Navigating the mortgage cliff: why we’re confident it’s more of a steppingstone than a stumble

It was comforting to read CoreLogic’s latest update on the state of the property market in August, which also happens to be the peak month for low fixed-rate mortgages rolling off onto much higher variable rates.

You may recall for the last year or so we have held a counter-consensus view about the so-called ‘fix-rate mortgage cliff’. Many commentators and economists concluded a large number of fixed-rate mortgages maturing this year and rolling onto much higher variable rates would result in a surge of distressed property sales, a consequent property price collapse and a recession.

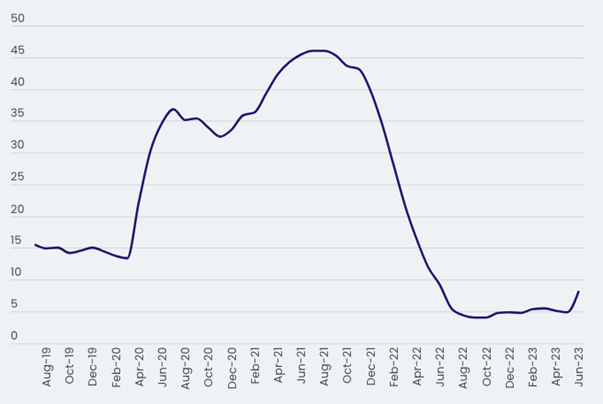

Our non-consensus view has been that the total number of fixed rate mortgages taken out on ultra-low rates was relatively small compared to the total number of mortgages. Despite the fact that mortgages taken out on a fixed rate peaked at 47 per cent (Figure 1) of mortgages on a monthly basis, the cumulative number of fixed-rate mortgages was relatively small compared to the total number of mortgages in Australia.

Figure 1. Monthly share of fixed-rate mortgage lending

Source: ABS, Corelogic

As reported in The Australian and in The Daily Telegraph, we concluded; “whatever the final number, we are talking less about a fiscal cliff the nation will be jumping off and more a fiscal gutter we can step over.”

In other words, the mortgage cliff would be a bit of a…yawn.

With respect to the more extreme forecasts for a resultant recession, we reminded investors that only about a third of households have a mortgage. The remaining two-thirds are divided evenly between renters and homeowners. This bigger collective cohort doesn’t have to worry about the immediate impact of rising interest rates, and they also contribute to the economy, remembering the supportive condition of full employment.

The consequence of our conclusion was threefold; first, the much larger cohort of mortgages on variable rates had already endured and survived 12 increases in mortgage rates without sending the economy over a ‘cliff’. Second, any impact from a small number of stressed mortgagees would be first felt in weaker consumption. Mortgages would wind back discretionary spending before selling their home. And, finally third, rather than be concerned the banks will undertake a wave of repossessions and mortgagee-in-possession sales, the banks, the Reserve Bank of Australia (RBA), and Australian Prudential Regulation Authority (APRA) would have a public relations nightmare on their hands – one they will attend to by working carefully with individual borrowers, just as they offered repayment holidays during COVID.

In its 10 August 2023 update, CoreLogic noted:

“The surge in fixed-rate fixed borrowing through COVID still only saw fixed lending peak at about 40 per cent of outstanding housing credit in early 2022…new lending has since returned to largely variable terms. This means a vast and increasing majority of housing debt is on variable rates. In contrast to fixed-rate mortgage holders, variable rate [short fall interest rate charges (sic)] borrowers have already been exposed to the majority of cash rate rises.”

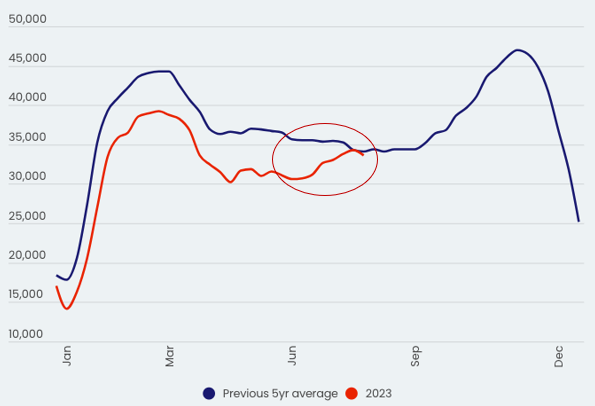

The one new piece of information CoreLogic has revealed is that an unseasonal number of homes are being listed presently for sale. In other words, the data suggest for a portion of those listing their homes recently, pressure has built sufficiently for some to feel forced now to put their property on the market.

Figure 2. National rolling four-week count of new listings added to the market for sale

Source: CoreLogic

Figure 2., reveals an unseasonable uplift in new listings. The reason could be due to the bounce in home prices, or it might be due to people wanting to get ahead of the spring selling season when many more properties are typically listed. Of course, the latter would be seen in the average data, which doesn’t reflect such a spike. It is likely some proportion of the uplift would be the result of selling by those who are feeling the pressure of rising rates. I expect this number will continue to rise in the coming months but without any collapse in property prices or triggering a recession.

We remain sanguine about the so-called mortgage cliff and remain convinced, provided employment conditions remain robust, that the cliff will be more of a speed hump or gutter that we will collectively step over. And now CoreLogic appears to have arrived at a similar conclusion, noting; “Overall, it seems official data on mortgage stress has not seen a blow out in arrears amid the expiry of low fixed-term loans.”

Hi Roger,

As a value investor who focuses on valuing things based on their underlying cash flows, surely a longer term correction in house prices is somewhat warranted?

Today retail investors can make >5% on a risk-free, government guaranteed Term Deposit, more for some high grade floating rate bonds and hybrids. Yet even with accelerating rents, I would guess that net rental yields in Melb/Syd would still be <3% once costs are taken into account. Keep in mind, property investment is not without its own substantial risks. On top of that you have an increasingly hostile regularly environment for property investors (especially in Victoria, with recent land tax increases and the state government openly talking about rent freezes).

Yes we have record migration and a lack of supply which act to create a floor beneath prices. However, surely over time a value investor would conclude that the price of any financial asset must adjust to match a rising risk-free rate (i.e. the denominator in any DCF calc). What do you think?

Hey Joe, for many many years the gross yields on property have been less than cash in the bank, and yet, house prices have continued to rise. Value investing in property rarely lets you secure a property. You’ll see what I mean by reading this blog post from 2013, keeping in mind what property prices have done since then. https://rogermontgomery.com/is-there-value-in-residential-property/