Aura Private Credit: Letter to investors 28 October 2022

This week, the Treasurer delivered the Federal Budget a day before the Australian Bureau of Statistics confirmed our expectations that inflation is still on the rise. The consensus view of the investment team was that the Federal Budget on the whole was conservative and responsible given the economic conditions we are currently experiencing and the degree of uncertainty that lays ahead.

Federal Budget 1,2

The Australian economy has demonstrated relative resiliency on the backdrop of a global pandemic, natural disasters and global volatility driven by geopolitical issues. Ongoing concerns around inflation remain at the forefront, with rising interest rates and an expected global economic contraction yet to come. It should be noted that the IMF and Treasury forecasts do not show Australia entering a recession. The labour market is tight as we are facing skill shortages and falling real wages. The years of COVID-19 driving monetary and fiscal policy support is now over, with the government focused on repairing the Federal coffers.

The budget was built upon adjusted economic forecasted figures, the key ones being:

- Economic growth – expected to be 3.25% in 2022-23 (a slight decrease from the 3.5 per cent forecast made in March) before dropping to 1.5 per cent in 2023-24 (a significant revision from the previously forecasted 2.5 per cent).

- Unemployment rate – expected to fall to 3.75 per cent over next 2 years.

- Wages growth – currently 2.6 per cent and expected to grow to 3 per cent – 3.75 per cent over the next 4 years. With inflation continuing to rise, Australian’s will not be getting a real pay rise for around 12 months.

Despite soaring prices and a tight labour market, Australia’s economic growth is cooling.

- 2021-22 net deficit was $32 billion ($48 billion lower than the March forecast) and is expected to rise to $36.9 billion in 2022-23.

- Net debt is expected to reach $572.2 billion in 2022-23 (down on March forecast of $714.9 billion).

- Net debt is expected to reach $766.8 billion in 2025-26 (down on March forecast of $864.7 billion).

The reductions reported in debt and deficit are driven in part by higher commodity prices (expected to moderate over time) which has boosted Australia’s national income, lower unemployment and $22 billion in spending cuts. As economic growth is expected to cool, net debt as a percentage of Australian Gross Domestic Product is expected to increase and peak at 28.5 per cent in 2025-26.

At a high level, the budget’s areas of focus were:

Families and cost of living:

- New National housing Accord between government, investors and industry to build more affordable housing and aim to build 1 million new homes over 5 years from 2024.

- Paid parental leave expanding to 6 months by 2026 accounting for $530 million.

- Cheaper childcare with $4.7 billion in funding over 4 years.

- Cheaper medicine from 1 January 2023.

Defence and foreign affairs:

- Defence funding rose 8 per cent in 2022-23 to more than 2 per cent of GDP over the next 4 years.

- Aid funding rise to $1.4 billion over 4 years.

Infrastructure:

- Reduced from $17.9 billion in the last budget to $8.1 billion. Largely to fund rail and road projects.

Housing:

- Building additional social and affordable homes in line with the government’s election promises.

- Help to Buy Scheme to assist young buyers get into their first homes.

Health:

- Cheaper medicines from 1 January 2023.

- Covid funding beyond 2022 was denied.

- Shift to assist urgent care clinics to remove some burden from the public health system.

- $2.6 billion in funding for covid vaccinations and treatments for people at risk.

- NDIS additional funding – $166.6 billion over 4 years, a $8.8 billion rise.

Education, skills and small business:

- TAFE funded positions for 480,000 fee-free places.

- 20k additional university funded places over 2 years.

- 10k new energy apprenticeships to train for new jobs and skills in the field.

- Aim is to assist the small business sector and businesses within the community as they are crying out for more skilled workers.

Climate and natural disasters:

- $25 billion in climate related spending through to 2030.

- $20 billion government promise to upgrade electricity grid to feed through more additional renewable energy solutions .

- $275 million to encourage use of electricity vehicles.

- $200 million for disaster ready fund.

With this being the Labour Government’s first budget in over a decade, taking a cautious and measured approach seemed appropriate. Spending is being attributed to areas that will assist households with inflated everyday costs and bringing skilled labour back to our workforce which will assist businesses currently feeling the strain from the very tight labour market. The budget has been designed to address current issues and time will tell as to the efficacy of the annual budget.

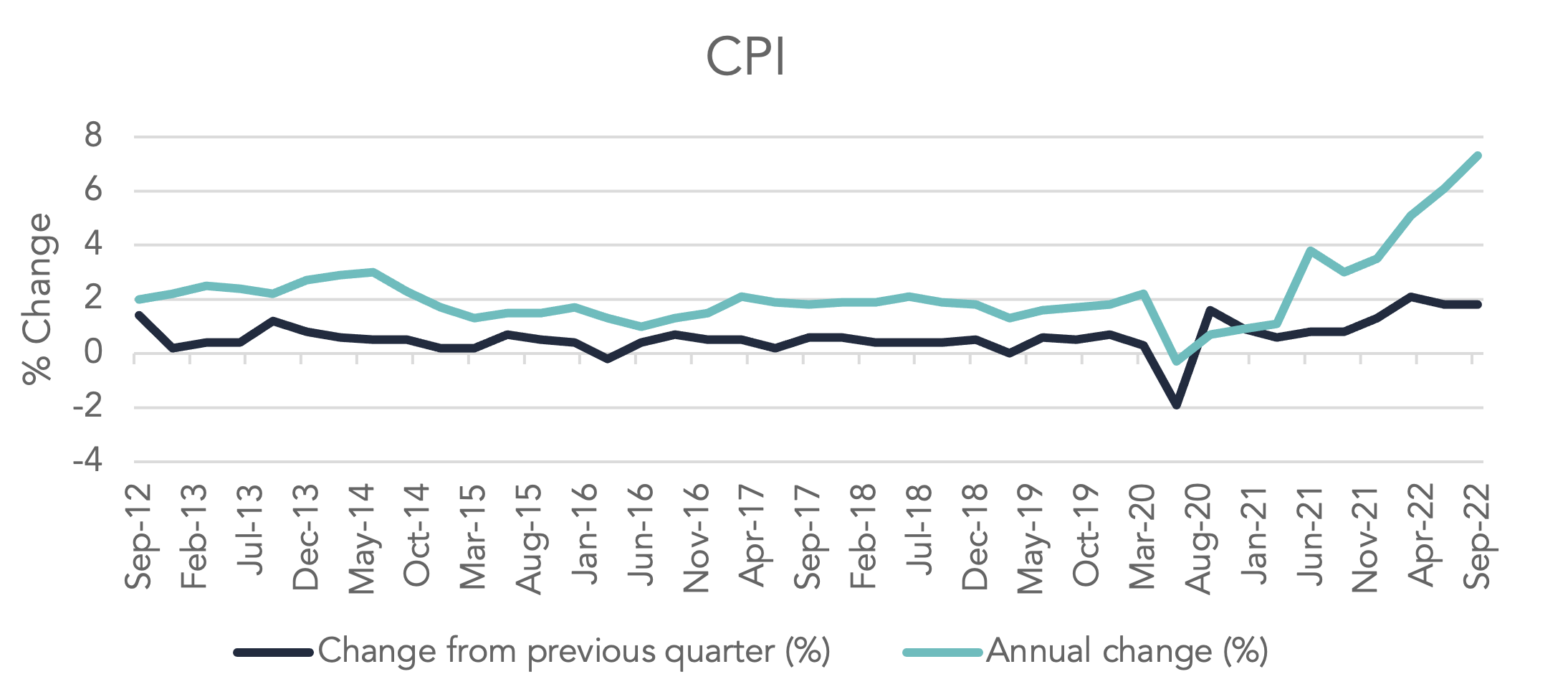

Consumer Price Index2

Inflation increased in September, up by 1.8 per cent and 7.3 per cent annually. New dwellings rose by 3.7 per cent over the quarter, gas up 10.9 per cent and furniture up 6.6 per cent.

The tight labour market is putting continued strain on the construction industry. Ongoing shortages for building materials has also created compounding pricing pressure. Despite these ongoing pricing pressures, we are also beginning to see a drop off rate in the number of new dwellings, implying that monetary policy intervention is starting to soften new demand which will assist in reducing the supply side constraints.

The annual review of gas prices revealed that higher wholesale gas prices were largely passed onto consumers in the September quarter. Electricity rose by 3.2 per cent which is much lower than the expected 15.6 per cent thanks to the State Government subsidies handed out in WA, QLD and the ACT. The Federal Budget did not provide households with much concession in terms of electricity and gas despite the ongoing cost of living pressures. As such, we would expect this to rise in the coming months.

Food was also on an upward trajectory, up by 3.2 per cent this quarter. Supply side issues and higher input costs were the drive behind the rise. The recent flood disasters will likely contribute significantly to another quarterly increase in the price of food, with damaged crops causing significant disruptions to supply.

Positively, fuel was not to blame for this quarter’s inflationary pressure and was in fact down 4.3 per cent, reflecting the falling crude oil prices. Still, it is important to note that annually fuel and new dwellings were the main pain points for inflation, up 18 per cent and 20.7 per cent respectively.

New global and domestic challenges continue to shift the inflationary pain points. Next week’s RBA monetary policy decision will take this inflationary read into account and will assist them in determining the extent to which they raise rates. The RBA has recently indicated that whilst household budgets are beginning to feel the pressure, the way in which household spending will respond remains uncertain. The board will closely monitor the global economy, household spending and price setting behaviours in order to determine the incremental rate rises they have implied are still yet to come.

1 Source: Budget October 2022-23

2 Source: Australian Bureau of Statistics – Consumer Price Index, September 2022