Why consumer-oriented stocks could soon struggle

While the Federal government continues to crow about the strength of the Australian economy, a worrying trend is occurring that is getting less attention: Australian households are saving less. Sooner or later, this trend will reverse. And when it does, consumer-oriented businesses will feel the heat.

On the 5thof September, Australian Bureau of Statistics released the June quarter national accounts.

The highlight as you might have seen in the news as that GDP showed an unexpected strong growth of 3.4 per cent compared to the same quarter last year.

One of the strongest contributors to the stronger than expected growth figure was the very strong consumption numbers which grew even stronger at 3.5 per cent compared to the year before.

Consumption numbers are made up both by household and government consumption. Government consumption grew by 5.2 per cent and household consumption grew by 3.1 per cent. As the household sector is quite a bit bigger than the government, household consumption is a bigger contributor to total GDP growth.

On the face of it, this looks like good news for the economy but if we dig a little bit deeper into the statistics, some worrying trends show up that throw up some question marks about how sustainable this is.

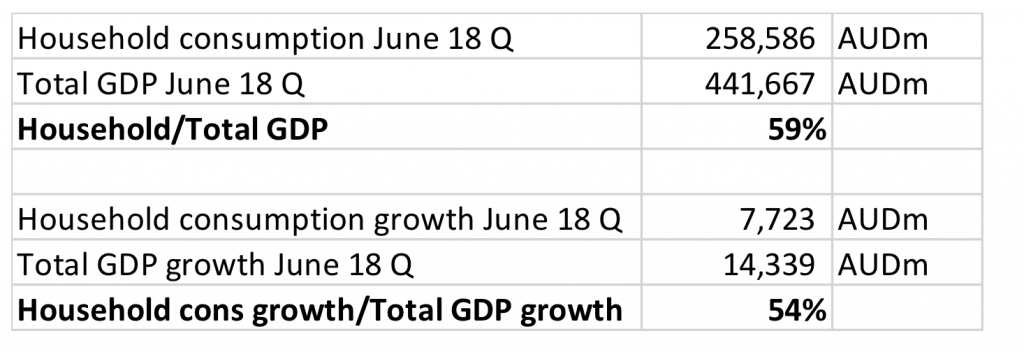

First, we can start by establishing that household consumption growth contributed 54 per cent of the total GDP growth in the June quarter and constituted ~59 per cent of Australia’s total GDP.

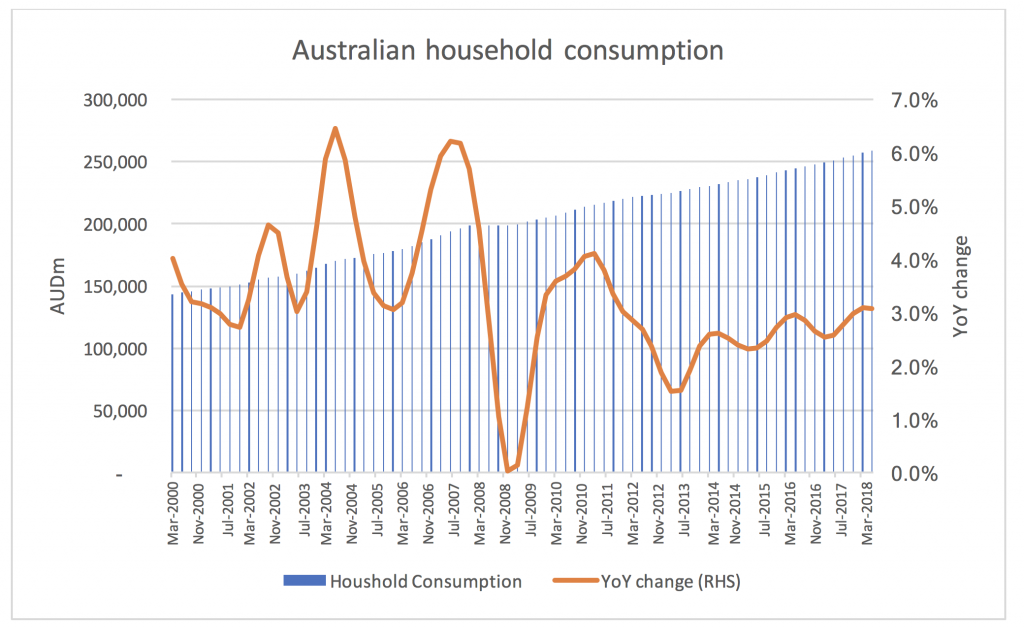

Secondly, we can see that household consumption has grown relatively steadily at a pace of between 2-3 per cent since 2013.

Source: ABS

So far so good!

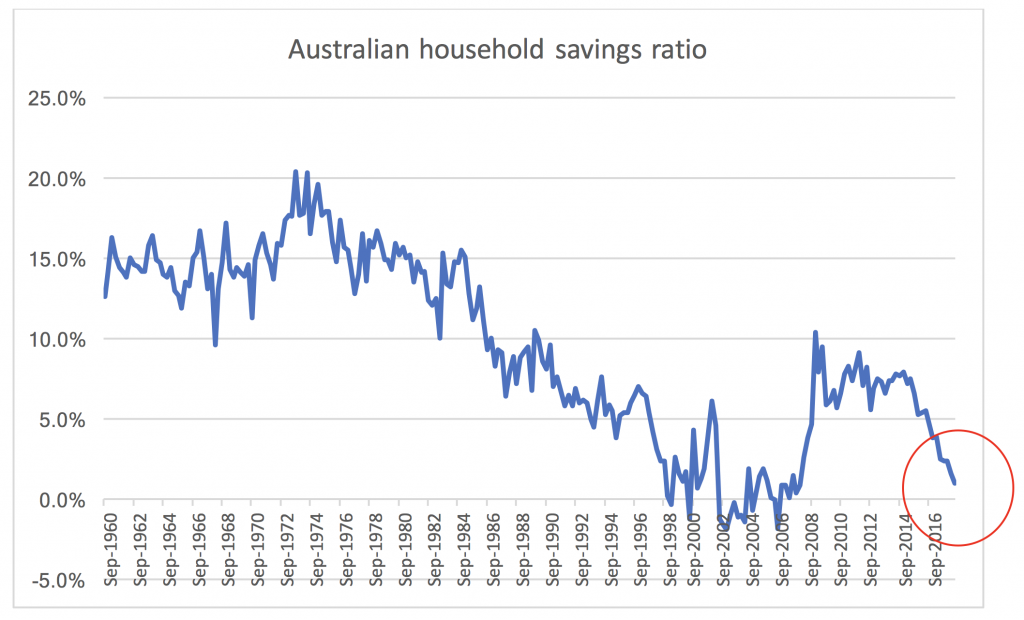

What is really worrying is that the household savings ratio is rapidly collapsing and is now only at 1 per cent:

Source: ABS

The household savings ratio is defined as the subtraction of household consumption expenditure from household disposable income, plus the change in net equity of households in pension funds divided by the household disposable income. It is basically a measure on how much of the disposable income the average household is saving for the future. Currently, the average Australian household is only saving 1 per cent of their income, which is the lowest since pre the GFC. If the savings ratio had kept stable on one year ago, the overall GDP growth would have been a much less impressive 2.2 per cent.

So what is happening?

As I have written previously, Australian consumption has benefited from the “wealth effect” from increasing property prices (i.e. people have felt comfortable spending more the more “equity” they have in the property and have been refinancing to release equity to spend periodically). Now when property prices are no longer increasing and have indeed turned negative on a national scale, consumers have not yet adjusted their spending behaviour and are instead sacrificing saving to continue to consume.

This is clearly not a sustainable source of growth as unless people will be prepared to (on average!) borrow to maintain or increase their consumptions level, they will eventually run out of funds once the savings ratio reaches zero…

The wealth effect worked well for companies benefiting from consumers spending when house prices were rising. Let’s see if it will hurt them to a similar extent when the wealth effect reverses and the savings ratio eventually cannot fall any more…

At Montgomery, we believe it will, and thus we have very minimal exposure to any consumer-oriented stocks in our portfolios.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY