A Tale of two market machines

While several factors can affect stock prices, Polen Capital believe long-term returns are ultimately driven by sustainable earnings growth.

A Metaphor for Investors and Speculators

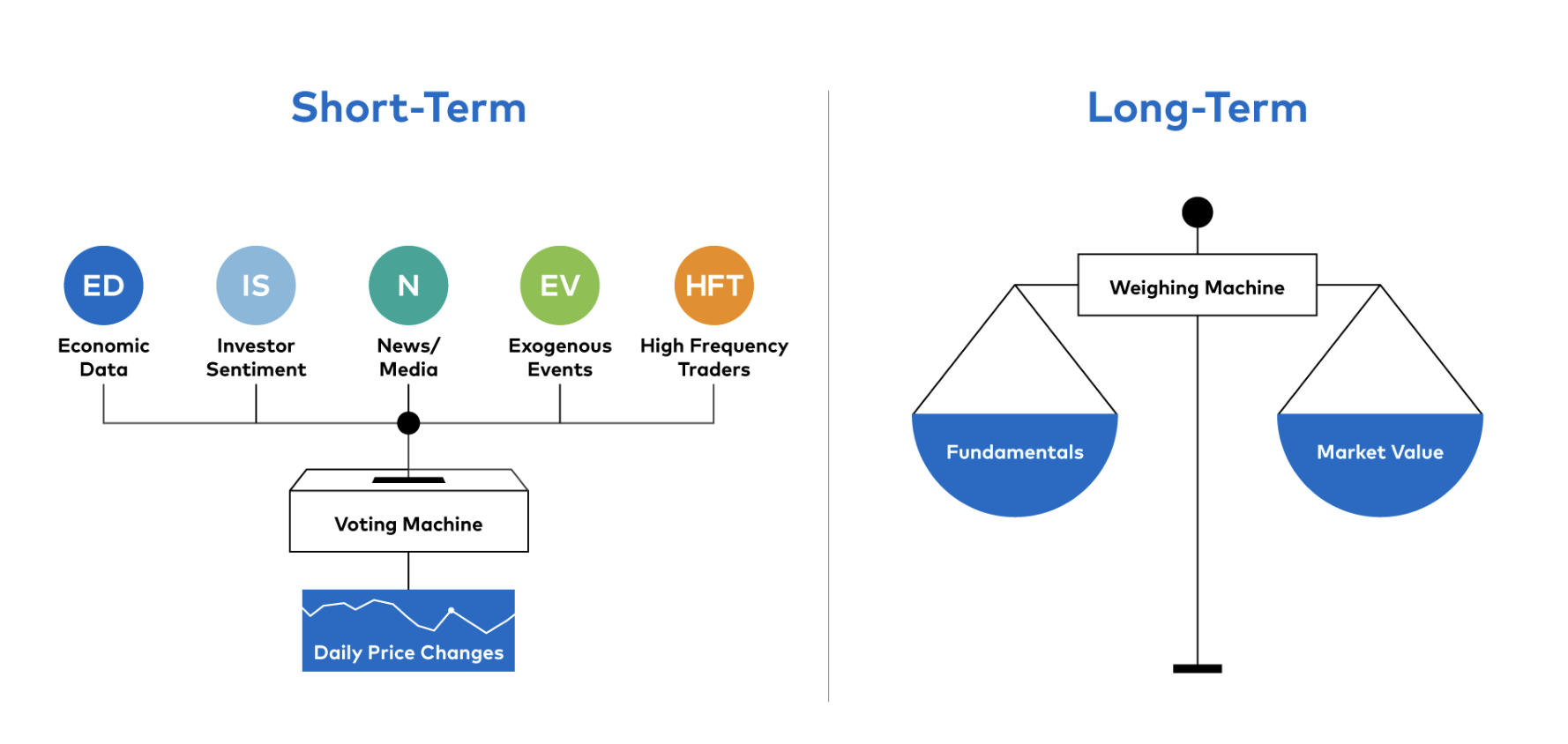

In a 1987 letter to Berkshire Hathaway shareholders, Warren Buffett stated that “in the short run, the market is a voting machine but in the long run, it is a weighing machine.” While simple, we believe the metaphor is remarkably accurate. It implies that the market can behave like an (often irrational) electoral contest in the short term, determining a company’s share price based on how popular or unpopular it appears at the time. When markets behave like a voting machine, they tend to ignore a business’ underlying fundamentals and are driven by speculation, sentiment, and other factors shown below.

Figure 1: The Voting vs. Weighing Machine

Source: Polen Capital

During periods of ebullience, the voting machine can become overwhelmed by optimism and propel a company’s share price beyond its fundamental value. We saw a manifestation of this euphoric behavior during the “everything rally” of 2020-2021, when equities, bonds, and other assets surged in tandem. Amid the risk-on environment, companies with negative operating profits and weak long-term growth prospects reached record highs, exemplified by the “Reddit” and “meme” stock run-ups.

In contrast, the machine can swing in the opposite direction when bearish sentiment and volatility strike the market. When fear takes over, it is not rare to see some market participants throw the proverbial “baby out with the bathwater,” selling both high-quality and low-quality stocks as they rush for the exit. In addition, the rise of algorithmic and high-frequency trading has also exacerbated volatility in recent years. Machine-led trading programs (which account for more than 60% of total U.S. equity volume1) buy and sell securities based on defined criteria with little regard to company fundamentals, research, or valuations. Thus, these “non-thinking traders” can trigger self-reinforcing short-term selling loops.

While even the strongest businesses can experience bouts of indiscriminate selling as the voting machine overlooks the long-term potential of these companies, Warren Buffett believed that in the long run, the market would act as a weighing machine. By this, Buffett meant that equity prices would eventually reflect the fundamental characteristics of a business, including a company’s earnings growth potential, financial strength, competitive advantages, and management quality. Similarly, we believe that our portfolios’ performance will track the fundamentals of our underlying holdings—even if, in the near term, the two could become temporarily disconnected.

When markets behave like a voting machine, they tend to ignore a business’ underlying fundamentals.

Though some market participants such as day traders and speculators may tend to be fixated with the daily fluctuations of the voting machine, we believe long-term investors should center their attention on the weighing machine instead.

Putting Market Volatility in Perspective

As we make progress through the year, we believe that understanding the differences between the two stock market machines will be essential to navigating the current investment landscape. With prospects of higher inflation and interest rates, it is worth noting that today’s market environment—one with less monetary and fiscal stimulus—is meaningfully different than that of the past two years. In our view, an active management approach will be essential going forward given that while passive strategies might prove somewhat effective in an environment where a rising tide lifts all boats, the current backdrop is likely to draw a wider line between winners and losers.

Even though sharp market fluctuations can be difficult to endure emotionally, staying the course and remaining patient through periods of heightened volatility can help investors avoid making impulsive (and often costly) investment decisions. By removing emotions from the decision-making process, we at Polen Capital look at market dislocations as opportunities to become owners of great businesses that rarely go “on-sale” given their competitive leadership and resiliency. This independent mindset—a pillar of our investment philosophy—has allowed us to look past temporary market noise and deliver consistent results for more than 30 years to our clients.