What ‘Appens’ next?

Appen (ASX:APX), a self-described global leader in data collection, adaptation, and labelling for major technology firms, has been variously considered a technology company, a machine learning beneficiary, and more recently, an AI winner. In truth, it is a stretch to consider it any of these things. And in my opinion, it is none of these things and never has been.

That hasn’t stopped analysts covering it, and even today, there are those who remain hopeful.

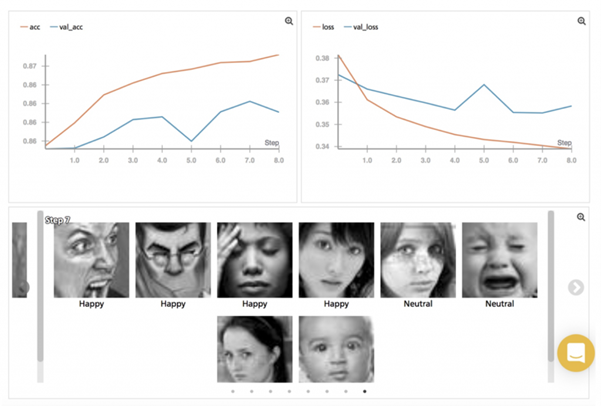

Back in 2019, I explained, “Keep in mind this is…what Appen does for its clients – employs millions of people to click on pictures and tag those that have the characteristics they have been asked to identify (see image). The results are then sold to clients like Google, Facebook, and Microsoft as datasets for their algorithms (AI) to learn from.”

To me, then and now, Appen is not a technology business at all. It has primarily been a labour-hire business, manually feeding results to much deeper-pocketed customers who would eventually replace what Appen does with their own automated technology. It is, in my opinion, just a matter of time.

In another blog post here, published in May 2019, after the share price had risen materially, I noted, “At circa $25, the share price implies revenue growth of 15-20 per cent compounded for at least five years with no diminution in per-unit margins. Nobody can have clarity on whether this is reasonable, so we must conclude that much of the company’s share price appreciation is due to momentum.”

In my concluding remarks, I observed, “Between August 2018 and February 2019, the company upgraded its earnings before interest, tax, depreciation, and amortisation (EBITDA) by U.S.$13-20 million. But in that time, the share price [rise] has seen the market capitalisation increase by A$1.8 billion. If you make the Figure8 acquisition valuation-‘neutral’, the market has effectively valued the U.S.$13-$20 million earnings increase at A$1.55 billion”, adding, “While it’s entirely possible the combined Appen/F8 entity is more valuable in the medium to long term, it’s difficult to reconcile the A$1.55 billion re-rate of earnings and the projected near-term losses for the F8 acquisition.”

None of that stopped the share price from rallying after a brief dip to $17.80, beyond $25.00 all the way to $39.00.

Today, however, after falling 96 per cent from its highs, the share price sits at a much more realistic $1.54 – something I warned investors was likely. Some analysts, however, still believe this is a technology business with the potential to ride the AI wave back to glory.

I don’t think so, and as I have repeatedly warned in various blog posts since Appen listed, this company’s work will eventually be superseded or supplanted by technology its own clients develop.

Today, the company stands at a pivotal juncture. Appen’s core operations are described as involving the ‘efficient’ analysis of substantial data quantities, which some hope will position it to ride the wave of artificial intelligence (AI) and machine learning (ML) growth. However, the once optimistic consensus view held by analysts for the company’s prospects now vary, reflecting both optimism and justified concerns.

Most analysts agree Appen’s recent performance hinges on the strength of its core operations. 1H23 revenue amounted to $139 million, marking a 24 per cent dip from the previous corresponding period (pcp). An alarming aspect however is the decline in revenue from Appen’s largest customer, which plunged by 34 per cent in 1H23 compared to pcp. This decline is the heart of the challenge Appen faces in stabilising its business. Despite this, the company’s expertise in efficiently managing and analysing data remains its core competency on which its future is based. The future does not look rosy.

One point of optimism for some analysts is Appen’s venture into Generative AI (GenAI), which presents growth opportunities. Nevertheless, the advent of GenAI and Large Language Models has led to customers re-evaluating their own AI strategies, causing project delays and scope reductions for Appen’s core business. The company’s pipeline includes 40 GenAI opportunities, yet the material revenue impact of these projects currently remains limited.

Appen’s cost reduction strategy might help it navigate its revenue challenges, but it could simply be delaying the inevitable. The company has targeted cost savings exceeding its initial $45 million goal and aims to maintain an annual cost base under $113 million. While this approach aids in achieving EBITDA profitability targets, there is understandably now apprehension among analysts about its potential negative impact on financial year 2024’s revenue. This shift to emphasising cost savings over revenue growth raises questions about the company’s future earnings trajectory. I’d suggest it raises questions about the company’s future.

Smart people don’t want to find themselves on a sinking ship without a life jacket. Changes within Appen’s management team, including the departure of the CFO and Chief Product Officer, raise questions about the company’s leadership stability during this pivotal time. Analysts note the balance between stabilising revenue and implementing cost reduction measures will be a defining aspect of Appen’s journey in the coming months, and that’s putting it mildly.

The divergence in analyst opinions is also evident in their valuations and recommendations. Some analysts who cover Appen retain a ‘Hold’ recommendation – albeit with reduced price targets due to revenue challenges. Others have adopted a more cautious “Underperform” stance, citing uncertainties in Appen’s revenue decline. These differing views underscore not only the complexity of the company’s current situation but also the meaningful decline in both the company’s status as a growth stock, and the esteem with which it was once held.

Reading the mostly dividend analyst opinions, certain consensus points emerge. The decline in revenue from Appen’s major customers, particularly its largest, stands as a common one. Additionally, the cautious stance towards the company’s ability to capture the upside from AI trends is a shared sentiment. I note the broader industry’s AI trajectory contrasts with the challenges Appen is navigating, and that’s because it is not a technology company in my view.

Appen’s immediate future remains shrouded in uncertainty. Its potential to harness Generative AI’s growth potential, the execution of cost reduction measures, and the stabilisation of its core operations will likely determine the trajectory of its share price and whether any recovery forms part of that trajectory. Meanwhile, concerns related to revenue, management changes, and revenue-cost dynamics remain, as do my doubts about the long-term durability of the service itself and, therefore, the very viability of the company.

Thanks Roger. I wish I had read this a year ago. I have now sold Appen and accepted a loss.

Can we have more articles on the core business of companies, their position 10 years ago, and thoughts on their position in ten years time !

Good topic suggestion Martin. Stay tuned.

Do you think it’s going to $0 eventually?

That depends Josh on whether it transforms and/or whether technology renders its alternative redundant.