How Polen Capital invest across the growth spectrum

In this video extract from our recent webinar, Polen Capital’s Damon Ficklin shares how the Polen Capital team construct their portfolios using the strategy of investing across the growth spectrum. To achieve a mid-teens earnings per share growth target, they look at a range of different types of growth companies across this spectrum. Damon shares two examples of companies in the Polen Capital Global Growth Fund including Adobe and Siemens Healthineers and their investment thesis.

Transcript

Damon Ficklin:

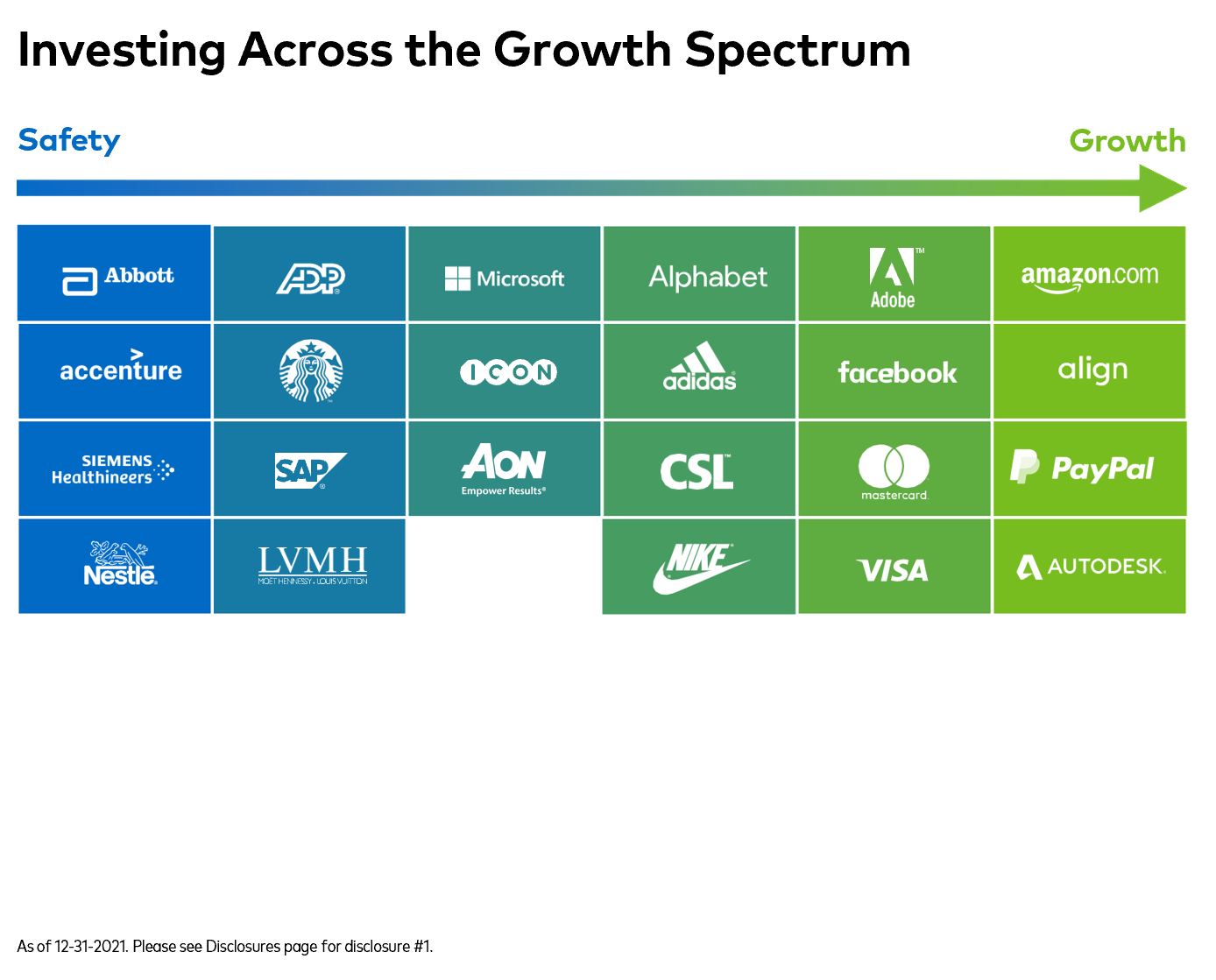

I’d like to share with you how we construct the Polen Capital portfolios and I think this is somewhat differentiated versus many of our global growth peers. We call this investing across the growth spectrum. In aggregate, we are trying to construct a portfolio to drive that mid-teens earnings per share growth profile with the expectation that drives the return profile over time. Every company plays a slightly different role. We’re very happy to invest in high growth enterprises and even happy to pay higher multiples, if the underlying earnings really supports that.

So you can see companies on the far right below, like Amazon or Align or Autodesk. On the other end of the spectrum though, we compliment that with companies like Abbott Laboratories or Accenture or Siemens Healthineers. These are businesses that may not grow earnings at 15 per cent or a higher rate over the long term, but they have sustainably been able to deliver, low double digit to low teens earnings per share growth in good times, in bad times, and because they’re not quite as dynamic a growth company or quite as sexy in some sense, they’re often quite reasonably valued.

We are putting this range of different types of growth companies together to achieve that earnings growth target, but to be able to do it at a valuation that’s quite reasonable. And importantly, there’s quality, sustainable advantages underneath each one of these companies. I’ll give you a couple of examples.

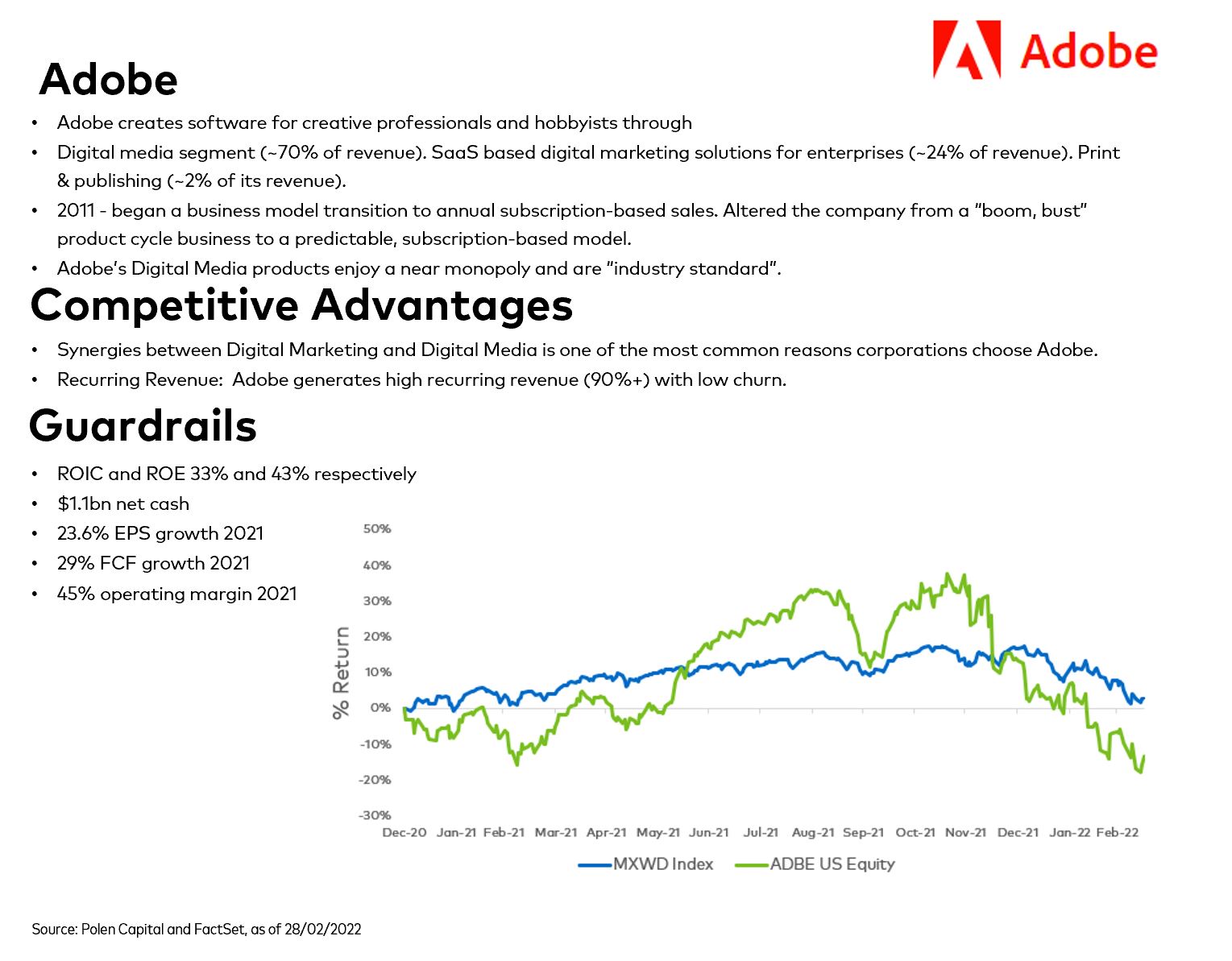

Adobe is owned for its strong growth. Adobe is nearly a monopoly in the digital media creation field. And it is also a leader in digital marketing. This business started to transition to Software as a Service (SaaS) back in the 2011 timeframe; today the vast majority of their revenues are recurring. So 90 per cent plus recurring revenue rate selling digital media solutions, which they’re nearly a monopoly in, and also offering digital marketing solutions where they have the largest, and I’d say, most integrated and advanced suite of digital marketing capabilities.

You can see the guardrails here just as an example of what the economics of this business are; very high returns on equity and invested capital, in a cash position so strong balance sheet, and you can see the very strong earnings and free cash flow growth that also highlights the margins. A 45 per cent operating margin is about as good as it gets, not just in software or SaaS, but in any business for that matter. So Adobe is growing at a rate of roughly 20 per cent on the top and bottom line, slightly below that recently but right around that range, with outstanding profitability and economics.

We’ve owned Adobe for about six years. It’s actually compounded at about a 30 per cent rate, slightly higher than that over that six year period, playing its role in the portfolio perfectly. The chart above shows just in the past 14 months, so during 2021 and into the first couple of months of 2022, which have been an interesting time of period, and you can see that over the short horizon, Adobe’s actually underperformed and trailed a little bit. And I highlight this just to say that market volatility really gives us opportunities. We’ve compounded an incredible rate since the inception of our position in Adobe and that’s inclusive of the recent pressure we see in the share price, and the recent share price pressure really gave us an opportunity to add to that position.

So after a 20 per cent pullback recently, we’ve added to that position and it’s now more than a 6 per cent weighting within the portfolio.

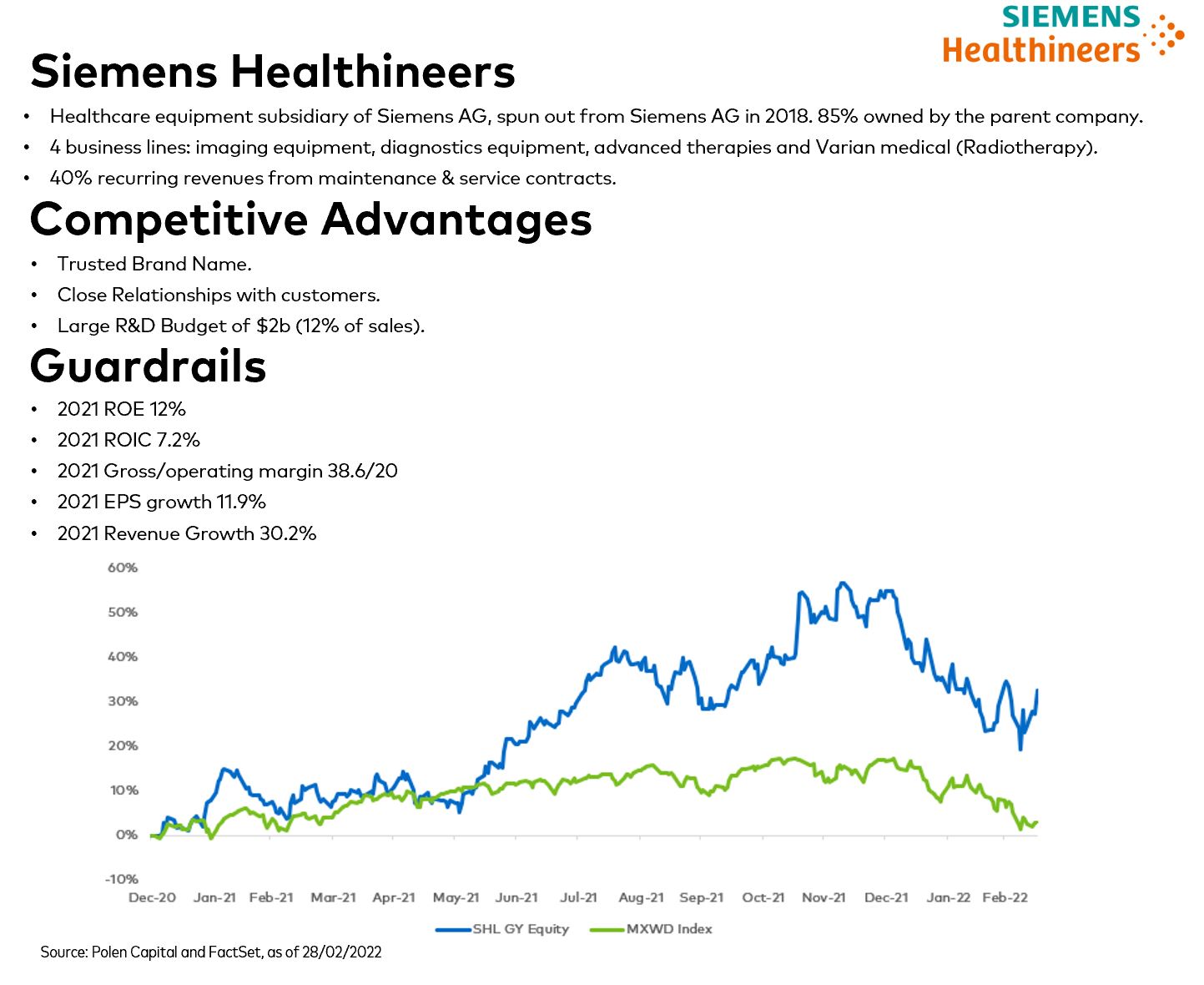

I will share one more example with you that’s really at the end of the spectrum, and this is Siemens Healthineers. So not quite as sexy as a high growth digital marketing SaaS business, but it is the leader in imaging on a global basis and it has been for quite a while. And this is a business that scale and reinvestment and innovation really drives more scale. It supports the largest service network to keep machines up and running.

If a hospital spends millions of dollars on imaging equipment and there’s any kind of glitch or downtime, they have to correct that quite quickly. So having a scaled enterprise, being the leader in this space with the largest service force, they’re able to do that. And again, importantly, that sales and earnings growth advantage enables them to reinvest and they really lead across all different modalities, whether that be CT, MRI, in all the imaging fields. It’s also really tied for second in diagnostics. It’s a leader in the space. Roche is the largest diagnostics company in the world, and Siemens Healthineers and Abbot are tied for second place, very closely behind, really a global oligopoly, if you will.

Another very attractive business, highly recurring in nature. And they’ve really been advancing their position through a new platform called Atellica®, which is really winning way more than its fair share in the largest labs. And they’ve now come out with an Atellica® Lite, that’s going serve some of the smaller kind of folks, if you would think of that as a hub and spoke approach in the lab marketplace. They also acquired Varian Medical very recently. And that’s why, if you look down at the guardrails, you’ll see return on equity of below 20 per cent. Why is that? That’s because they have good will on their balance sheet. And we’re looking through that to the underlying economics of this business.

Varian is an excellent business, one that they’ve actually had a partnership with for a decade because Varian is the leader in radiotherapy, and as you can imagine, imaging is a very important component of delivering radiotherapy to the right place in the body. And so they’ve had this partnership for a long, long time. Now they’ve acquired Varian. And as we look forward in the coming years, I think they’re going to be in an even more advantaged position to integrate their technologies into bringing the best-in-class products. They’re already both leaders in their field, I think this is only going to further their advantages over time.

So Siemens has also played its role perfectly. We’ve owned it for about three and a half years, and it’s compounded right at the mid-teens. So for a highly durable safety business that tends to grow consistently through good times and through bad times, delivering that type of return, doing exactly what we aim to do. So every company on that spectrum has a story and they’re all advantaged and I’d love to talk to you about more of them.

The Polen Capital Global Growth Fund owns shares in Adobe and Siemens Healthineers. This video was prepared 22 March 2022 with the information we have today, and our view may change. It does not constitute formal advice or professional investment advice. If you wish to trade these companies you should seek financial advice.