Know what you own: stocks vs. businesses

Successful business owners are often said to be able to feel the pulse of the companies they lead. For instance, great restaurateurs know what dishes are most popular on the menu, who their regular patrons are, when suppliers will deliver fresh ingredients, and how much revenue is needed to cover basic expenses such as salaries and rent.

While a thorough understanding of a business’ ins and outs may seem logical—and almost necessary—for small business owners, we believe it is vital that investors also apply this mindset when navigating financial markets. However, for many investors, the idea of owning shares of a company seems disconnected from the concept of being part owners of a real business.

For example, we believe that very few people would hop onto a private venture without first becoming familiar with the company’s history, business model, and financial health. Yet, in today’s world, many market participants look at stocks as lottery tickets, often exposing themselves to unknown risks in the hope that another buyer will pay a higher price down the road.

The rise in popularity of speculative assets—such as meme stocks, cryptocurrencies, nonfungible tokens (NFTs), and special-purpose acquisition companies (SPACs)—is, in our view, a clear manifestation of this behavior. And the heavy losses incurred in some of these same assets over the past year should remind the investing public that speculative frenzies rarely end well.

Having a business owner’s mindset

This is why Peter Lynch, widely considered one of the greatest money managers of our time, stated that the single most important investing principle is to “know what you own, and why.” According to Lynch, most market participants cannot explain in a few sentences why they own a certain stock aside from “because it’s going up.” Therefore, he advised against investing in any idea that couldn’t be easily illustrated with a crayon in a minute or less.1

To us, Lynch’s mantra is just as applicable today as it was nearly 30 years ago: Understanding a company’s fundamentals and conducting extensive due diligence are what differentiate investors from speculators. Likewise, we believe that a business owner’s mindset can help investors tune out the noise and focus on business performance rather than market performance.

In our experience, investors who study markets through the prism of a business owner tend to gravitate towards high-quality companies with sustainable cash flows and unique competitive advantages. After all, very few people would favor becoming the CEO or majority stakeholder of a mediocre corporation over an industry-leading organization.

Also, the highest-quality businesses can usually be explained quite simply, given that their strengths tend to be obvious and easily recognized. Furthermore, while the daily ups and downs of the market might tempt us to move first and think later, we believe that taking your time and exercising patience are critical in assessing the sustainability of competitive advantages.

A long-term investment approach

A business owner’s mentality and a long investment horizon are inextricably linked in our view. In contrast to securities traders who seek to “buy low and sell high,” business owners rarely have an incentive to sell their stakes in great companies. In fact, Warren Buffett—who is renowned for his buy-and-hold approach to investing—once said that “when we own portions of outstanding businesses with outstanding managements, our favorite holding period is forever.”2

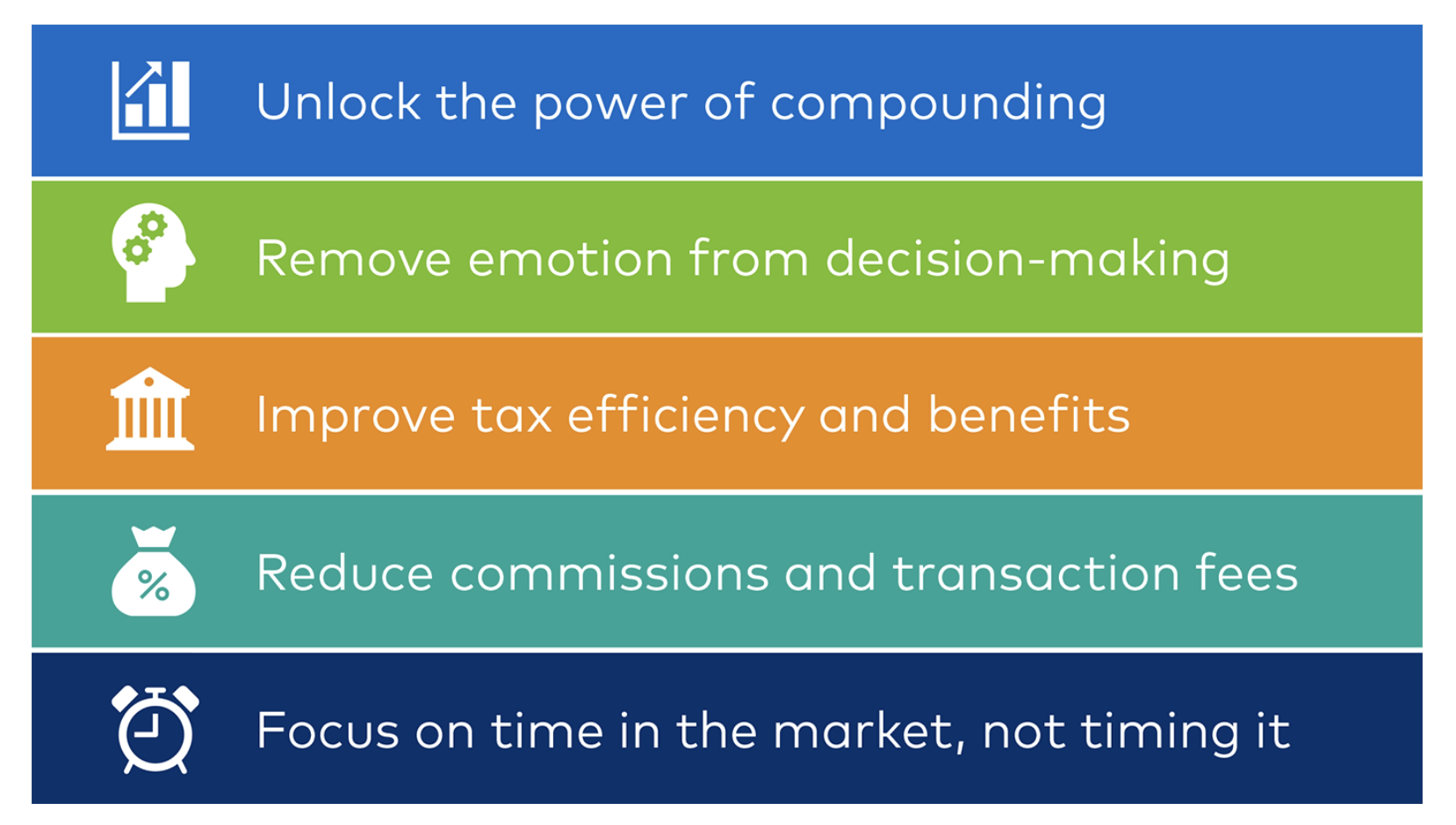

And this is precisely why knowing what you own is critical in today’s market environment. During challenging times, speculators who lack a business owner’s mentality will tend to run for the exit, possibly incurring losses on their way out. In contrast, investors who own great companies tend to feel more comfortable staying the course when volatility strikes the market, increasing their likelihood of reaping the rewards typically associated with long-term investing seen below.

The potential rewards of long-term investing

Source: Polen Capital

Finally, we also believe that thinking like a business owner supports the case for maintaining a concentrated portfolio consisting only of high conviction ideas since it is more difficult to fully understand and closely monitor 50, 60, or 100 companies compared to only 20 or 25 great businesses.

We truly believe that focusing on owning businesses gives us a very heavy advantage over others that tend to buy and sell stocks more frequently. —David Polen, Founder of Polen Capital

1 In reference to Peter Lynch’s (former manager of Fidelity’s Magellan Fund) lecture on equity investing at the National Press Club in 1994.

2 Berkshire Hathaway 1989 letter to shareholders.

Special purpose acquisition company (SPAC): An empty shell company that goes public, raises money in an initial public offering, and then uses that money to merge with some private company, which will thereby become public. (Source: Bloomberg)