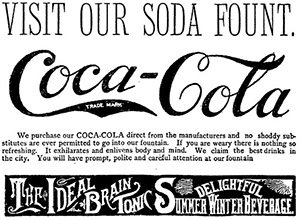

Has Coke lost its fizz?

Interesting to see the commentary around Coca-Cola Amatil Limited’s (ASX:CCL) 1H profit result yesterday. CCL has an impressive track record of profit growth, but expectations for the full year are for a slight decline on FY12.

When a traditionally strong business disappoints, a very good way for an investor to spend some time is in working out whether the disappointment reflects a permanent or a temporary effect. The latter is often a good buying opportunity.

In the case of CCL, one might wonder whether increasing recognition of the health costs of sugary soft drinks might have caught up with them, leading to a permanent curtailment of growth. For now, however, that view appears to overestimate the consumer’s interest in health: CCL reports that the non-grocery business continues to perform well, and the problem is isolated to the grocery channel.

This raises questions of whether the negotiating power of Woolworths and Coles in Australia is now sufficient to squeeze the excess returns out of a brand as strong as Coke. This could also be a permanent effect, but it doesn’t appear to be the main issue here. While EBITDA trends between the supermarkets and FMCG suppliers and wholesalers have been diverging for some time, nothing has happened more recently to materially increase the power of Woolworths and Coles, and, more importantly, CCL has identified discounting by Schweppes, which has slashed prices in recent times to promote Pepsi Next, as its greatest concern.

We suspect that this will be a temporary effect. If Pepsi discounts in an attempt to take share, it is strategically sensible for Coke to respond with its own aggressive discounting. This results in short term pain for both parties, but avoids bigger long-term problems for Coke. If Pepsi was allowed to grow share with unchallenged discounting this year, you can imagine what their strategy would look like next year, and the year after.

On that basis, there may be better times ahead for CCL, and the recent price decline might just represent an opportunity for patient investors. If, on the other hand, you believe CCA’s bargaining power is permanently impaired, even patience won’t mitigate the risk of further losses.

CCL is a resilient innovative business with significant competitive advantages primarily being the strength and breadth of their brand portfolio (check their market share with AC Nielsen) and it’s distribution reach and sales execution. The Pepsi out of stock situation observed by Andrew is not always a positive indicator of brand preference sometimes (not always) it can be as a result of a “loss leader” price or just poor execution by the brand owner or their customers, “out of stock” is considered to be a cardinal sin within CCL and one which ranks at the top of any salesman’s “immediate action”list. The current issue I believe relates more to the aggressiveness of the major Foodstore retailers in their quest to compete with one another, squeezing supplier margins in the process, together with a softening of consumer off take in traditional on premise outlets i.e. Food courts etc. This is not the first time CCL has had to contend with these challenges and it will not be the last, however with their wealth of experience and adaptability they will overcome and return to growth as I have seen them do on a number of occasions in the past, and I for one intend to hold on to my CCL shares.

Thanks for those insights Ron and welcome back.

I think they do much more than Coke ! http://ccamatil.com/OurBrands/Pages/Australia.aspx

And this fact sheet shows their rising earnings over the years and their market share across various market segments.

http://ccamatil.com/InvestorRelations/Documents/2012%20CCA%20Fact%20Book.pdf

I am not a current shareholder but looking to enter but as per my IV calculations (using ROE of 25% and investor’s return of 10%) it is valued around $9 for 2013 and going above $10 by 2015 only.Therefore, it still needs to fall a bit more to make for a value investing opportunity though, in my opinion.

Not sure what Skaffold’s current calculation of the IV is for CCL?

Thanks for the insights and links Vish…

..If you’re not sure Andrew, sounds like it might be both?