Why REA Group remains a stand-out business

For some years we‘ve advocated for our investment in Australia’s dominant real estate portal, REA Group. For us, REA ticks all the boxes. It’s a well-run business with high returns on equity and an ability to raise prices in the face of excess supply – without an adverse impact on unit sales volume.

BHP cannot cannot raise prices in the face of excess supply and it cannot do it without a detrimental impact on unit sales volume. If BHP were to raise its price for iron ore above its competitors, sales volume would go to zero.

REA on the other hand has the ability to raise prices, despite an excess supply of websites in Australia offering to list a vendor’s home or investment property – many for free.

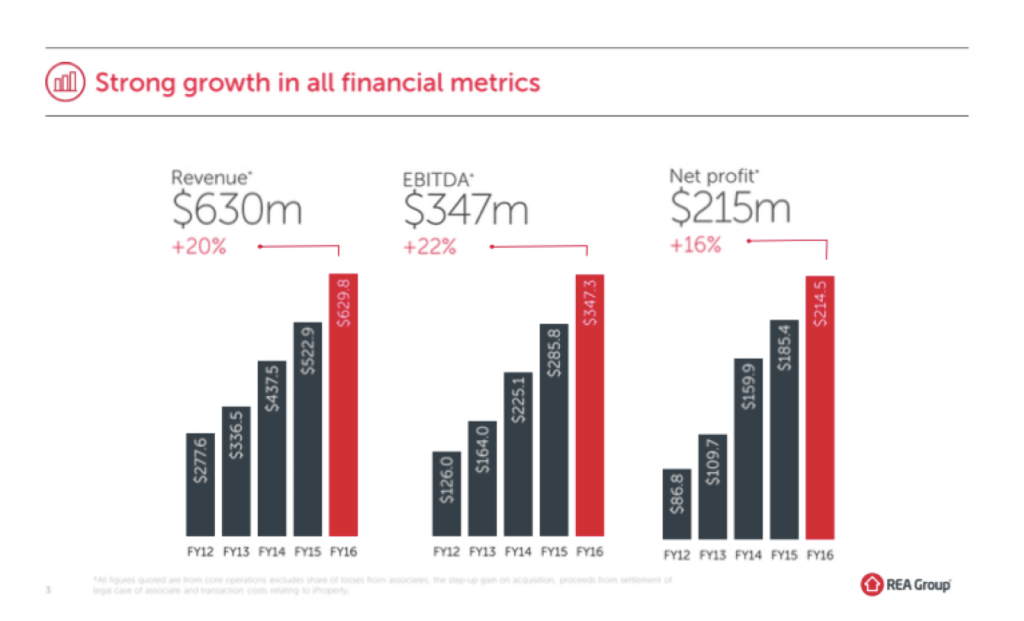

REA has been regularly raising prices either directly or by creating and offering superior products and services. The result has been a strong growth in revenues despite the fact that listing volumes have been declining nation-wide for some years. Indeed, since 2011 listing volumes have declined 21 per cent. But as the below chart from REA’s 2016 full year results presentation illustrates this has not hampered revenue or earnings growth.

REA revenue and earnings growth

Back in 2016 we wrote here at the blog:

“We also know that the company’s revenue is a function of the number of ads multiplied by the time they are listed. In a boom property market, properties don’t remain listed for long, if they are listed at all. In a mature market however, there is more competition (more ads) and properties take longer to sell thanks to there being more choice, and because of buyer wariness, which means listings will remain on the site for longer.

So growth will come from more listings, longer listings, a higher proportion of depth/premium ads and price rises. That sounds like growth on growth, on growth, on growth.”

And on several occasions before and after the post in which the above statement was made, Scott Shuttleworth – our analyst covering REA – has explained REA’s strengths in the face of tighter listing volumes and the resilience of revenue and earnings if the property market softens, contrary to conventional wisdom. We have also explained that our valuation was significantly higher than market consensus and many of the broker/sell-side analysts covering the company.

We were encouraged therefore, in recent days, by one of the large brokers, Citi, upgrading its valuation for REA. Citi analyst David Kaynes wrote:

“contrary to popular belief, Australia’s rapidly rising house prices have been a significant headwind for the two portals that advertise properties for sale” adding “both sites charge per ad (30-45 day duration) and, over the last decade, the average time on market for a property was 50 days. In a balanced market (auction clearance rates 60 per cent) roughly half of all properties will require more than one listing (ad) in order to achieve a sale.”

Citi now has a target price of $80 on REA. We welcome Citi’s confirmation of our thesis.

CEO Tracey Fellows and CFO Owen Wilson will report REA Group’s full year results on the morning of 15 August.

The Montgomery Funds and The Montgomery Global Fund own shares in REA.

Hi Roger – I always like reading your comments about REA even though at times I struggle to agree with them. The Australian operations are OK but the overseas operations are a millstone around the neck of the Group as the recent $180M Goodwill write off on the I Property purchase shows. That write off did not surprise me as they paid a ridiculous amount for the Business. Expect more pain from I Property. The REA share price continues to surprise , but it remains to be seen how well management deal with the $480 M loan for the I Property purchase which will be repaid over the next few years ( first instalment of $120 M due late 2017) . That loan will gradually sit on the Balance Sheet as Shareholder Equity. Assuming cost of that loan is say 4% and a Company Tax rate of 30% then the current after tax cost to the Group is currently about $13.5 M per annum. When the loan is repaid and becomes Equity then using a ROE rate of say 30% the $480 M would need to generate a return of $144 M per annum – Taking into account the after tax cost of $13.5 M which the Group is already covering it will need to find an additional $130.5 M to maintain ROE at say 30%. Will it be able to do that? If it can’t then what affect will it have on Intrinsic value and valuation going forward ? Will management continue to write of the value of Goodwill to maintain return on Equity at say 30% because I property can’t deliver the profits required to justify Goodwill valuation ?

Great quality company, but what of value? At $70 per share, it seems to be priced at quite a lofty valuation. Is there still a margin of safety in your opinion?

Hi Joe, depending on the assumptions we choose for price rises, we can reach a valuation of up to $80.00