Why it pays to invest in structural growth businesses

Structural growth companies – like Appen (ASX:APX) and Nanosonics (ASX:NAN) – are generally involved in cloud-based technology, data centres, digital payments, e-commerce and medical technology. Importantly, they can grow regardless of the COVID-19 crisis and the broader economic cycle. Which is the reason we hold an overweight position in our small companies portfolio.

Following on from my blog on the Montgomery Small Companies Fund I thought I would explore the Structural Growth category in a little more detail and its effect on the valuation and other pertinent fundamentals on the overall portfolio.

The Montgomery Small Companies Fund owns 21 companies (out of a portfolio of 49 companies) within the Structural Growth category. Collectively, these companies account for 45 per cent of the portfolio, which is 12 percent overweight relative to the benchmark, the S&P/ ASX Small Ordinaries Accumulation Index at 33 per cent.

Structural Growth companies are generally involved in cloud deployed technology tools, data centres, digital payments, e-Commerce and Medical Technology. Selected companies in the MSCF include Appen (ASX:APX), City Chic Collective (ASX:CCX), Nanosonics (ASX:NAN), Megaport (ASX:MP1), Pointsbet Holdings (ASX: PBH) and Pro Medicus (ASX:PME).

Gary Rollo and Dominic Rose have produced the following data for both the Montgomery Small Companies Fund and the benchmark.

| MSCF | Benchmark | |

| Growth | ||

| Annualised sales growth for the year to June 2022 on the year to June 2020 | 14.8% | 6.4% |

| Annualised EBITDA growth for the year to June 2022 on the year to June 2020 | 16.2% | 11.6% |

| Valuation | ||

| EV/EBITDA for the year to June 2021 | 11.5X | 11.6X |

| PE for the year to June 2021 | 17.9X | 18.1X |

| Yield for the year to June 2021 | 1.3% | 2.5% |

| Risk | ||

| Average daily turnover (last 3 months) | $7.5m | $6.3m |

| 3 year rolling standard deviation of share price | 2.3 | 3.1 |

Observations include:

- Relative to the benchmark, the Montgomery Small Companies Fund has significantly faster forecast sales and EBITDA growth over the two years to June 2022.

- In terms of the forecast EV/EBITDA and PE for the year to June 2021, the Montgomery Small Companies Fund is slightly cheaper than the benchmark. While the Fund’s dividend yield is approximately half the benchmark, our view is small companies are often founded by entrepreneurs; their businesses often occupy profitable niches with the opportunity to grow at much faster rate than the broad economy.

- While small capitalisation companies generally involve more risk because of their lower liquidity, their greater sensitivity to management’s influence and their greater sensitivity to general economic conditions, the Montgomery Small Companies Fund offers superior liquidity characteristics and a lower three year rolling standard deviation relative to the benchmark.

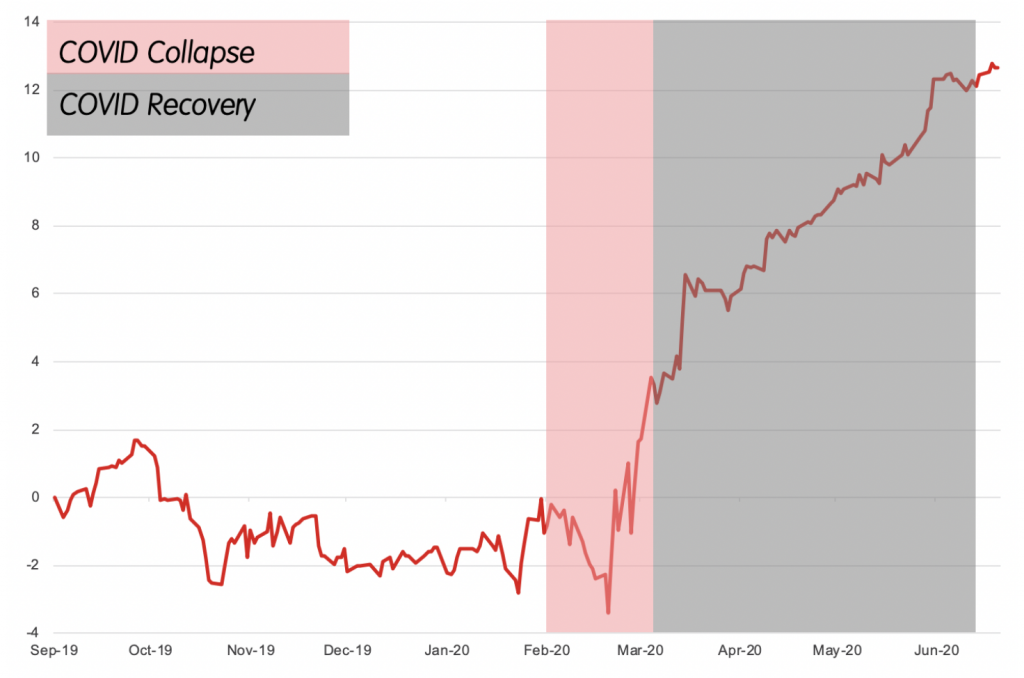

Finally, the chart below illustrates the outperformance of the Fund relative to the benchmark from its launch on 20 September 2019 to 30 June 2020.

Source: Fundhost, Montgomery

You can learn more about the Montgomery Small Companies Fund here.

Alternatively, if you would like to discuss, please call me or Toby Roberts on 02 8046 5000.

The Montgomery Small Companies Fund owns shares in Appen, City Chic Collective, Nanosonics, Megaport, Pointsbet Holdings and Pro Medicus. This article was prepared 23 July with the information we have today, and our view may change. It does not constitute formal advice or professional investment advice. If you wish to trade these companies you should seek financial advice.