Discretionary spending is under pressure

The restaurant and cafe segment of the hospitality industry holds some sway with government, with its 110,000 venues generating $64 billion in annual revenue. Additionally, it is one of the country’s largest employers of young people. With tougher trading conditions, increasing rents and costs of inputs, the sector is facing unprecedented challenges.

Under a banner of “enough is enough” and calls for government change, the recently formed Australian Restaurant and Cafe Association (ARCA), intends pushing the case of restaurants and cafes to the government on a range of issues, from skilled worker immigration, wages, and tax, right down to micro issues such as outdoor dining.

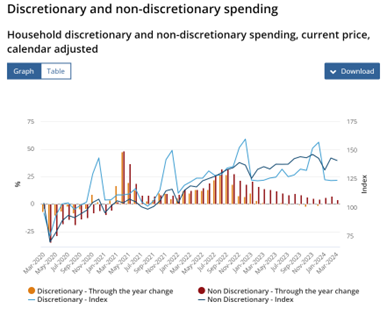

On the demand side of the equation, the Australian employee Living Cost Index grew 6.5 per cent over the 12 months to March 2025, exceeding wages growth (4.1 per cent) by 2.4 per cent. It is no surprise customers are being more discerning and as illustrated below, discretionary spending (as measured by the orange bars) has been flat to down over the past 15 months.

Some decades ago, Australians ate out for special occasions only. The Pizza Hut or the Black Stump restaurant were family favourites before KFC, and McDonalds were everywhere. Nowadays, we love to go out regularly to eat and drink, and this is especially true of the younger generation, irrespective of the $5 coffees, the $10 schooners, the $15 glass of house wine, the $20 cocktail, the $25 nachos, or the $35 steak and chips.

However, many are now experiencing the stress of 13 increases in interest rates (over the 18 months to November 2023) or the substantial growth in rents and/or HECS. And when the economy is struggling, restaurants get less traffic, two sittings may become one, and poor performing locations are shut.

In the U.S., for example, data indicates visits to sit-down restaurants in 2023 fell by 5 per cent compared to 2022, and with the increasing cost of inputs, such as orange juice (+72 per cent YoY), coffee (+60 per cent YoY) and labour, “restaurant closures” seem to be sweeping the country.

Dine Brands Global Inc., the parent company of Applebee’s, the American grill chain famous for $10 burgers, which competes with Waffle House and Denny’s, has recently shut dozens of its 1,500 locations, and its share price has performed poorly (-60 per cent) over recent years. Conversely, trading conditions for brands like McDonalds, Pizza Hut and Chipotle seem to be solid.

Got to agree; retailers and restaurants at the two extremes (high end vs low end) has been OK, but anyone caught in the middle as “a nice cafe, better than a ‘cheap and cheerful’ outlet but not silver service” is getting smashed.

A decent pub steak is going for $45-50 upwards, with the “cheap and cheerful” perennial favourite of “schnitzel and chips” at $20-$30. Even a beer wasn’t cheap between $12-18; I paid $18 for a pint of Asahi in BNE not that long ago and thought THAT was expensive…