Could mobile eclipse fixed broadband?

Just as mobile telephony has led to a plunge in fixed line connections, it’s possible that mobile broadband could have a similar effect on fixed line broadband. If this happens, there will be major implications for broadband service providers, mobile operators and the NBN.

Advancing technology presents a range of fascinating challenges for long-term investors. The possible impacts from electric and autonomous vehicles is one topic we have written about here, here and here. Another is the way in which developing communications technology may change the way we are all connected to the outside world.

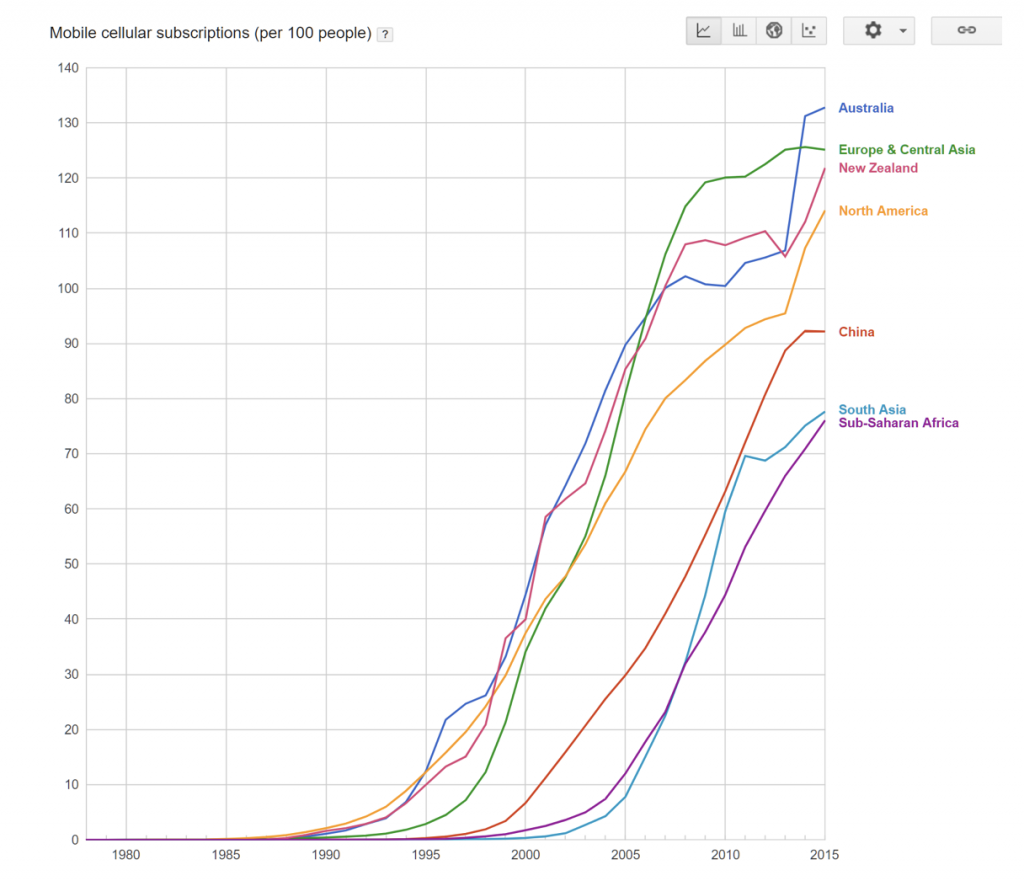

An interesting case study can be found in the decline in fixed telephone lines resulting from the development of mobile telephony. The following charts using World Bank data show: firstly, the S-curve adoption of mobile telephony for different regions and countries. You can see that Australia has been an enthusiastic supporter of mobile telephony, and by 2015 was at the top of the league table with more than 1.3 mobile subscriptions per head of population.

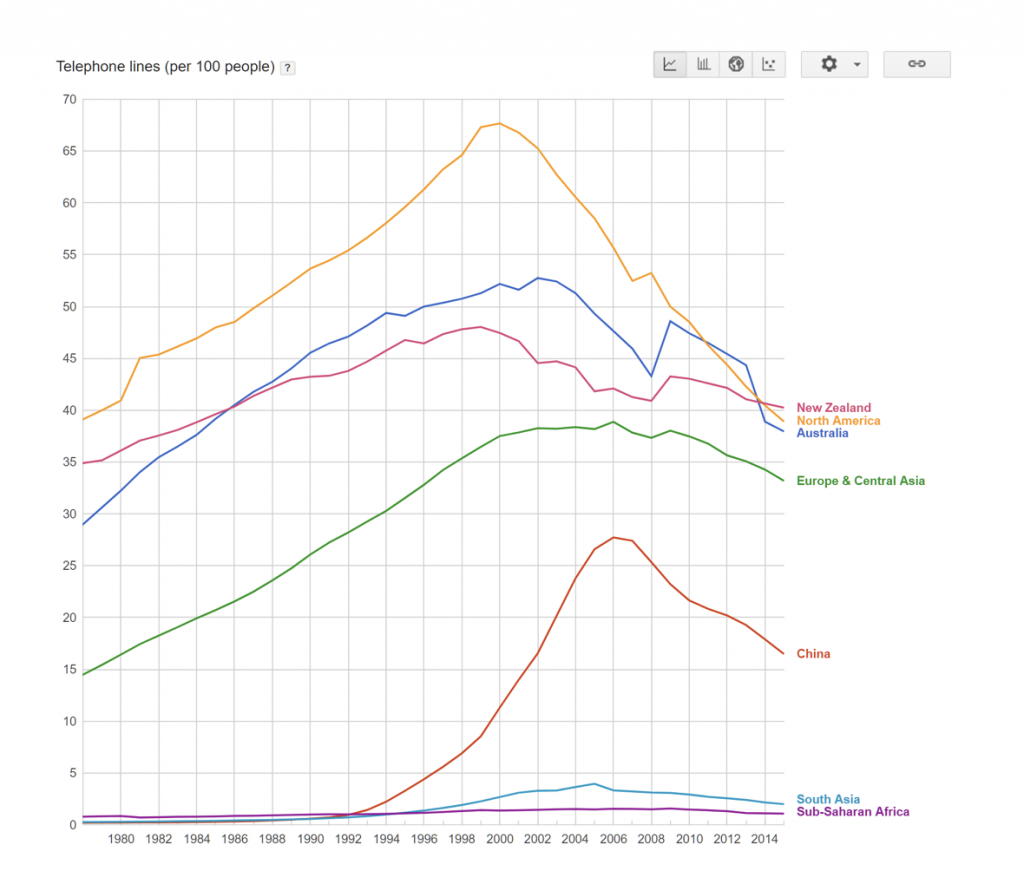

Secondly, a corollary of this – the decline in telephone lines per capita. For developed economies, telephone lines peaked around 2000, right about the time mobile subscriptions reached 0.4 per capita.

An interesting question for a number of Australian companies is whether an analogous pattern may emerge in terms of fixed broadband. Currently, mobile networks struggle to compete with fixed broadband on cost and capacity. 4G (the fourth generation) of mobile technology can compete with lower quality copper broadband services, but can’t match a half-decent fibre connection.

This may become more interesting, however, as 5G mobile technology emerges, given current indications are for a substantial lift in performance for 5G over 4G. Mobile technology is inherently more convenient than fixed wires, and if mobile technology can catch up with the (growing) data and speed requirements of a typical household, we could find that fixed broadband connections peak and start to decline in a similar way to telephone lines. It may not make sense to arrange a visit from a technician to install fixed line if a mobile solution will work straight out of the box.

This obviously has potentially interesting ramifications for broadband service providers, mobile operators and the NBN. Telstra’s sale of fixed line assets to NBN Co could end up looking like a better deal than first thought. As may its planned investment in 5G.

Thanks Tim….interesting article as always.

My take on the subject is that it is more a question of “when” rather than “if”. Given the current rate of acceleration I think it is not unreasonable to assume that the “when” will happen within the next 5-10 years. Constant coverage is therefore required.

Just as an aside….which does not deserve a response……imagine if electromagnetic radiation raises it’s prominence as the next “climate control” concern, accompanied with some sound evidential research. Could be fun!

Thanks Tim

Given the above are you still comfortable with Chorus as an investment?

At this stage our analysis doesn’t indicate a sell, but its an issue we’ll be keeping an eye on as the market evolves. Its worth noting that New Zealand has gone with a Ftth model, which is more “future-proof” than the fttn approach of the NBN.