The US – Capital’s Share Of Output At An All Time High, Part 2

Following on from the blog of 14 February 2013, I have been asked by a number of readers why I think Capital’s share of output as it all time high, and conversely why “Labour’s share of output has, in recent years, declined from 70% to 64%”.

I think there are three significant factors at work.

1. Globalisation has seen a structural decline in Western World manufacturing. The declining price of manufactured goods, in real terms, has ensured a weak bargaining positioning for labour. In Australia, for example, the Manufacturing Sector as a percentage of all workers has declined from 19% to only 9%, in the past thirty years;

2. Technology has driven productivity growth, particularly in the Services Sector. Again, in Australia the Services Sector as a percentage of all workers has grown from 73% to 85%, in the past thirty years; and

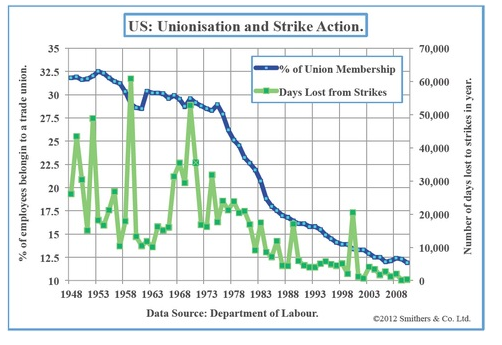

3. The combination of Globalisation and Technology has reduced the relevance of Trade Unions. The graph below, from Smithers & Co. Ltd, compares Unionisation with Strike Action in the US. Both are currently at an all-time low. In the US the percentage of employees that belong to a trade union has halved since 1978 to 12%. In Australia the percentage of employees that belong to a trade union has declined by two-thirds from 55% in 1983 to 18% today.