How understanding demographic shifts can help investors

Investors understand the power of demographic information. Back in the early 1990s, when I was presenting to investors at ASX-sponsored conferences, I recall ‘time-lining’ the baby boomers and predicting – reasonably successfully, I might add – what industries the boomers would have a substantial impact on.

In 1993, when the oldest boomer was just 47, it was easy to forecast a wave of retirement planning in the years immediately preceding my presentation. And as the boomers began hitting their mid-sixties, from 2011 onwards, no special insight was required to see what those same individuals would think about an ocean cruise. I specifically recall pointing investors to Carnival Corporation (NYSE:CCL), whose share price subsequently rose eight-fold between 1993 and 2018.

An understanding of demographic shifts can, at a minimum, certainly help investors identify tailwinds. Today, the eldest baby boomer is 78 years of age, and the youngest is 60 years old. What sectors, sub-sectors and industries do you think will see an unprecedented increase in demand for their products and services over the next twenty years?

The baby boomers are unique in that there has not previously been a similar-sized cohort. The change, or the ‘delta’, is the largest for the wave of boomers. And while the wave created by the boomers was, and is, massive, the volume of water behind them is also unprecedented. This will impact the economy and industries in different ways.

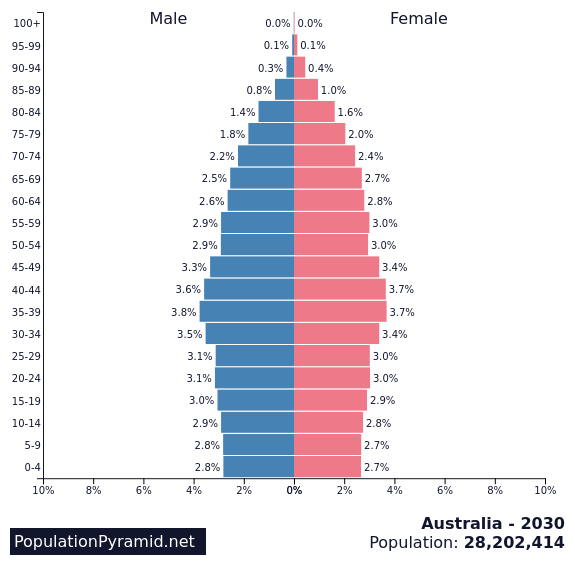

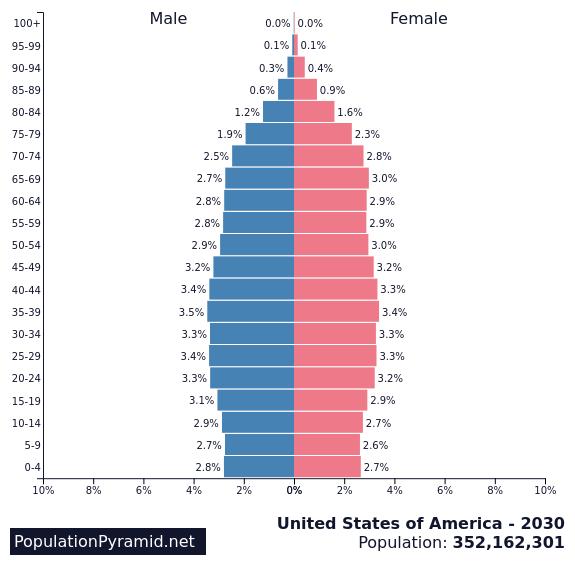

The charts that are the subject of today’s blog post are remarkably similar. Figure 1., represents the expected demographics for Australia in 2030 – just six years away, while Figure 2., is the same image depicting demographic expectations for the U.S. in 2030.

Figure 1. Australia’s demographics in 2030

Figure 2. 2030 forecast demographics for the U.S.

Perhaps the most surprising observation is that it’s not too long before the boomers begin handing over their crown as the largest cohort in the population both here and in the U.S. In 2030, millennials – those born between 1981 and 1996 – will be aged between 34 and 49 years. While boomers in the U.S. and Australia will represent 20 per cent and 17.8 per cent of the population, respectively, millennials will make up slightly more than 20 and 21.5 per cent, respectively.

There’s little doubt that demographic trends significantly influence economic and societal developments. By the 2030s and 2040s, the millennial cohort will mature into their mid-30s to late 50s. Many boomers will still be with us, so the total population of older people will expand significantly. As I mentioned a moment ago, this demographic landscape is unprecedented; unlike the baby boomers era, where no similar-sized group previously existed, millennials are at least parallel that generation in size.

This addition to the population of older people initially raises questions about whether there’s an adequate population of younger people to care for the vastly larger cohort of people requiring care. Are healthcare resources adequate? What technologies will be embraced to enhance the healthcare experience for older people, and what technology is in development that will, for example, help make more efficient a diagnosis of aetiology?

Additionally, an escalation in palliative care needs is virtually guaranteed in the years to come. Could the anticipated stresses on existing healthcare infrastructure be mitigated, for example, by artificial intelligence (AI) powered robots? Who’s making those AI-powered robots? Nvidia (NASDAQ:NVDA) owns a stake in Figure.ai. Could Figure.ai be the ocean cruise operators of 1993, positioned ahead of a massive wave of inevitable demand? Jeff Bezos’ Microsoft (NASDAQ:MSFT) and OpenAi must think so – they’re investors in Figure.ai.

Another question is whether Generation X, Generation Y, and Millennials will emulate their parents’ lifestyle choices. Historical patterns suggest generational behaviours converge over time. For example, despite early predictions of urban living and flexible global work arrangements, millennials have begun embracing home and car ownership, settling down to have kids, building a pool, and installing a backyard barbecue.

Regarding housing, a dear friend of mine describes a large trophy home as an ‘option over newly-minted billionaires’. No matter what industry they emerge from, the first thing newly-minted billionaires seem to desire is a trophy house. We can be sure, with the passing of enough time, the market value of those trophy homes will follow the demand for larger, more luxurious abodes as older millennials increase their wealth and seek upgraded lifestyles.

And don’t forget, Generation X, Y and the millennials are all poised to inherit significant wealth from the baby boomers, who currently control a substantial portion of wealth in the U.S. and Australia. The coming intergenerational wealth transfer will be a driver of huge asset turnover. Is anyone thinking about becoming a real estate agent or art dealer? Stick around for a while, be reputable, and I am sure you will be stamping your name on ‘sold’ signs at unprecedented prices.

Understanding demographic shifts is a simple way for investors to consider structural tailwinds and the businesses that might benefit from them. Robotics, luxury real estate, and changing skills demands are just the tip of the (melting) iceberg.