Rising rates are crimping US and Aussie spending power

Rising interest rates in Australia and the U.S. are having a profound effect on discretionary spending and housing markets. In Australia, they’re also adding to mortgage stress. According to Roy Morgan research, 942,000 Australians are experiencing mortgage stress, and that figure will rise if rates keep heading north. The good news for investors is that equity markets usually bottom when the times are at their toughest.

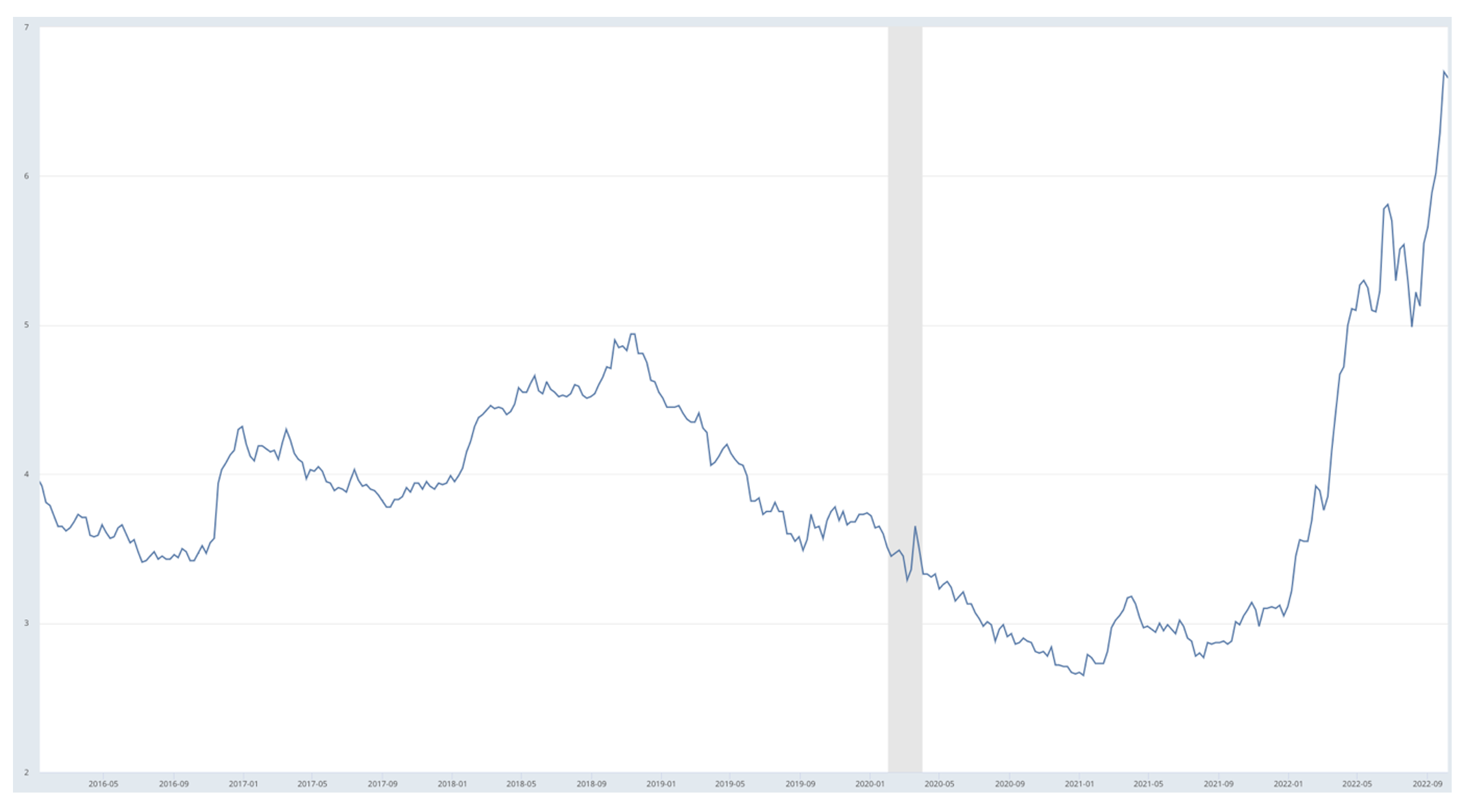

Just have a look at Figure 1, the shift in the rate of interest paid on a U.S. 30-year mortgage. In early 2021, the rate fell to 2.65 per cent. Today that rate is 6.70 per cent. Demand for new mortgages has slumped 90 per cent year-on-year.

Figure 1. U.S. 30 year mortgage rate to 6 October 2022

Source: Freddie Mac

High borrowing costs have also met with tight supply, keeping real estate prices relatively elevated – albeit off recent highs – strangling affordability, which is now at a 37 year low. Buyers are no longer rushing madly to secure a purchase, and in turn, seller confidence has faded.

According to the Mortgage Bankers Association, U.S. demand for mortgages is at a 22-year low, where it has been since the end of August and purchase activity is 30 per cent lower than a year ago.

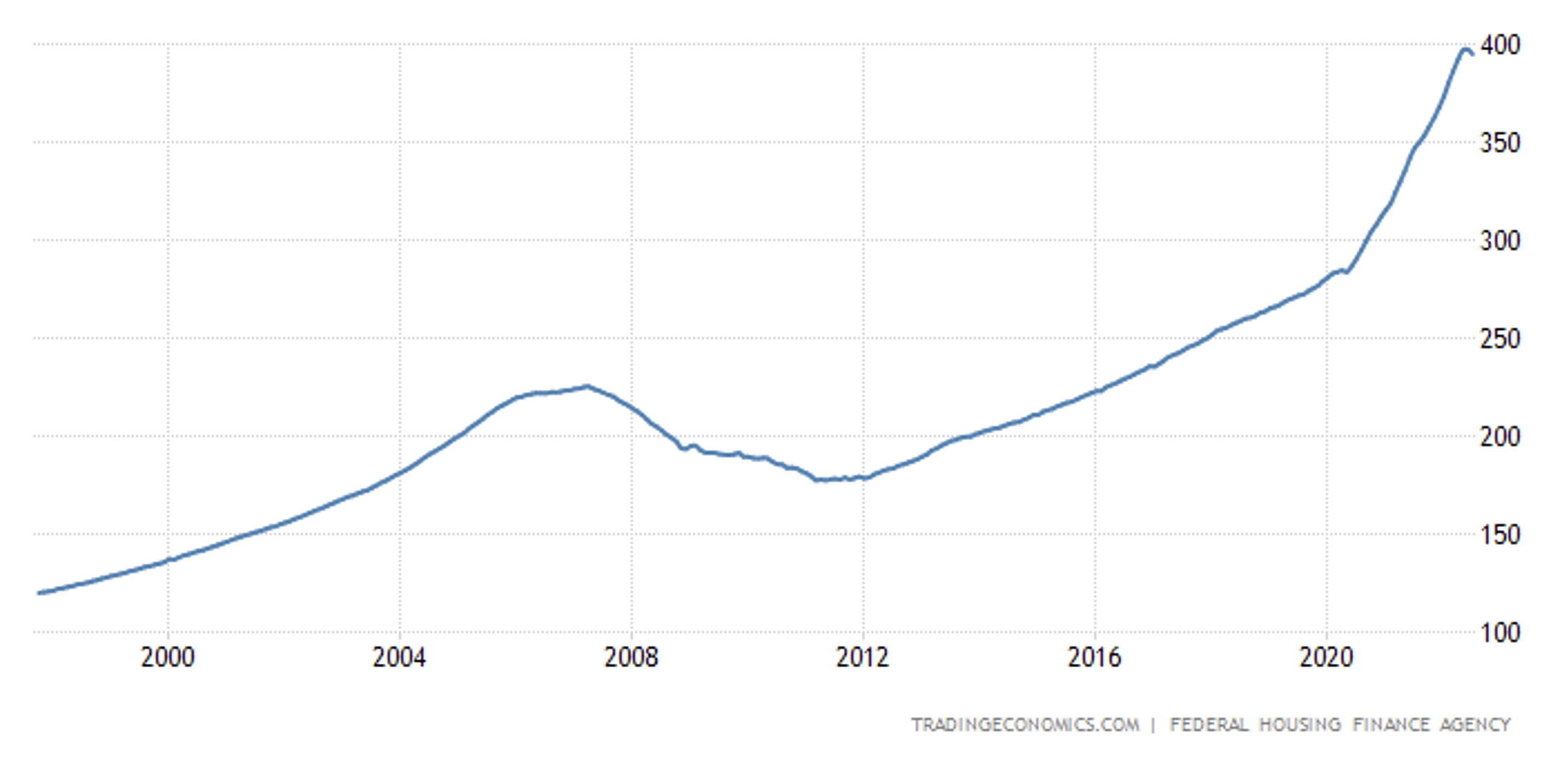

They’re spectacular numbers. But high levels of employment mean vendors aren’t forced to sell, so despite higher interest rates, property prices aren’t plunging, as Figure 2 reveals.

Figure 2. U.S. house price index to July 2022

A similar picture appears to be emerging in Australia, although house prices appear to have fallen more, in aggregate at least.

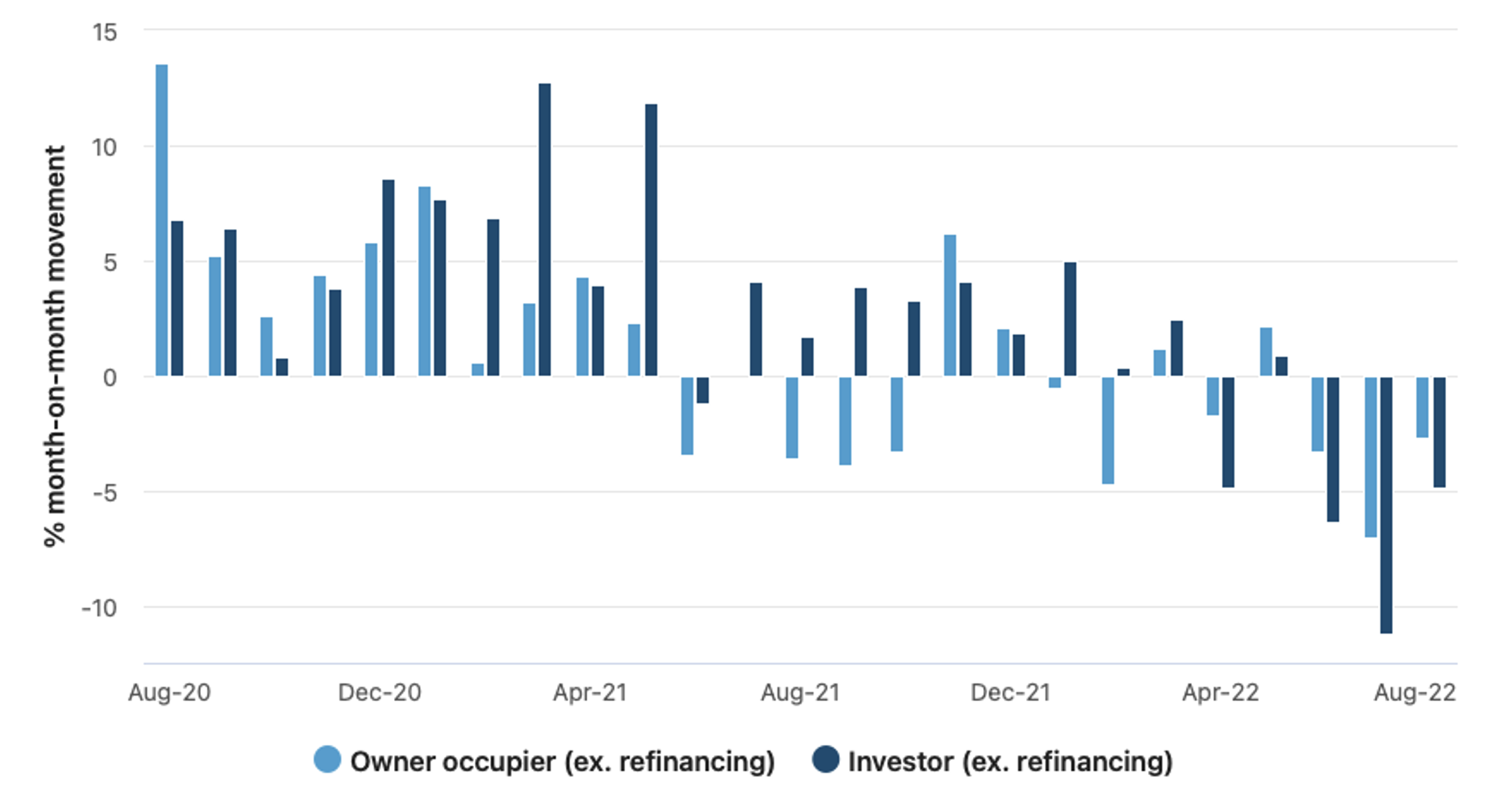

Figure 3. Australian new housing loan commitment change

Source: Australian Bureau of Statistics

Mortgage demand in Australia buckled in August, no doubt in response to four consecutive interest rate increases by the RBA.

According to the Australian Bureau of Statistics (ABS), the total value of new mortgage commitments fell 3.4 per cent in August and 12.5 per cent year-on-year. Splitting out owner-occupiers and investors, the ABS reported investor mortgage commitments were down 6.4 per cent in the year to August, while owner-occupier mortgage commitments fell 15.1 per cent.

The falls in mortgage demand aren’t as dramatic as those experienced in the U.S., and importantly (for recent home owners at least) owner-occupier housing mortgage demand remains 35.8 per cent higher than the pre-pandemic level seen in February 2020 and investor housing is 69.9 per cent higher.

Meanwhile, the Commonwealth Bank of Australia’s Household Spending Intentions (HSI) Index fell 0.5 per cent down to 114.9 in September from 115.5 a month earlier, reflecting the beginning impact of higher interest rates on household spending. The most significant declines were in health and fitness, home buying, household services and transport.

The monthly decline in the HSI was the first since the Reserve Bank of Australia began raising rates at the beginning of the year.

Changes to discretionary spending

Higher mortgage rates eat into the discretionary spending ability of consumers while simultaneously adding to mortgage stress. While no official definition exists, mortgage stress is said to occur when more than 30-35 per cent of gross income is required to pay the mortgage.

According to Roy Morgan, there are 942,000 Australians in mortgage stress, and if, as predicted, the RBA lifts rates again in November the number of Australians in mortgage stress will rise to 1.1 million, the highest since July 2013.

According to the RBA, if interest rates peak in mid 2023, as currently predicted by markets, more than a quarter of mortgage holders will be spending at least 30 per cent of their gross income to repay debt, and therefore in mortgage stress.

Understandably, the RBA’s semi-annual financial stability review, noted Australian households, firms and banks are entering a more challenging environment. The report, however, observed they are in a strong financial position but strains would be felt unevenly and intensify.

As noted above, the RBA has modelled the impact of rates rising to 3.6 per cent, which is the level the market currently implies, and assuming incomes grow in line with current forecasts, the percentage of borrowers in mortgage stress will be 25 per cent by the end of 2023. At the current overnight cash rate of 2.6 per cent, mortgage stress is said to be experienced by 20 per cent.

Elsewhere, the RBA’s liaison team has noted demand for social and community support services – including low-cost housing and food services – has increased reflecting “indicators of financial stress [that] are likely in the period ahead.”

While U.S. numbers, the financial system and mortgage relationships are different in the U.S. and Australia, it certainly seems like the impact on each country’s citizens is the same. Nervousness about a recession next year and a tougher time for earnings growth certainly seems to be justified. And while it may be the case an equity rally won’t occur while central banks are tightening, investors should be reminded markets usually bottom when the news is ugliest.