So is it a good time to invest globally?

It is only natural for investors and advisers alike to question whether now is a good time is to invest in global equities. As an investment manager, we are constantly asked if it is the right time to either add more funds or redeem funds from their portfolios. Here we discuss what we do in our own funds.

While we are not licensed financial advisers, and cannot take everyone’s personal circumstances into consideration, we can discuss what we do in our own funds and how that may provide a useful perspective when investing globally.

In our long-only strategies (Montgomery Global Fund and Montgomery Global Equities Fund ASX:MOGL) we are seeking to invest in a high quality portfolio of 15 – 30 companies which are listed on developed market exchanges and trading well below our estimate of their intrinsic values. Now, when we look at all the companies in the world that meet our minimum size and liquidity requirements, we calculate that there are about 5,000 companies to choose from.

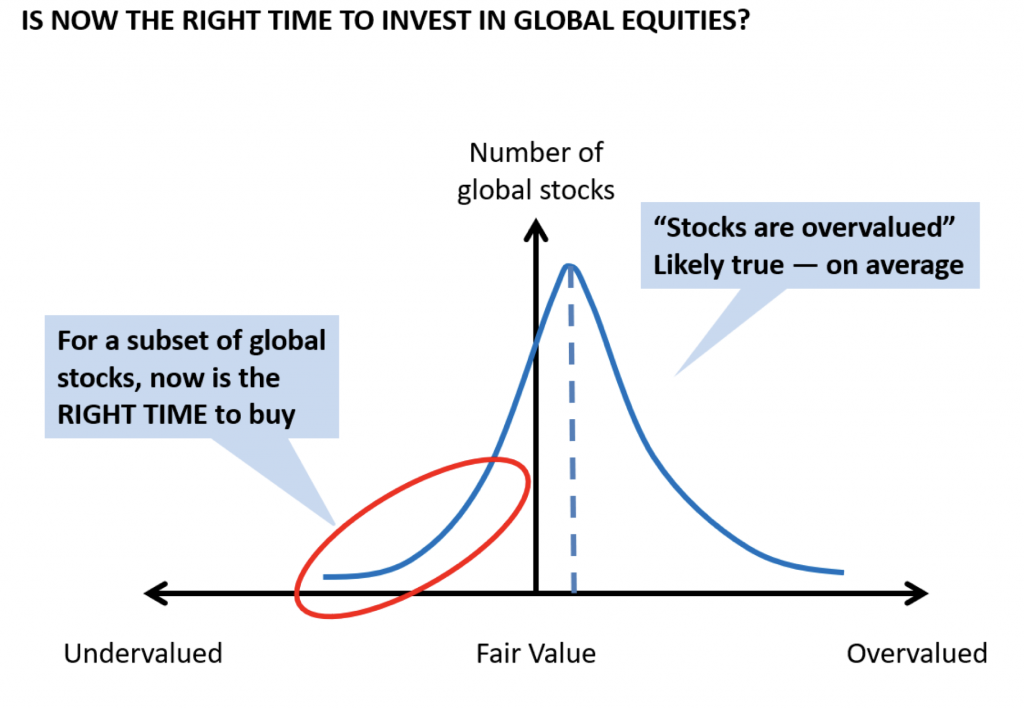

As a firm, we believe that equities are on average expensive relative to their fair value. However, unless you are buying the market in its entirety (maybe via abroad based market cap weighted index ETFs) then you won’t “own the market” average. If we look at the diagram below, it attempts to illustrate the distribution of stocks (vertical axis) according to their relative value (horizontal axis). So, while the dotted line representing the average stock’s value may well be above that of fair value, there is still a proportion of stocks (circled in red) that currently represent undervalued investment opportunities. For this group of stocks, now is the right time to buy them and it is our job as an investment manager is to identify the best investment candidates through skillful research and analysis.

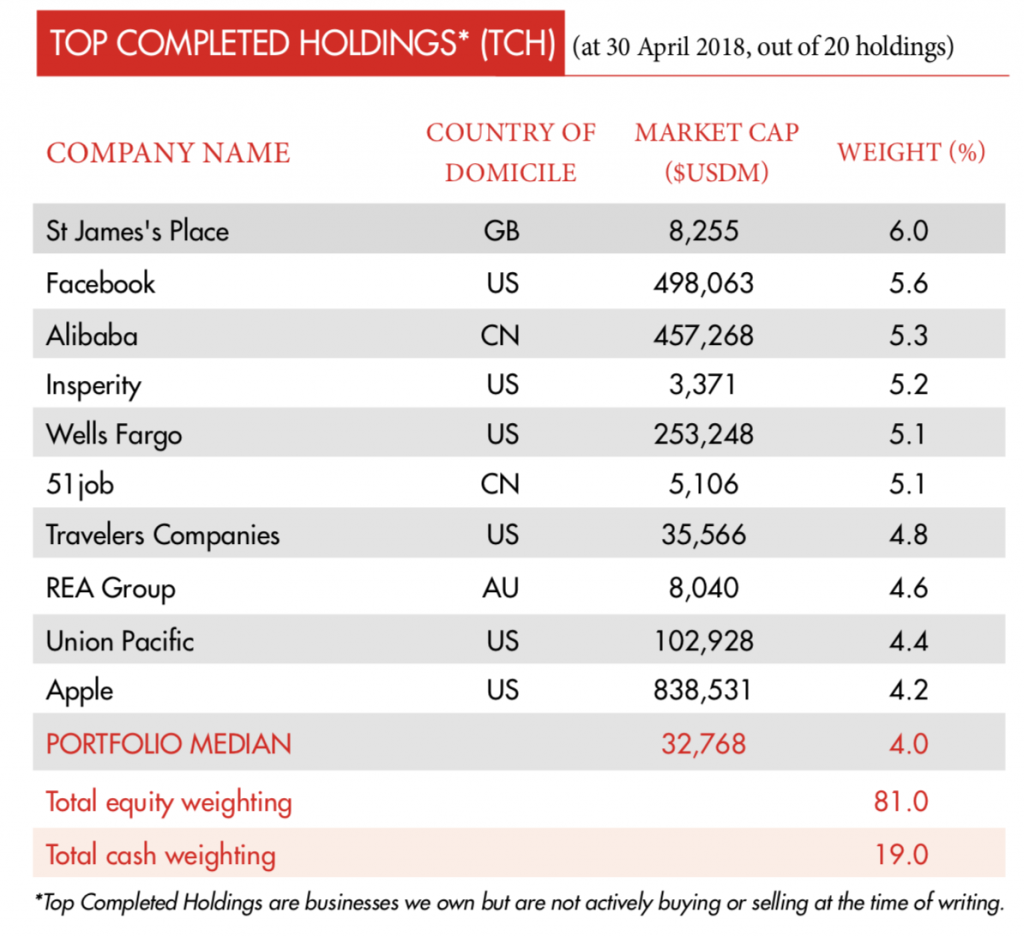

Today we have 20 companies in our long-only strategies, the table below shows the top 10 at 30 April 2018. And when people ask why we own US stocks in the portfolio, we point to the fact that we “don’t own the US market”, we selectively invest in just 8 businesses out of the 500 represented in the S&P 500 index.

The other investment tool we have at our disposal is the ability to invest in cash. Our long only funds can hold between 0 – 30 per cent (and up to 50 per cent in extreme circumstances) in the safety of cash. So, when valuations become stretched and if we can’t find compelling investment opportunities then we, unlike many other investment managers can invest in the safety of cash.

Of course investing in global equities doesn’t have to be constrained by just buying (long) equities and cash. In our Montaka funds, we hold a portfolio of long (bought) stocks alongside a portfolio of companies we have shorted (sold). The attractive feature of this added flexibility is that we can potentially add returns from both the long and short side of the portfolio. We can also vary the average net market exposure (long portfolio weight minus short portfolio weight) depending on the opportunities we find in the market. Generally, the strategy will be 30 per cent – 70 per cent net long. We aim to generate materially higher risk-adjusted returns, than is available in the equity market place over the medium-term. The Funds will also seek to offer a significant level of capital preservation, across all market cycles.

So, in summary it is our view that equities in general are somewhat expensive compared to their long-term averages, but if you are selective in your stock picking, then there are often opportunities for the focused investor.

If you would like more information on our global strategies including our listed fund (ASX:MOGL) please click here.