F.B.T. – Fairly Badly Trampled?

Readers will be well aware of the controversy surrounding the Federal Labor government’s proposed changes to FBT legislation and the potential impact of these changes to businesses linked to car leasing and salary packaging. As owners of one of the businesses most directly in the firing line for these changes – McMillan Shakespeare – we have been following the debate with particular interest.

The focus of this post is not on the merits (or otherwise) of lenient tax treatment for novated leases as a policy. We will leave that to others better qualified than us, and instead focus on some of the investment concepts that are illustrated by the recent developments. There is however, one broad observation we would make, and that is this:

The FBT arrangements affected by the proposed changes have been in place for a long time, and a substantial industry has evolved in response to those arrangements. There is no arguing that it is open to government to seek to change the arrangements. However, to make sudden and dramatic changes – apparently without a proper understanding of how those changes will impact the industry that has evolved – just doesn’t seem like the best way to approach the issue, particularly when those changes contradict the recommendations of a recent and detailed review of the topic (the Henry Tax Review).

Consistency and predictability is an important foundation of business confidence, and it is a shame to see businesses in good health one week having to retrench large portions of their workforce the next.

With that said, let’s consider some of the investment questions that arise. One of the first questions is: having incurred a loss on our initial investment, what can we learn that will help us in future? Unfortunately, the answer in this case is very little. We knew when we invested that MMS was a creature of the FBT regulations, and that there was a risk of regulatory change. However, we judged the likelihood of sudden and dramatic change to be low given the multi-decade consistency in business and legislative conditions. In the circumstances, it seemed to be a risk worth taking, and part of our job is to take those risks (with a modest position size of course). Without the benefit of hindsight we would do the same again.

The second – and in this case more interesting – question is: how do we manage our investment following announcement of the changes?

After releasing a very well-crafted announcement to the ASX last night, MMS came out of suspension and resumed trading this morning. The opening price was $7.00 per share, 54 per cent below the last trading price prior to the trading halt (which was granted on 16 July, shortly after the government announced the proposed changes). The question that arises is, has the impact of headlines such as; “McMillan Shakespeare Gets Smashed: As expected, the share price of McMillan Shakespeare was destroyed in Thursday morning trade as the effects of FBT changes took their toll”, which appeared on today’s SmartInvestor site, produced one of those very rare opportunities to purchase a diamond in the rough?

Prior to the market opening, and based on the information contained in the MMS announcement, we had calculated a revised estimate of MMS’s intrinsic value in the event that the proposed changes are implemented. Our assessment was that the likely impact would be devastating to MMS’s business, with most of its after tax profits destroyed.

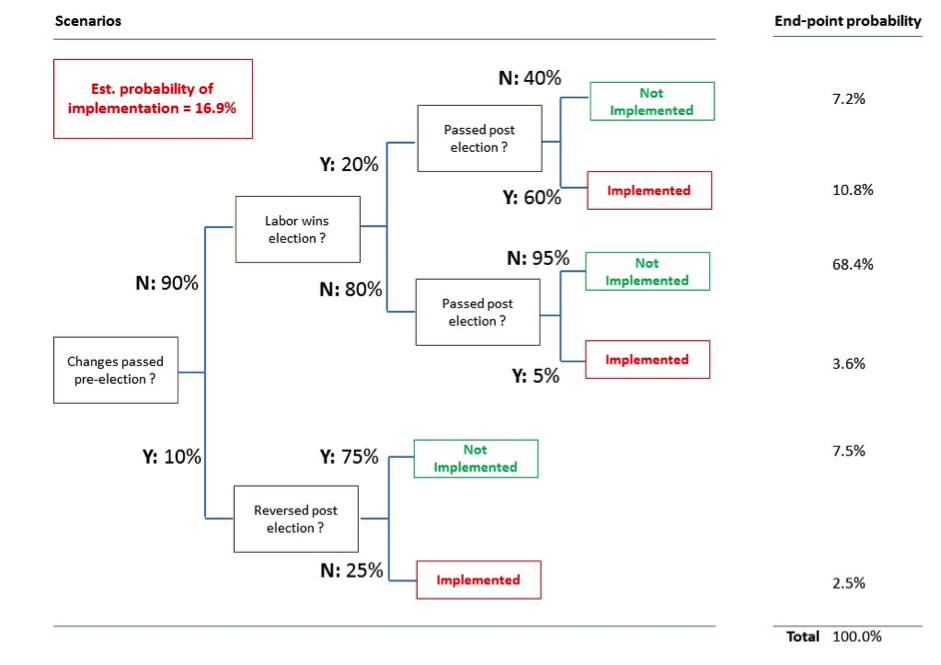

Note, however, that this calculation assumed the changes were implemented. We separately estimated the probability that the changes would not be implemented, noting that the Coalition has said it does not support them, and that Labor may not have the numbers to implement the changes even if it did gain power. Our best guess at the probability of the changes being implemented was somewhere below 20 per cent. The framework we used for this is shown in the attached diagram. Using a80 per cent probability that the business would suffer only relatively minor damage, we estimated a probability-weighted fair value for MMS shares.

Based on that estimate, we were at the head of the queue this morning to buy additional MMS shares at $7.00 and grateful for the ‘McMillan get smashed’ sentiment. Clearly there is some risk in doing this, and the fact that we are underwater on the initial investment makes us acutely aware of this risk. However, a critical part of our job is being able to put emotion to one side and take decisions based on a considered assessment of the facts, keeping in mind one does not pick up bargains when there is a cheery consensus.

In this case the assessment was clear. At $7.00 per share, the upside considerably outweighs the downside, and our investment team was unanimous in its recommendation: a meaningful increase in our holdings in MMS.

Montgomery Investment Management owns shares in McMillan Shakespeare.

This article was written on 25 July 2013. All share and other prices and movements in prices are to this date.

This article is the first in a three part series on McMillan Shakespeare. Click here to read part two, and here for part three.

To find out more about investing with Montgomery Investment Management, click here. To request an information pack, click here.

Value investing with a little inside liberal know how at its very best, if Labor wins this election based on their past performance over the next three years Australia will decline financially and economically and most stocks on the ASX will be a lot cheaper than current values.

Hi Roger, I don’t know if this is something you’d be prepared to comment on but given the rapid gains made already on MMS and that it retains the potential for a lot of volatility I wonder if you have any plan to manage this investment at all?

Would you consider reducing exposure/locking in some of the quick gains made or do you think MMS has buy and hold potential even post-FBT reform (should it be implemented)? Do you see MMS as a bet on the election that offers great odds or do you consider this a business-as-usual Montgomery value investment made in a great business once the entry point became attractive?

Hi Colin,

Ultimately it depends on the price but the probabilities and valuations haven’t changed in the last few days. It could be we see even lower prices (hopefully – if all else is equal).

Tim, good analysis.

Even if the decision turns out to be wrong, the process is valid, and correct in my view. It is exactly this sort of process that will lead to better returns overall.

Thanks Mr Fox, and that is precisely the point. Its over 30 of these events that on average our clients should be well in front.

Just had a quick look, it appears the market agrees with you at the moment Roger (who knows what will happen tomorrow though).

Looking at the current share price of $9.49 and using as a method for experimentation your book Value.ables formula depending on whether you use a 10%,11% or 12% discount rate the implied ROE is 28.18%, 30.99% or 33.81% which are all around the current or 10 year averaged performance of MMS so the money is being put on very little difference to the overall business.

The betting markets, which i think are sometimes a better estimate than polls has the Liberals at $1.40 and ALP at $3.40 so even though the 90%/10% prediction may seem extreme, it could easily be there around.

It will be an interesting case study as to how governments can impact companies on the market and what to look out for. Anything involving tobacco, alcohol, gambling and things that are perceived to make “rich” people richer and pay less tax are things that will always be easily targetted.

Tim, you have calculated the chances of Labor winning the elections at 20%. I find this very strange considering the recent polls. Otherwise great article. Thanks

Watch carefully!

Not sure i agree with you on this one Roger, seems like a trip the races or the casino might offer better odds!

SO far so good….a few million dollars up so far.

MMS is a well run, high quality company that is dependent on the largesse of Australian taxpayers, and this poses a difficult question for investors.

Roger, you have been pretty public in your warnings about the mining capex cliff, China re-balancing and the effect of these two scenarios on Federal government revenues. You have also previously spoken about the woeful competitive landscape of businesses in this country, one that resembles large duopolies, and a predilection for rent-seeking over innovation or true competition.

Finally, when the government tries to reverse some of the ‘structural’ imbalances in the tax code, your response is reactionary, and position yourself to benefit from more of the same. I understand that this is the right and proper response given your responsibility for the funds entrusted to your care, but how can you expect anything to change if the rational profit seeking motive is not metered by a superior integrity?

I guess my question is, if the causes of the things you bemoan are aided by your fiduciary duties, at what point do you leave potential profits on the table?

PS – I’m not meaning to attack you on this issue, but am generally curious about a difficult moral dilemma.

You raise an excellent point Robert. First responsibility is indeed to our investors. We haven’t made a moral stand for or against the current legislated and statutory practice. Commentary and a desire to improve our fiscal and competitive position is something I will continue to bark loudly about and fiduciary responsibility will take first place. We will of course take a loss if the legislation is changed.

It seems to me your initial investment didn’t necessarily have the downside scenario (or avoiding the risk of permanent capital loss) as your foremost thought. MMS has always been a business that has been at risk from a single change in regulation. A number of other well known value investors in Australia and at least one other value investing newsletter has had an avoid on this company for that very reason. Your investment thesis was based on the past being the same as the future (always dangerous), a govt that wouldn’t tinker (also seems dangerous) but most problematic for me, an investment into a business that that had such a fundamental vulnerability – which was out of its control. Contrast this with say COH, also exposed to single product failure (although it does have multiple product lines) but COH has much of the control of this event in its own hands (through its own R&D, quality control and of course, good post crisis event management).

Seems like you are now compounding this by taking a complete punt on a close election outcome, in a business that will remain with a fundamental vulnerability. Not for me…but good luck (since that is what this seems to be, a luck based investment).

That depends on your insights into the direction of opinion polls towards the election and after the honeymoon is over.

Hi Tim,

Interesting analysis – although I would have disagree on the odds. It’s like a football match, the odds may be favourable but on match day, it really depends on who can perform, hence I think it is a 50 – 50 chance.

Like the article and it’s a classic of a Rort that has been to successful for its own good. I don’t agree that it will not get through to legislation as any government will be facing a difficult budgetary situation. However, it may be modified to be for only Australian manufactures, cap on value or fuel economy limits. To trust a LNP government to keep its part promise to stop is assuming a heroic assumption as their attention span is known to be month (referendum) and at least Joe Hockey is financially literate enough to ‘Rort’ consequences.

Liked the comment aI read in the press; since when is ‘statutory’ a ‘rort’?

Many thanks for gining us look at the inside workings of how a decision is made at Montgomery. Based on yesterdays closing price, and assuming you were able to buy at $7.00 (and there were 100,000’s traded at that price) you’ve made 25% on day one. Well done.

All the best

Scott T

The lesson is that, when the government pulls the rug out from businesses highly reliant on a favourable legislative environment, it will always be, in your words, ‘sudden and dramatic’! The fact is that businesses highly reliant on favourable environments artificially created by governments often trade at *premiums* to the broader market (as these businesses generate returns on capital artificially enhanced by the legislative environment), whereas they should trade at significant *discounts* based on the fact their forecast future cash flows are at high risk of change due to a change in governmental policy. In these cases, the risks are assymetrically skewed to the downside and are frequently misspriced in the market.

In my relatively short time following the stock market (5-6 years), i’ve seen TAH, TTS, CAB, TIM + GTP & SHV, ALL, RHC and now MMS have their businesses interrupted by a change in government policy (i’m surely forgetting plenty), and the results have been anywhere from a mild disruption (in the case of RHC) to devastation (in the case of TIM, and MMS if these proposed changes are legislated). The point is that, in all cases, investors generally knew and understood what sort of governmental policy change would hamper these businesses, it’s just that they routinely underestimate the likelihood of such a change coming to pass.

I wasn’t an investor in MMS as it always seemed absurd to me to pay 15-20x earnings for a business that exists purely as a result of the roundabout way in which we remunerate public sector employees (pay below market headline rates, give extremely generous fringe allowances to level the playing field with the private employment market, and let MMS take a chunk of the proceeds along the way), but your probability matrix for managing your investment going forward makes sense to me.

I thought you didn’t gamble? That kind of rationale sounds decidedly like gambling to me – could apply the same thing to a gold miner…

Just saying…

Good analysis, but unfortunately faulty. The entire calculation hinges on getting your “Labor wins election” 20% versus 80% right. If you look at the most recent polling, you would be looking at around 50:50. So buying McMillan now is as easy as flipping a coin.

For a company that depends its entire lifeline on the government flipping a switch, (now that the hand is already ON the switch!) I would say it’s a gamble. And finally, even if Tony Abbott wins, I’m sure he would happily pocket the $1.8 billion saving from FBT to relieve his surplus addiction. Would I make a large investment decision based on a few words from Tony Abbott? Good luck if you do.

Ask anyone on a honeymoon what the polling is for their new partner? Then ask again 20 years later…

Nice one. I arrived at the same conclusion, albeit without the pretty chart.

Despite my personal expectation that Labor will lose the election, making it a moot point, I think there is a real likelihood that if they were to win, the legislative changes to FBT as they currently stand won’t go ahead.

My impression is that the Labor ministers involved didn’t anticipate the unintended consequences that the proposed changes would have and have been caught by surprise by the response. I think there is a real likelihood that these changes won’t go through in their current form (or at all) should Labor win the election.

As per my post in the other thread, I also think that should the status quo be maintained, MMS will come out better than its competitors, in part because they have kept their leasing staff on while others have let them go, but also because a few of their weaker competitors might drop off their perch in the interim.

I think there’s an interesting hedge option in betting on an ALP election win with a sportsbook in combination with buying MMS.

Tim, your prediction for the upcoming election seems very confident.

Great illustration of something you use to help take emotion out of it.

In the current political climate i don’t think anyone can really know what we will and won’t get from either major party in government. Both are focused solely on the game and playing a playing a pretty populist campaign. You can barely watch the news without hearing a questionable at best or outright distortion of the truth at worst from the two leaders. Analysing and acting rational is a must.

Investing lessons, well finding which sectors are most at risk of government interferance and tread carefully with them and seek greater discounts are some that come to mind. Also, expect the worst for the short term.