Why I’m less pessimistic about rising official cash rates

In this week’s video insight David identifies why he is less pessimistic about rising official cash rates than many commentators, and with the damage done to share prices since late-2021 why we might soon be provided with some good opportunities to buy high quality businesses at very reasonable prices.

Transcript

David Buckland:

Hi I am David Buckland and welcome to this week’s video insight. I have written many times about New Zealand being the canary in the coal mine, given the Reserve Bank of New Zealand (RBNZ) started tightening on 6 October 2021, 6 months ahead of Australia. The RBNZ has tightened five times in the past eight months from 0.25 per cent to 2.00 per cent, and a move to 2.50 per cent over the September 2022 Quarter would not surprise.

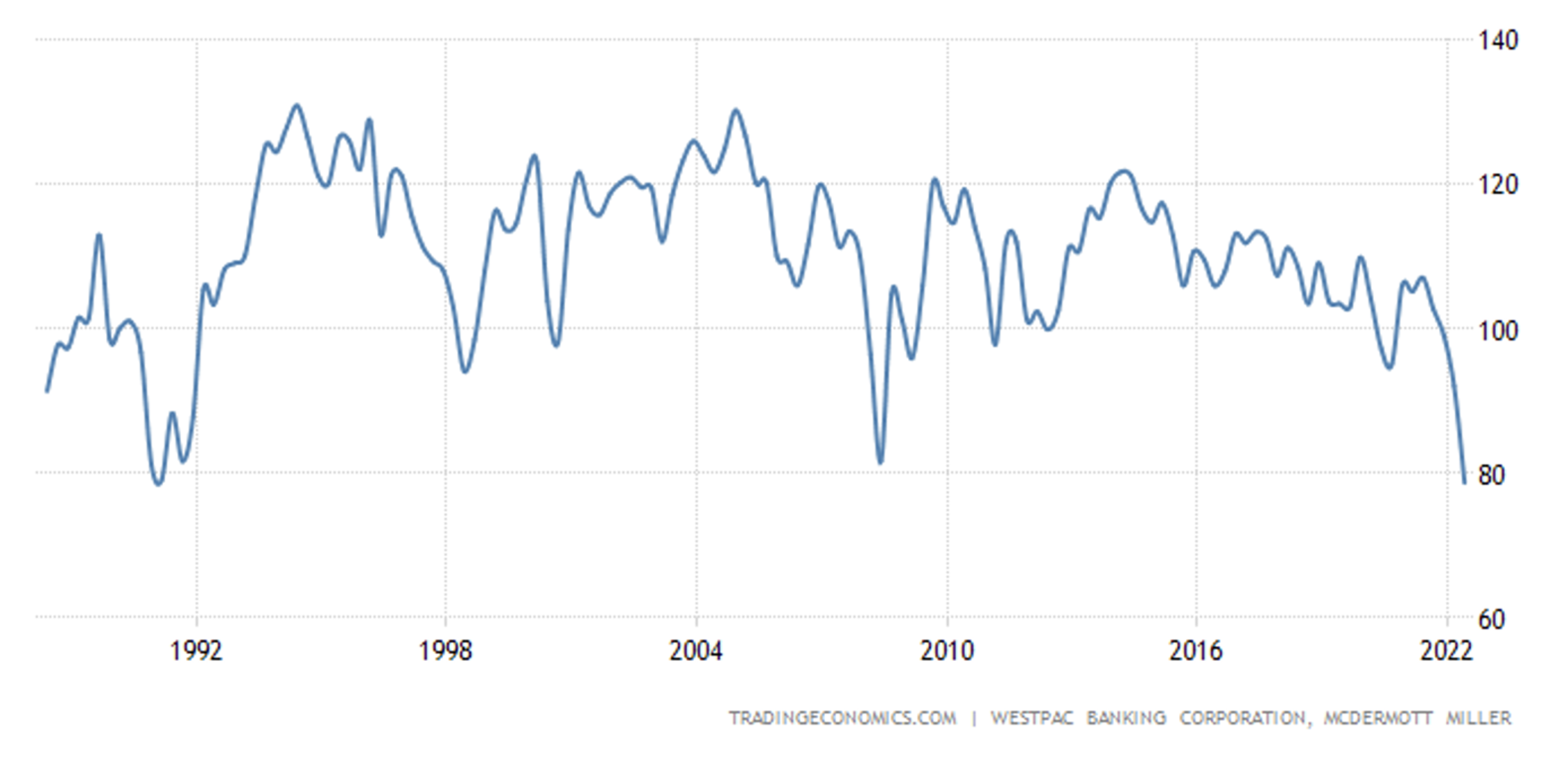

That said, with the tax from higher fuel, food, gas and electricity, higher mortgage servicing costs, and the median house price decline of around 10 per cent in the past eight months from $930,000 to $840,000, then it is unsurprising the New Zealand consumer confidence index had one its sharpest falls to its lowest level in 35 years of data collation.

The consumer confidence survey reading is now below the lows recorded in the 1991 recession – when the unemployment rate exceeded 11 per cent and the official cash rate hit 16 per cent – as well as the 2008 GFC – when share markets around the world halved.

With close to full employment and cash rates still close to historical low levels, this consumer confidence survey paints an economy with far too much leverage, now suffering from the first debt-deflation cycle for some decades.

Unsurprisingly, consumer confidence indexes in both the US and the UK are also hitting multi-decade lows despite exceptionally low unemployment levels.

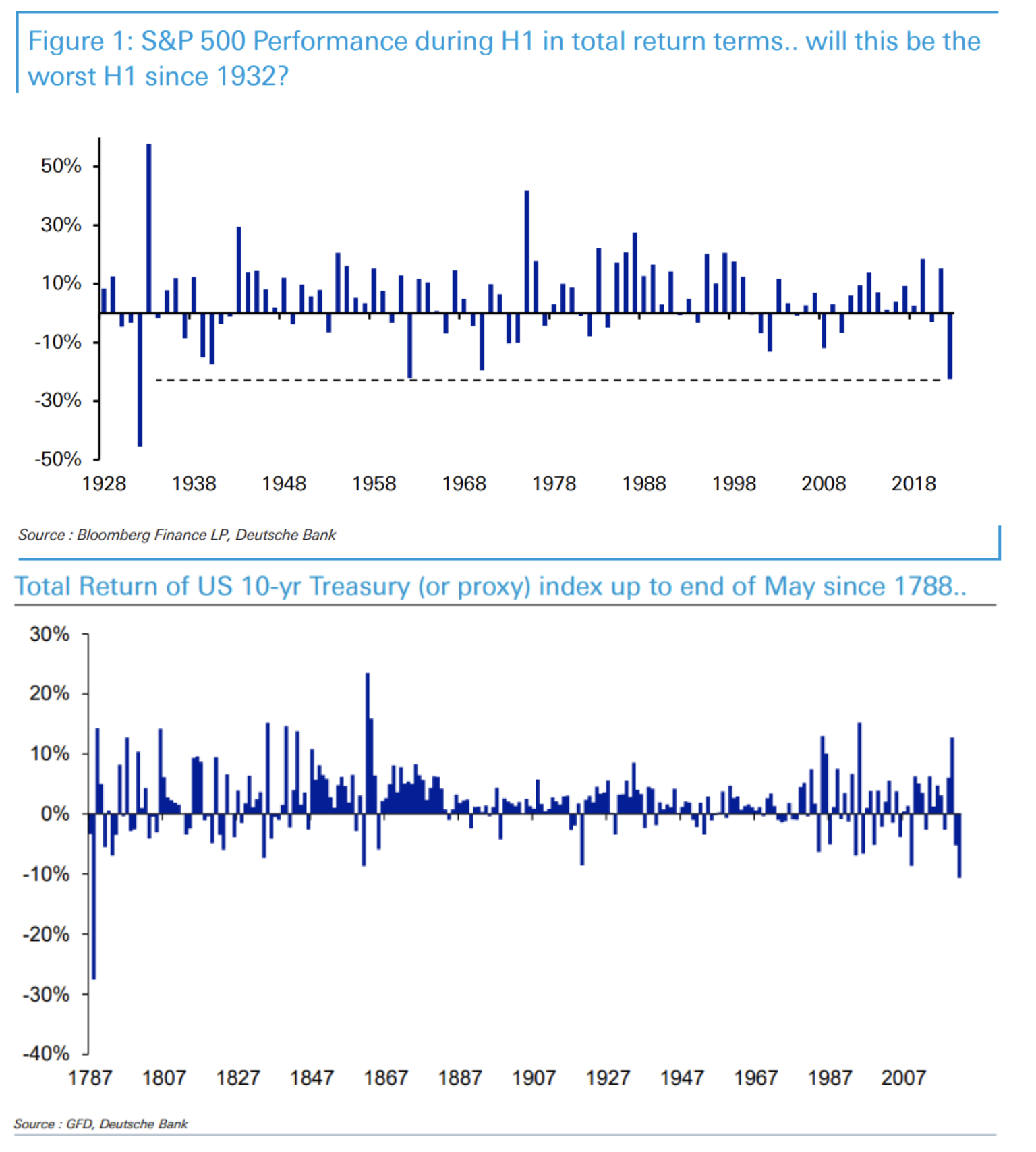

And with US ten year bonds jumping from 0.92 per cent to the current 3.28 per cent over the past eighteen months, and producing one of the worst June half-year returns for hundreds of years, and the US S&P 500 Index down 21 per cent in the past six months, the worst June half-year in 90 years, it seems logical the negative consumer confidence indexes for other English-speaking economies: the UK, Canada, the US and Australia will follow New Zealand over the next few months.

We are all suffering from the same pain of high food, fuel, energy and debt servicing costs and pressure on the price of housing.

Although all Central Banks will belatedly tighten their official cash rates two or three more times over the next few months, any move to hike them too high will likely push their underlying economies into a severe recession. And this is likely to be less palatable than living with a bit of inflation.

For that reason, I am less pessimistic about rising official cash rates than many commentators, and with the damage done to share prices since late-2021 I suspect we will soon be provided with some good opportunities to buy high quality businesses at very reasonable prices.