australian unemployment rate and the official cash rate both exceed 10 per cent, and I believe that deep recession will most likely prove an outlier.