One big question – who prevails?

After the recent setback in prices from record highs, many investors wonder whether mega-cap U.S. technology company shares continue to slide, dragging down with them the main indices in which they represent a significant proportion, whether they merely underperform non-technology companies or smaller companies, or whether they return to leading a charge higher in both absolute and relative terms.

Having admitted forecasting is difficult, especially forecasting the future, it may be helpful to make some observations about U.S. technology stocks.

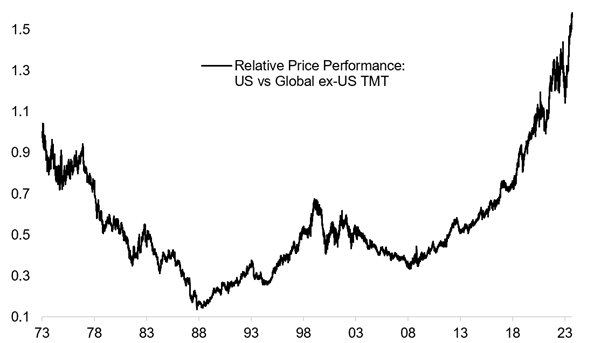

The first is that collectively, they have never been more highly prized by global investors. As Figure 1 reveals, U.S. technology stocks are more expensive compared to their global peers than at any time at least in my lifetime.

Figure 1. Relative price of U.S. versus global tech, media and telecom (TMT) stocks

Source: Refinitiv, Datastream, Topdowncharts

While many point out the pandemic sent tech stocks soaring, Figure 1 demonstrates that FANG stocks, which include Facebook (NASDAQ:META), Amazon (NASDAQ:AMZN), Netflix (NASDAQ:NFLX), Google (NASDAQ:GOOG), Microsoft (NASDAQ:MSFT), and Apple (NASDAQ:AAPL), have been soaring since the global financial crisis (GFC) in 2008. According to Factset, the S&P500 now trades (July 26, 2024) on a one-year forward price-to-earnings (P/E) ratio of 20.6, above its five-year average of 19.3 and above the ten-year average of 17.9 times earnings.

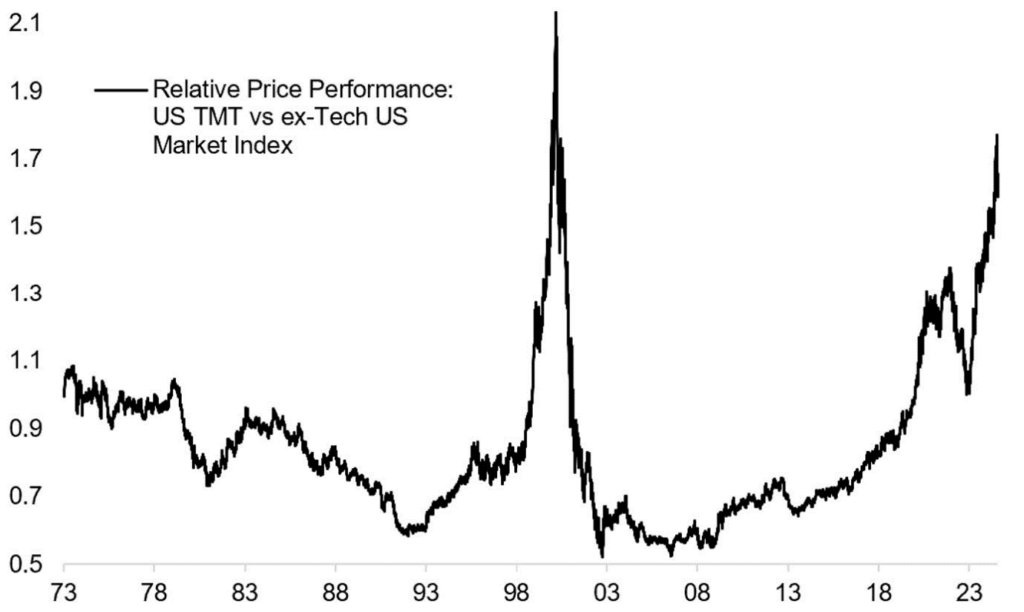

Since 2008, U.S. technology media and telecommunications (TMT) companies have also performed far better than their non-tech peers, as Figure 2., reveals.

Figure 2. U.S. Tech versus the rest of the market

Source: London Stock Exchange, Topdown charts

While part of the reason for their popularity is perceived safety amid fears of a recession, their P/E multiples also reflect some fundamental truths about the U.S. versus the rest of the world. And these truths may be perceived as even more valuable amid the threat of heightened geopolitical tensions. They include America being the largest economy in the world (and more resilient because exports account for only 12 per cent of gross domestic product (GDP), having the most desirable demographics of any developed nation, measurably the most productive labour force, the most arable land of any country, and being the world’s largest exporter of agricultural commodities and the largest producer and exporter of oil and gas. At 20 million barrels per day, it is also the world’s biggest oil and gas producer and exporter, with Saudi Arabia at number two with 12 million.

Having the deepest capital markets, and some of the best tertiary institutions in the world, have helped the U.S. become the world leader in Research & Development (reportedly spending US$879 billion last year – more than the next five countries combined), which, in turn, has put the U.S. at the forefront of technical innovation.

Tech stocks are usually considered high-risk investments. The flood of cheap money during the pandemic, however, period afforded investors the opportunity to chase high returns in tech stocks (and even crypto) by borrowing at all-time low interest rates.

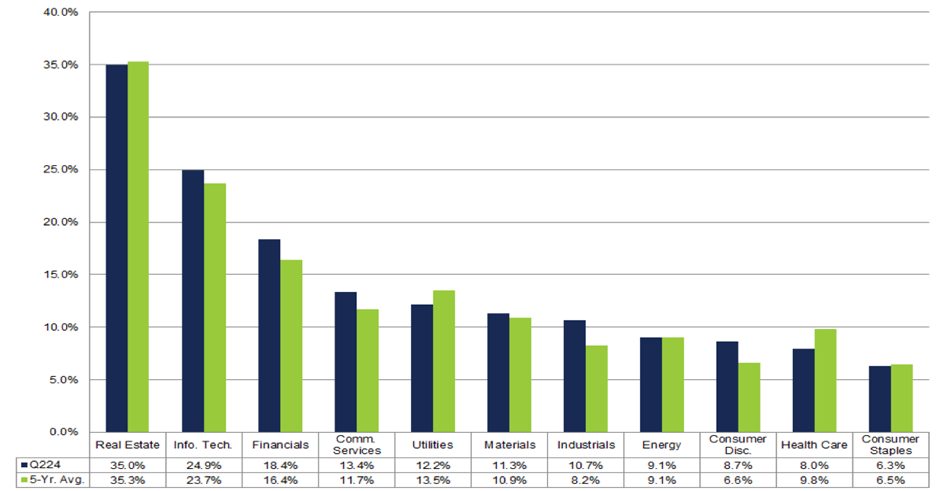

As Figure 3., reveals, the technology sector of the U.S. also offers investors access to the second-highest net profit margins

Figure 3. S&P 500 Sector-level net profit margins: Q2 2024 v 5-year average

Source: Facset

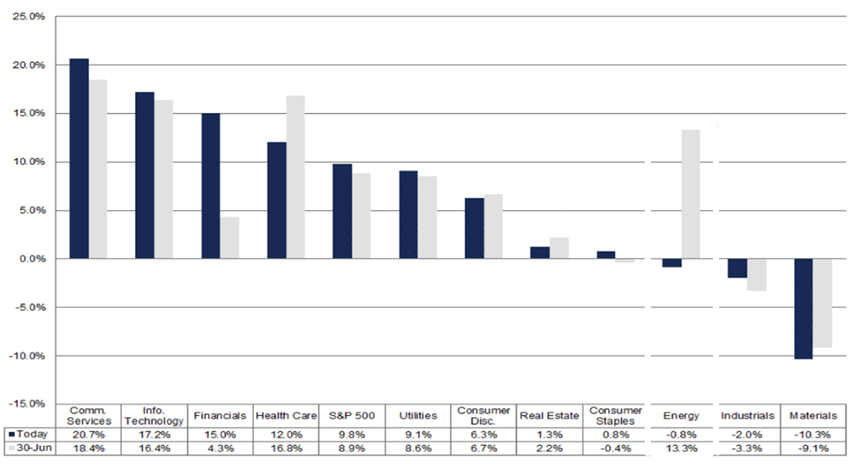

Figure 4 also reveals that communications and information technology sectors provide investors with access to the highest rates of earning growth, something always prized by investors because it ensures the preservation of purchasing power (beating inflation).

Figure 4. S&P 500 Q2’24 forecast earnings growth 30 June’24 v 26 July ‘24

Source: Facset

Figure 4., reveals analysts forecast the highest earnings growth (more than 15 per cent) for communications and technology companies, and well above earnings growth predicted for other sectors such as industrials, discretionary consumer stocks, or even healthcare.

Figure 4., and Figure 3., help explain why U.S. technology stocks are performing better than their non-tech U.S. peers.

We should point out that their economic performance also justifies their relative popularity. The best businesses to own are those with the highest sustainable returns on equity, and high returns on equity can only be sustained by a competitive advantage. The most valuable competitive advantage is the ability to raise prices without a detrimental impact on unit sales volume. Companies like Meta, Google, Microsoft and Apple have broken the mould in terms of economic performance. As they have raised prices, their return on equity (ROE) rises. They become even more profitable as they get bigger. That’s the opposite of what was taught at business school in decades past – that as a company became bigger and competition entered a market, the company’s profitability mean reverted.

By way of example, in the last two quarters, Spotify has added millions of new subscribers even as it raised prices and introduces an even higher premium tier.

There are fundamental reasons why U.S. technology has performed so well on a relative basis and why they remain relatively popular investments today. Understanding what happens next, on an absolute basis, would require the ability to predict share prices, and nobody can do that accurately and consistently.

U.S. technology companies continue to offer the best growth prospects and superior economics. They are domiciled in a country with arguably the strongest economics, demographics, and economic resilience. On that basis, they should remain desirable. Whether their share prices reflect their relative desirability will ultimately come down to sentiment, and predicting sentiment is a fool’s errand.

For what it is worth, there is a better relative value and equally attractive earnings growth prospects among a select number of innovative small-cap companies both domestically and in the U.S. The Montgomery Small Companies Fund and the Polen Capital Global Small and Mid Cap Fund are both focused on identifying and owning these businesses.

Generally speaking, markets appear to now be fully priced for the U.S. Federal Reserve (Fed) to commence cutting rates in September, if not before. This has helped fuel a rotation of funds out of the U.S. mega-cap tech stocks and into small caps. In the last month, the Russell 2000 Index – an index of U.S. small caps – has jumped 10 per cent compared to a flat return for the S&P 500 Index. And over the last week, the small cap index is up 3.5 per cent, while the S&P500 is down 1.5 per cent.

Provided economic growth remains positive, and disinflation prevails, we could see a group of carefully selected small caps challenge the mega caps for great relative returns over the next 12 to 18 months.

Ultimately, it will come down to sentiment.