How should you think about the prospects for a vaccine?

Gauging the possible extent and duration of the economic downturn resulting from the COVID-19 crisis is a challenging exercise with many unknowns. However, one thing is reasonably clear: in the event that a safe and effective vaccine becomes widely available, the threat posed by the virus will be much diminished and the path to recovery made far smoother.

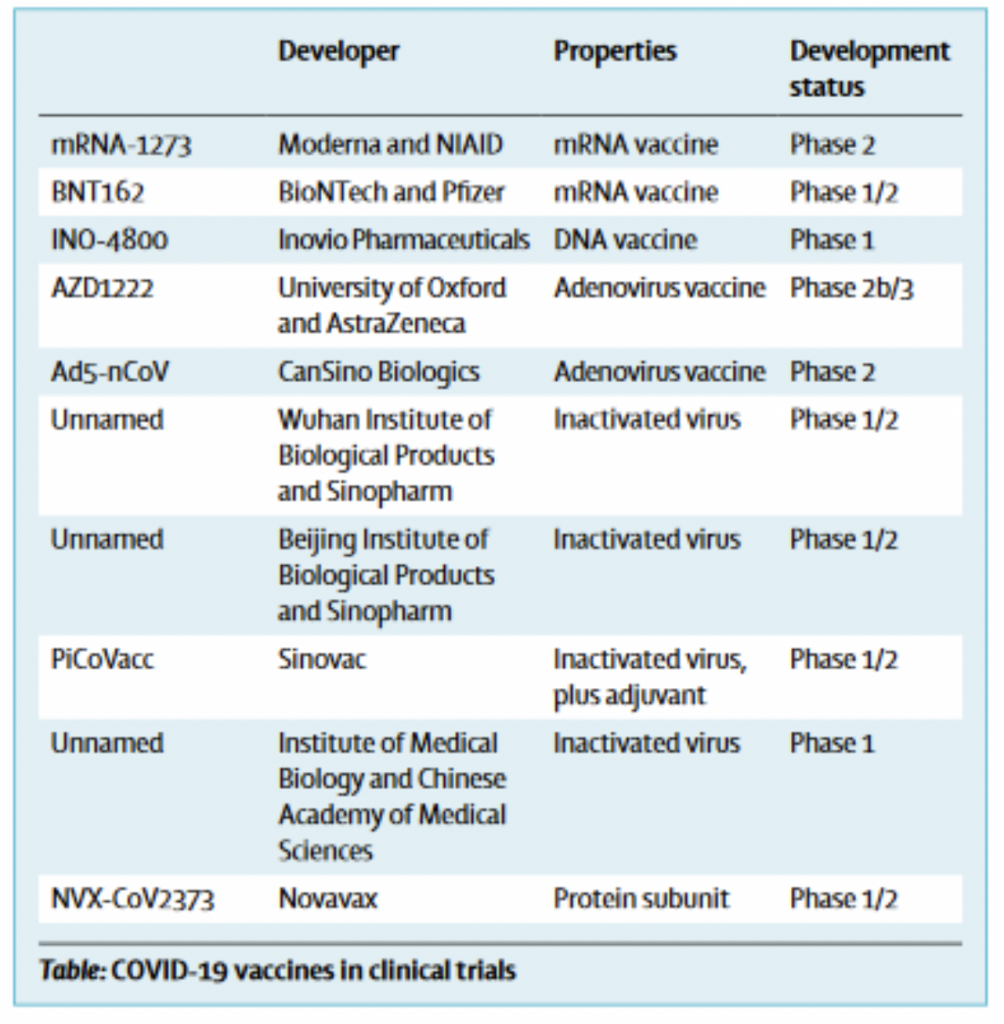

Given that, it is worth keeping an eye on the progress that is being made, the potential for ultimate success, and the likely timeframes. On June 6, the Lancet published an article setting out the status of the various clinical trials already underway, including the following table setting out the details of the ten programs already underway.

The full article is available here.

While this is a reasonably long list of prospects and includes some candidates that have generated significant excitement, including AZD1222 which we have previously written about, and mRNA-1273 which has triggered some impressive share price moves for Moderna, it is important to keep in mind that the statistics around any particular vaccine candidate successfully getting through all the necessary clinical hurdles are not necessarily very encouraging. Some historical data on the success rates for passage from one stage of clinical trials to the next can be found here.

At the same time, there are enormous resources are being devoted to the problem of a COVID-19 vaccine, and that allocation of resources has resulted in a long list of candidates being investigated, with more to follow. Even though the odds of a single candidate are not good, we estimate (very roughly) that there may be a 70 per cent probability that at least one of the candidates on this list will successfully clear all the necessary hurdles to make it into distribution. In addition, the more advanced candidates (those beyond phase 1) have the best chance statistically, and would also be the first to complete the process. Accordingly, we think there is a reasonable prospect (possibly as high as 50 per cent) of a vaccine being available within a 6-12 month timeframe. On the other hand, there is clearly also a fair chance of a much more drawn out process. Unfortunately, this doesn’t give us much certainty as to potential outcomes in the foreseeable future, but it does tell us something about how investors might want to position themselves today.

In particular, it tells us that it may be unwise to position either for a best case scenario (vaccine available by the end of 2020) or a worst case scenario (no vaccine for 18 months or more). Instead, investors should adopt a position that they can live with in the event of either of these possibilities emerging.

In a few years time and with the benefit of the hindsight, some investors will no doubt look like geniuses for having positioned themselves correctly either for a rapid recovery or a drawn out recession, but the reality is not so clear cut. As we stand today there are too many unknowns, and many of the investors who confidently bet today on one end of the spectrum or the other are basically gambling. For long-term investors, consistent, repeatable success with modest risk should be the primary objective.