A look at the NAB remediation charges

Last week, the National Australia Bank (ASX:NAB) released details of the customer remediation charges it expects to take in its 2019 interim result following the Royal Commission into Financial Services. NAB will provide additional detail in its interim result, which is released to the market on 2 May.

NAB announced an after-tax charge of A$525 million, with A$325 million of this billed to its continuing operations and the other A$200 million attributed to the divested MLC operations. Approximately 91 per cent of the charge relates to NAB’s Wealth businesses, and the residual being customer remediation in the Banking operations.

Importantly, the company release states that the charges taken recognises the estimated costs associated with salaried wealth advisors, but do not include aligned advisors. Therefore, there are likely to be more charges taken in future periods.

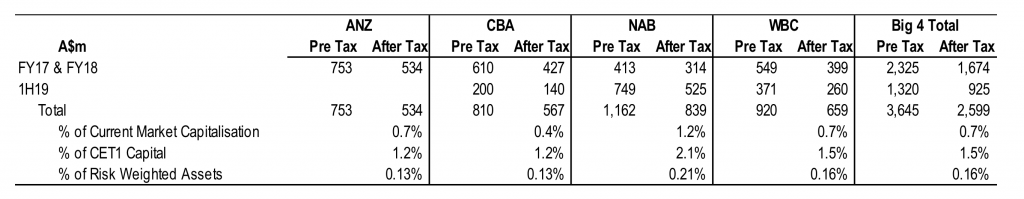

The announcement takes NAB’s total after tax customer remediation charges to A$839 million, well above the levels announced to date by the other major banks. The total customer remediation charges announced by the major banks to date are shown in the table below.

Source: company reports, MIM estimates

Note: CBA has only provided a cumulative pre-tax figure to the end of 1H19. The numbers above only include the direct customer remediation payments and indemnity provision for NewCo. The after-tax figure is an estimate assuming a 30 per cent corporate tax rate.

The table shows that NAB has borne more pain than the other three majors in terms of both absolute and relative cost from customer remediation, with charges to the end of 1H19 equating to around 1.2 per cent of its current market capitalisation. While NAB is yet to incorporate the cost of remediation for aligned advisors. Offsetting this, NAB appears to have taken fewer charges for the rest of its businesses, with over 90 per cent of the charges taken relating to the Wealth business.

While these charges, and an expectation of further charges, have a material impact on near term earnings, they will not be charges that recur into perpetuity. As such, it is important to be cognisant of the underlying earnings generation of the bank excluding these charges in assessing their sustainable value less a finite value of remediation costs.

What is of more interest in the near term is the impact these charges have on the capital position of each bank given the need to meet APRA’s new ‘unquestionably strong’ capital requirements by 1 January 2020.

The charges taken to date have had an impact on the amount of capital accumulated by the banks to meet the raised capital hurdle, and additional charges in future periods will provide an ongoing headwind to capital accumulation. For the better capitalised Australia and New Zealand Banking Group (ASX:ANZ) and the Commonwealth Banks of Australia (ASX:CBA), the charges reduce the potential for capital management, while for Westpac (ASX:WBC) and NAB, it increases the risk of an equity raising and/or cut to the dividend.

The Montgomery Funds own shares in Westpac and National Australia Bank. This article was prepared 23 April with the information we have today, and our view may change. It does not constitute formal advice or professional investment advice. If you wish to trade these companies you should seek financial advice.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

In view of the Montgomery team’s view on the Australian property market and the article above, I am slightly surprised that the Montgomery Funds own WBC and NAB shares at current levels. I would have thought that better entry opportunities await.

The share prices of the banks have already factored in a lot of bad news. That of course does not mean it can’t get worse. Certainly a recession would see their share prices fall considerably from current levels. However, if a more benign low growth and inflation environment persists, the risk premium currently implied by the share prices would justifiably unwind, generating good returns for shareholders. Risk is almost always two sided. In assessing risk assets, its important to understand both sides and the probabilities that are effectively factored into the share price. While we believe an exposure anything like what is factored into the broader market indices and their tracking funds is not appropriate in terms of the risk and return of offer, a smaller exposure is justified in a portfolio context.