Following the ETP market through COVID

The Australian Exchanged Traded Product (ETP) market crossed a staggering $100 billion in assets as at the end of March[1], which was a new all-time high from where they closed 2020 at $95 billion. This is quite a feat when you think about the volatility in markets that occurred over the 12 months prior.

In fact, it may come as a surprise to some that 2020 represented the greatest inflow year on record for ETPs in Australia at north of $20 billion in net flows.[2] The structural drivers behind this growth, accompanied with opportunity in markets, were key ingredients for the strong year.

At the end of March, there are now 378 different ASX-listed strategies accessible to investors in the form of Exchanged Traded Funds (ETFs) and Listed Investment Companies (LICs). These include both active and passive management across a number of assets, sub-sectors, and thematics or styles.[3] The growth in the options available to investors via the ASX in one trade has been a big driver of the adoption of ETPs to date, and one expected to continue to drive growth this year and beyond.

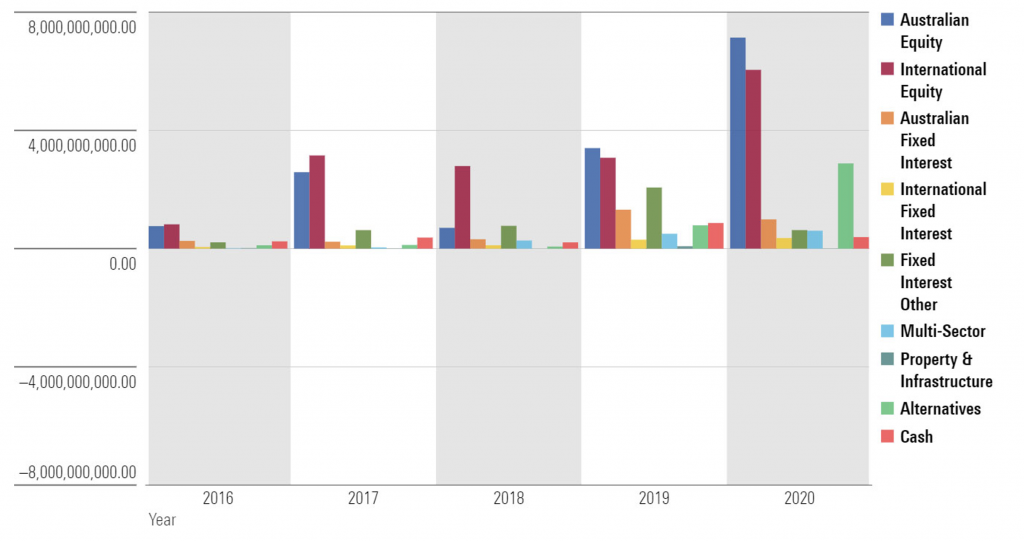

So where did all the money into ETPs in 2020 go?

The largest flows were into Australian and International Equities, closely followed by Alternatives which is a new category killer in the ETP space where the main types of strategies available are those commodity (namely gold) based or short exposures. Fixed Interest was the quietest asset class for flows in 2020, which is understandable given the structural headwinds of record-low yields facing the sector.

Chart 1 – Calendar year flows by category

Source: Morningstar

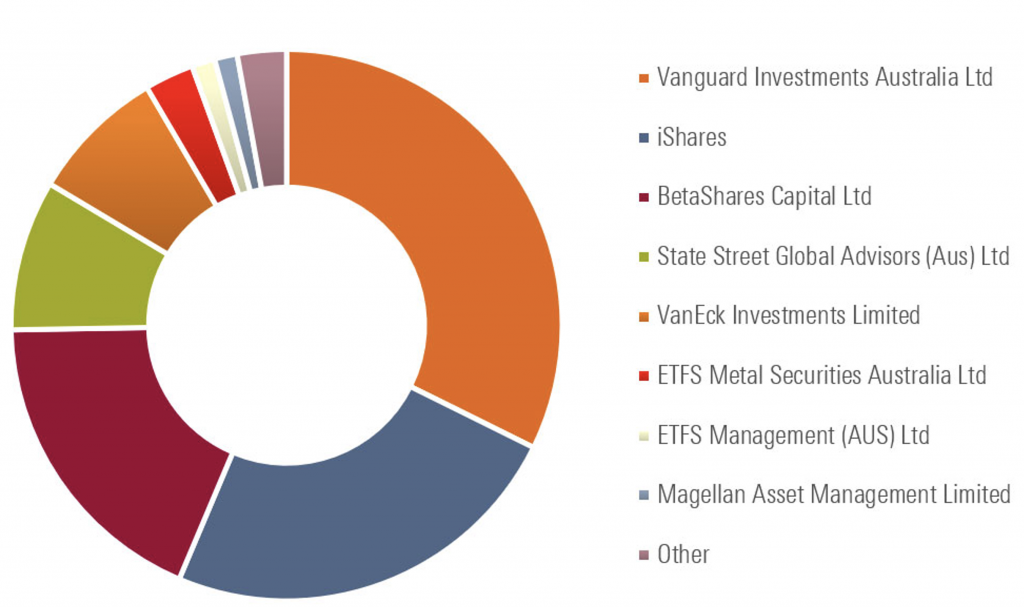

When shining the light on net flows by ETP manager last year, Betashares had a strong 2020 across a very (very) large number of strategies: passive, thematic, smart beta and everything niche in between. Vanguard, currently the largest domestic player in passive land, were second, followed by global giant iShares. The breakdown of total assets by manager in ETPs is captured in Chart 2 below. Magellan have the largest slice of the pie for an active manager in this space, second only to Vanguard overall.

In the intermediary (advised) market, it is important to note passive strategies are usually used as a core allocation in a portfolio. Therefore it makes sense for these types of strategies to capture a larger part of the ETP market share, particularly when coupled with their low cost. However, there are a lot of niche capabilities (such as those ESG focused) and active managers coming to market in the ETP space which will increase the options available to the end investor.

Chart 2 – Total assets by managers

Source: Morningstar

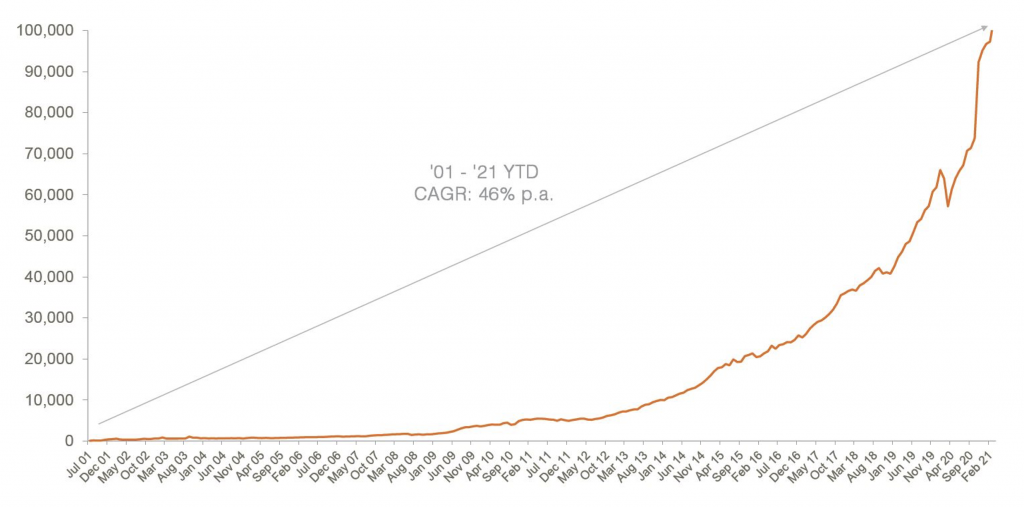

Can the ETP market continue the growth of 2020 into this year and beyond?

Many market commentators certainly believe so, and this has definitely been the case historically. In fact, since 2001 the ETP market has been growing at over 40 per cent per annum. A key continued driver of its growth going forward will be both market performance and of course the growth in investment options in this space.

Where does Montgomery fit into all of this?

The research team are very interested in this space through holdings in the Montgomery Small Companies Fund in businesses like Pinnacle, where one of the strategies they represent recently launched an ETP. We are also, of course, interested in this space for our own capabilities going forward.

Chat 3 – Growth of Australian ETPs by market cap

Source: ASX, Chi-X, BetaShares

[1] Betashares Australian ETF Review – March 2021

[2] Betashares Australian ETF Review – 2020 in Review

[3] ASX Monthly Update – March 2021

The Montgomery Small Companies Fund owns shares in Pinnacle Investment Management. This article was prepared 27 May 2021 with the information we have today, and our view may change. It does not constitute formal advice or professional investment advice. If you wish to trade Pinnacle Investment Management you should seek financial advice.