Aura Private Credit: Letter to investors 05 May 2023

Tuesday 02 May saw the Reserve Bank of Australia (RBA) announce a 25-basis point increase to the Cash Rate, bringing the rate to 3.85 per cent. This caught the market and mortgage borrowers off guard, which had priced in no further increase. However, it remained consistent with commentary released by the RBA Governor, Phillip Lowe, in April.

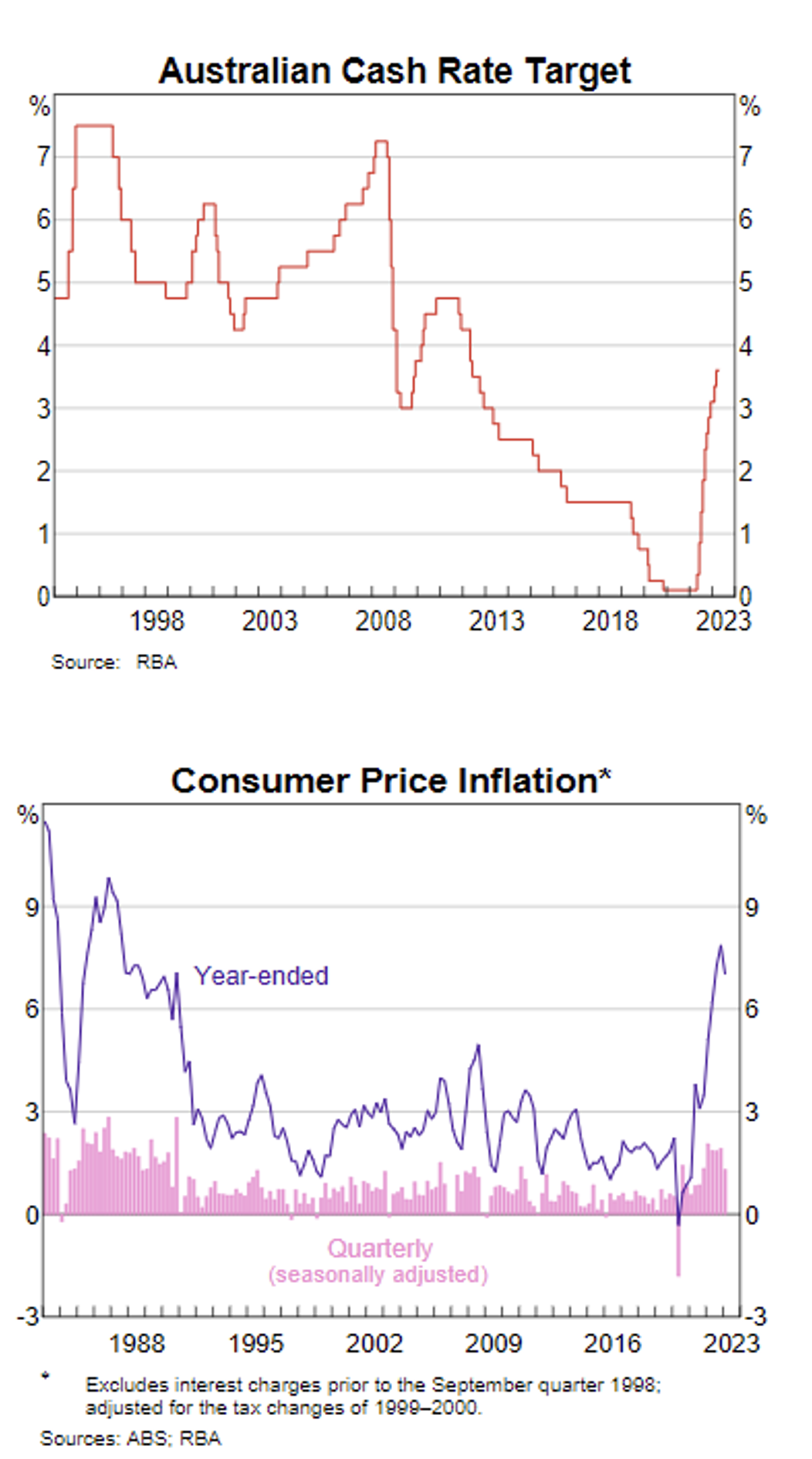

RBA Cash Rate & Inflation 1,2,3,4

A further 25 basis point increase to the RBA Cash Rate brings the total Cash Rate to 3.85 per cent, the highest level since April 2012. Lowe made it clear in his statement that from the Reserve Bank’s point of view, the battle against inflation is not over and further rate rises may be required. He restated that the board remains resolute in its determination to return inflation to the 2-3 per cent target level and will do what is necessary to achieve that.

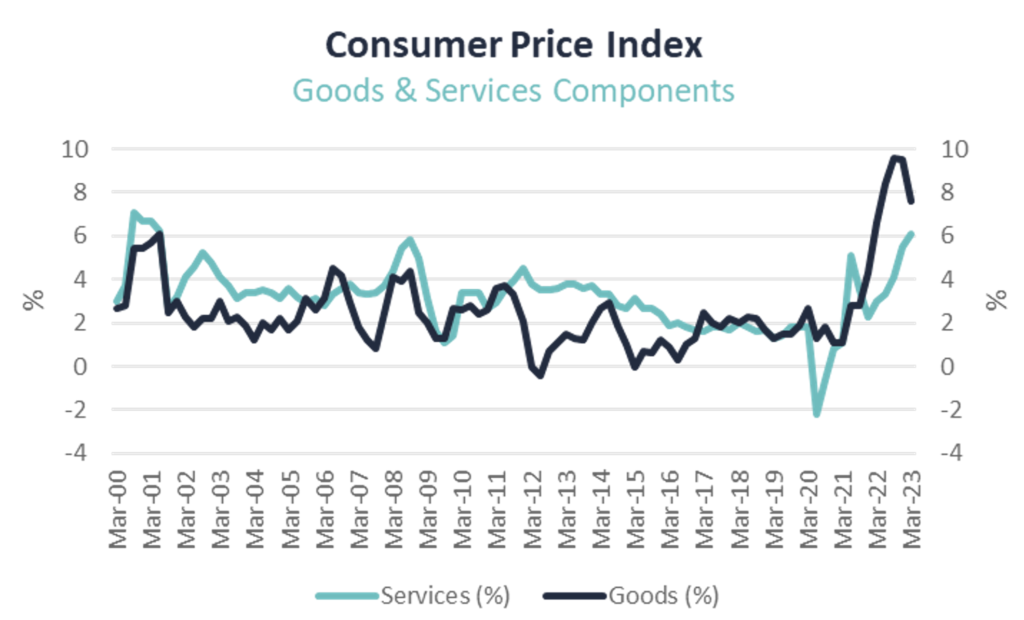

A key talking point in the statement was the contrast between the total rate of inflation versus that seen in the underlying components of inflation. The read for total inflation for the 12 months to the end of the March 2023 quarter came in at 7 per cent, down from the 7.8 per cent displayed in the 12 months to the end of the December 2022 quarter. However, when looking a further layer down at the two core components of inflation, goods inflation and services inflation, there is a two-tiered tale.

Goods inflation has displayed downward movements over the last two quarterly reads, peaking at 9.6 per cent in the September 2022 quarter read, then falling modestly to 9.5 per cent in the December 2022 quarter read and finally, more convincingly to 7.6 per cent in the March 2023 quarter read. Let there be no confusion that the prices for goods in the economy are still increasing at a rate meaningfully above the 2-3 per cent target range, albeit increasing at a decreasing rate.

Services inflation on the other hand saw its last trough at 2.3 per cent in the December 2021 quarter and has increased in every quarterly read since, landing at 6.1 per cent in the most recent March 2023 quarterly read. It is the price of services increasing at an increasing rate that is now the primary concern of the RBA Board and the broader Australian economy.

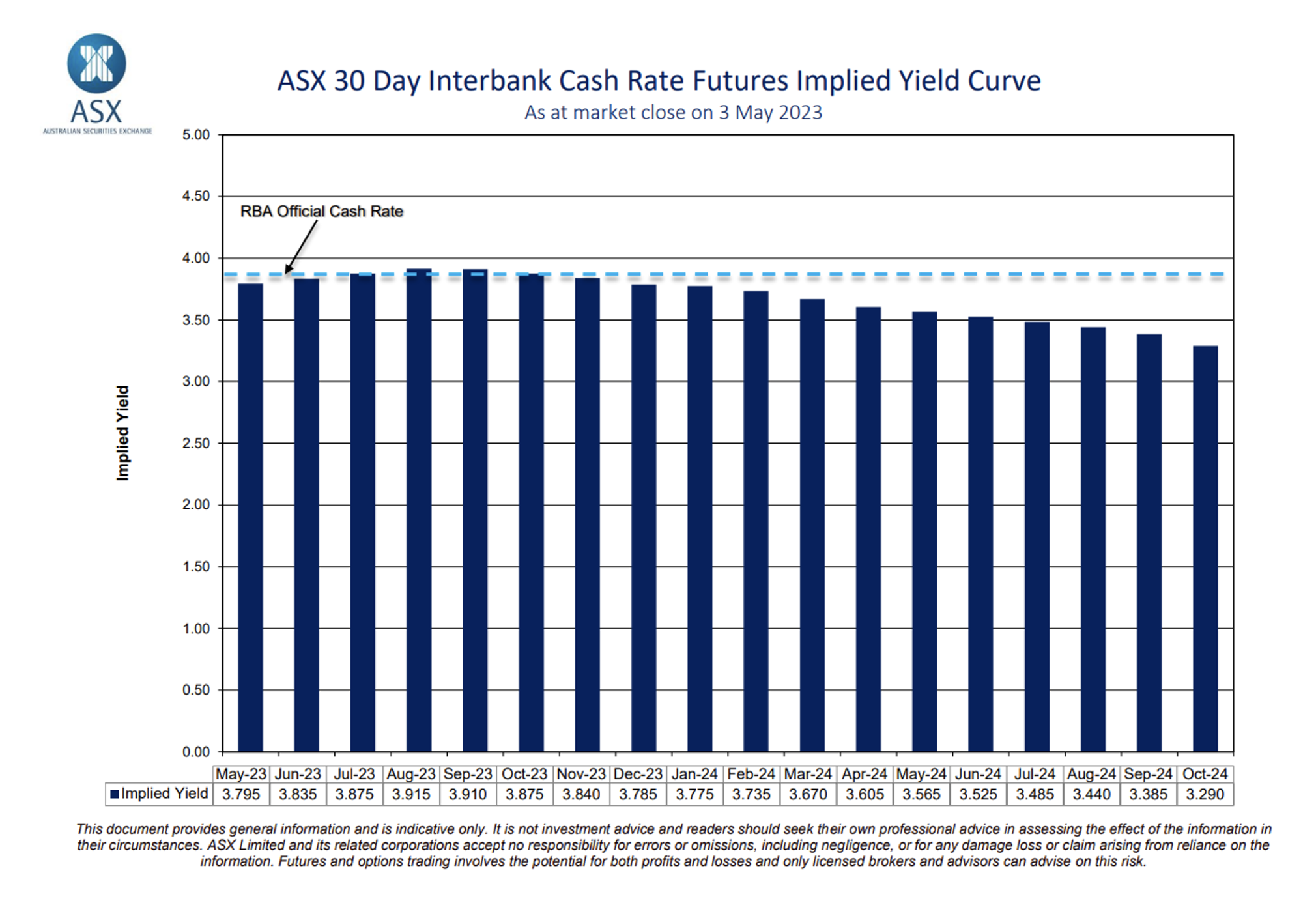

In response, the market has changed its tune, pricing in a further increase to the RBA Cash Rate as at market close on Wednesday 03 May 3rd 2023.

The Aura Private Credit investment team remain diligent in monitoring for any impact on underlying SME borrowers and allocating selectively.

1 Australian Bureau of Statistics: Consumer Price Index, March 2023

2 RBA Chart Pack – May 2023

3 May 2023 RBA Monetary Policy Decision Statement

4 ASX 30 Day Interbank Cash Rate Futures Implied Yield Curve – 3rd May 2023