Is it a fad? Yes, always

Is this a fad? This is one of the questions an investor must always ask themselves, no matter what company they are investigating. And when the company in question is fitness related, the answer is it usually is a fad.

Back in September 2019, the week after Peloton (Nasdaq: PTON) filed to list on the Nasdaq, I wrote of the US$8 billion float in The Australian newspaper;

“Let’s be honest; Peloton is selling a grown-up version of Nintendo’s Wii, the 2006 game console that introduced a hand-held pointing device that detected movement in three dimensions.

“Peloton is selling an interactive exercise game. Bringing streamed and connected cardio workouts home is no more “game changing” than the 1980s fad of doing an aerobics workout with Richard Simmons in front of the TV. (Indeed, they are identical!)

“While advocates see a business model that is less a traditional fitness-equipment manufacturer and more like an Apple or a Gillette, let’s get real. Peloton is a fad just like the vibrating belt of the 1960s, Jane Fonda’s aerobics videos of the 1980s, rollerblading in the 1990s, Nintendo’s Wii Fit in the 2000s and, most recently, Soul Cycling/spin classes.

Peloton’s products, apps and in-room cycling fad will fade just as surely as all the fitness crazes that came before it. And I can assure you Simmons didn’t spend $US324 million to gain awareness like Peloton has in the last two years.”

It is easy to be conned by the numbers. In its IPO documents, Peloton disclosed it had grown its “subscriber” base five-fold since 2017 and consequently enjoyed revenue growth from $US218.6 million in 2017 to $US915 million in 2019.

Those numbers alone are a red flag. Only the most rarefied quality businesses can grow their business that fast and retain the revenue year-in, year-out. A quick glance however at the unsustainable advertising spend in the company’s IPO documents confirmed the revenue growth was reliant on promotion.

Inevitably, customers would drop off, there would be churn, the cost of acquiring new customers would rise, margins would fall and the stock price would eventually plunge.

Any cursory investigation would reveal that the US$8 billion IPO valuation was preceded, only a year earlier, by a private equity, Series F, funding round at US$4 billion. In other words, informed private buyers, without the emotionally charged pressure of public markets, were willing to ‘only’ pay US$4 billion a year before. IPO investors should always ask; why are these, more-informed, investors selling?

After commencing trading Peloton shares closed their first week at $25.24 on 27 September 2019 with a roughly US$8 billion market valuation.

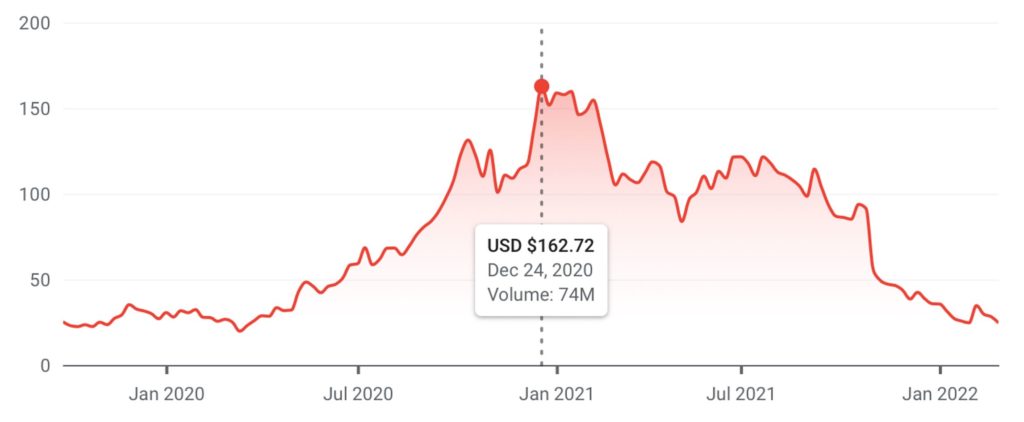

By Christmas Eve 2020, just as many academics began to theorise, the COVID-19 pandemic-inspired lockdowns would forever change the way we live, eat, exercise and breath, the shares were trading at $162.72 – a near six-and-a-half-fold increase. The company briefly enjoyed a market valuation nearing US$50 billion.

Figure 1. Peloton share price. Stationary bikes can roll downhill

Following its share price peak, the company continued to make headlines but for all the wrong reasons. In 2021, the company recalled its main treadmill product following a litany of injuries and the death of a child.

In December 2021, the return of the spin-off TV series to Sex in the City included the death of a main character while riding his Peloton bike.

Many analysts are now acknowledging the company was a clear beneficiary of the COVID-lockdown-inspired home fitness craze.

As the weather fines up and it’s safe again to go outside, fitness heads back to the gym and outdoors. And all those Peloton bikes that were stinking up the dining area in New York bedsits will hit eBay’s second-hand market as rapidly as they were purchased. Peloton can kiss recurring revenue permanently goodbye.

But COVID, or no COVID, the fitness world advances by way of fads. Newfangled ideas for getting in shape and staying in shape will come and go. That is a permanent characteristic of the fitness market and one investors need to always remember.

Since listing, on February 9, 2021 Peleton raised another US$875 million in post-IPO debt, and since its share price peak Peleton’s shares have cratered nearly 85 per cent.

If the rumours of Amazon’s takeover bid for Peloton are true, investors may receive a small reprieve but for most it is better to simply exercise your investment dollars elsewhere.