Gen Y winning the spending race

The latest e-commerce report from Australia Post simultaneously reinforces what we know about the ineffectiveness of monetary policy and recent Commonwealth Bank household spending insights reports.

The headline data from Australia Post reveals Australians reduced their online spending by 1.2 per cent in calendar year 2023, compared to the year before, to $63.6 billion.

Just pause and consider that number. Sixty-three-point-six BILLION dollars! And that’s just what has been spent online. When economists were trying to invent a measure of happiness, they couldn’t do it, so they decided the best proxy was consumption. Evidently, when we are buying stuff, we must be happier. But seriously, how many dresses, shirts, shoes, cat towers and fake eyelashes do we actually need?

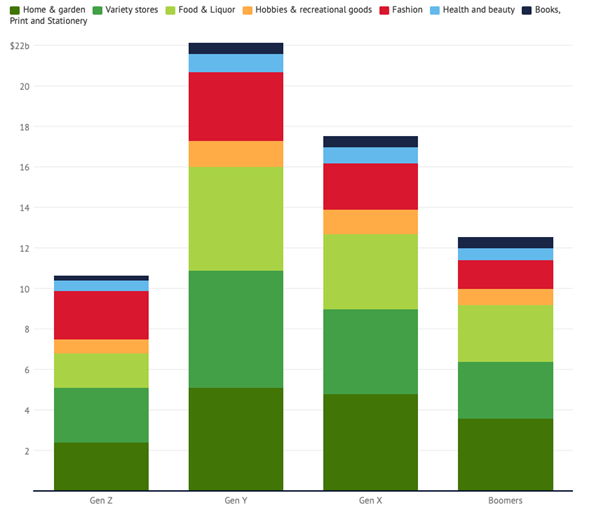

Figure 1. Spending by Generation

According to the Australia Post data, boomers are the only cohort that increased their spending last year. Given the increase in boomer spending of seven per cent, which exceeded inflation, the data confirms that volume rose as well as price. Boomers are literally buying more stuff than the year before even though prices are higher.

The finding helps us understand one of the reasons the Reserve Bank of Australia (RBA), refers to monetary policy as a “blunt” instrument. You see, the whole point of tightening rates is to slow the economy by slowing spending and reducing inflationary pressures. The problem is that the biggest impact from interest rate rises is felt by those with a mortgage. Only a third of households in Australia have a mortgage, and baby boomers aren’t largely represented. Most baby boomers paid off their homes a long time ago when houses were much, much cheaper. When rates rise today, the boomers aren’t impacted. They are, in fact, rewarded. You see, when rates rise, the returns they receive on the cash they hold at the bank and in term deposits go up. They earn more when rates rise, giving them extra spending power. That might help explain the Australia Post report’s finding. Higher rates mean more interest earned, which means more to spend.

Meanwhile, for the RBA, the increased spending power of the boomers undermines the effectiveness of each rate rise, rendering the whole instrument rather ‘blunt’.

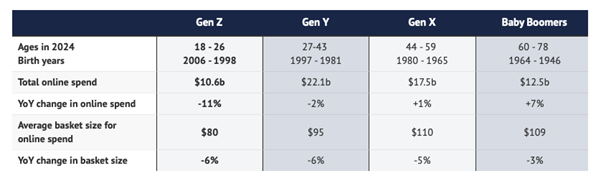

Table 1. Consumer spending by generation

According to Australia Post, the remaining cohorts are doing it tougher than the boomers. Gen Y (those aged between 27 and 43) is reported to have reduced their online spending by two per cent. However, by assuming the data is not adjusted for inflation, a two per cent increase in spending, after inflation of circa four per cent, suggests spending ‘volume’ went backwards for this cohort. Of course, we cannot be precise; we don’t actually know what the inflation rate was for the goods purchased.

If we adjust for headline inflation, only boomers increased their spending.

However, merely looking at changes in the quantum of spending year-to-year ignores the comparison of the nominal amount of spending between the cohorts.

Gen Y is spending the most online – $22 billion compared to just over $12 billion by the boomers. And keep in mind we are only talking about retail online spending here, not spending on kids’ education or mortgages.

One question that comes to mind, given Gen Y are reportedly, and understandably, the most vocal about housing affordability: Has housing become so expensive, so unaffordable, that many Gen Ys have given up on the dream of owning a dwelling and are instead spending up elsewhere? Are they earning mountains more than Gen X? Is that why they are spending more than all the other cohorts?

If the population of Gen Xers is greater than Gen Y, the latter are really making up for it in their spending online. Meanwhile, Gen X should be earning the most, so are Gen X simply bogged down with mortgages and private school fees and, therefore, have fewer discretionary dollars for online merch? Or do Gen Y simply conduct a higher proportion of their spending online than offline? You might have some insights and answers to these questions, and I’d be delighted to hear from you.