Is Capricorn Metals due a re-rate?

Capricorn Metals is a junior gold company that is entering an exciting time in its development phase. With the company very close to first gold pour and commissioning underway at its 100 per cent owned Karlawinda project in WA, we believe there is significant re-rating potential if the company successfully executes on targeted project metrics over the next 6-12 months.

While The Montgomery Fund has historically been reticent to invest in mining companies partly due to their price-taking nature, our investment thesis on Capricorn Metals (ASX:CMM) is more about successful execution by a quality management team with a history of shareholder value creation and less about the gold price. Once fully ramped-up, Capricorn will have established a run-rate of profitability and cash-flow that in our view should command an earnings multiple in-line with its considerable 10+ years of reserves and resources.

Some key points to the investment thesis include:

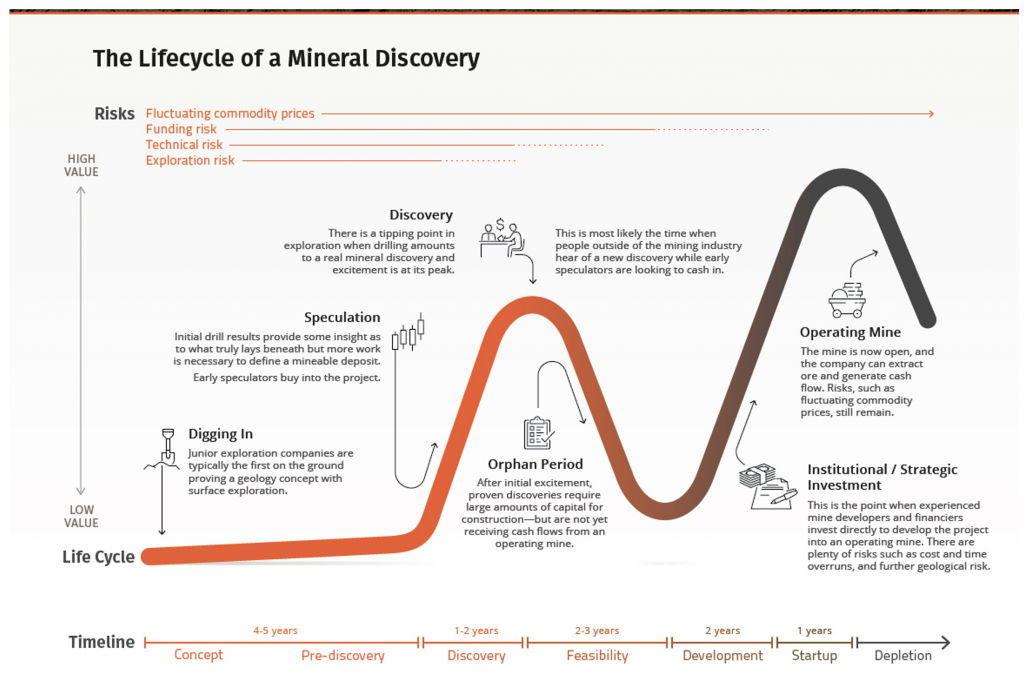

- Potential upside is contingent on project de-risking and project delivery – while the gold price will undoubtedly influence the share price given the high degree of correlation between gold price and gold companies, there is significant additional shareholder value to be created with successful project delivery. This is depicted in the figure below:

Based on Karlawinda’s expected production, cost targets and current gold price, we estimate Capricorn will generate over $160 million of EBITDA (with more than 50 per cent cash-margin at spot gold) versus its current enterprise value of approximately $800 million, relative to a reserve life over 10 years.

- Strong management team with history of delivery – key management include Mark Clark, Kim Massey and Paul Thomas, who were instrumental in creating significant value for shareholders at Regis Resources and are highly rated for their execution.

The management team is well known for running lean operations and adopting conservative accounting policies where the focus is on cash-flow generation over accounting-based cash and All-in sustaining costs (AISC) measures. This provides for a simple reconciliation of cash cost and AISC measures to the company’s free cash-flow – something we value highly at Montgomery.

There is also significant alignment of shareholder interests with the board and executives owning over 10 per cent of the issued capital.

- Relative low-risk project – the project is an open-pit bulk mining operation – similar to those developed by the team at Regis – with a very conventional processing CIL circuit.

There has also been significant grade control drilling conducted – something the management team has been specifically focused on given grade reconciliation issues experienced at Garden Well at Regis.

- Project is fully funded and remains within budget – with commissioning imminent, the risk of cost blow-outs has diminished considerably, with CMM noting the project remains within budget of $165-170 million. The company has also recruited all operational staff, which is important given the labour shortages being faced in WA.

The project has been funded with equity and project financing, but also has a hedging profile of around 200koz at $2,250/oz to help mitigate the revenue risk on debt in the event of a significant fall in gold price.

- No significant gold ETF holders – many junior gold miners have a significant Gold ETF shareholder presence on their register (up to 10 per cent of the issued capital). As Capricorn enters steady production, we believe there is strong consideration for index inclusion over time.

Should CMM be eligible for index inclusion over time, there may be considerable demand from passive investors that may help share price performance.

With the company at the cusp of the “Startup” phase of the Lifecycle of a Mineral Discovery, we believe the company has the potential to follow the re-rating playbook enjoyed by other developers turned producers such as Gold Road Resources (GOR).

The Montgomery Funds own shares in Capricorn Metals. This article was prepared 04 June with the information we have today, and our view may change. It does not constitute formal advice or professional investment advice. If you wish to trade Capricorn Metals you should seek financial advice.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY