Why it pays to take a long-term view

We tend to sensationalise how quickly life around us is changing. But, in reality, change rarely happens quickly. And that’s why investors with a considered long-term view should do well. Let me illustrate, using Australia’s gas market as an example.

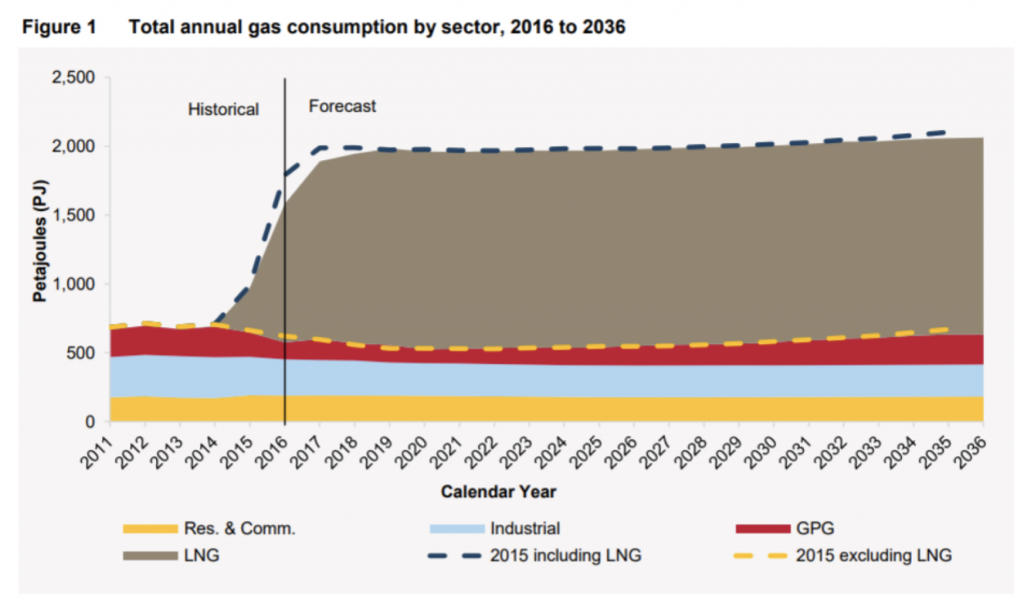

In 2013 we attended a presentation which highlighted that Australia’s gas exports would increase substantially by 2016. A central tenet of economic theory states that if demand increases while supply remains unchanged, then prices must rise.

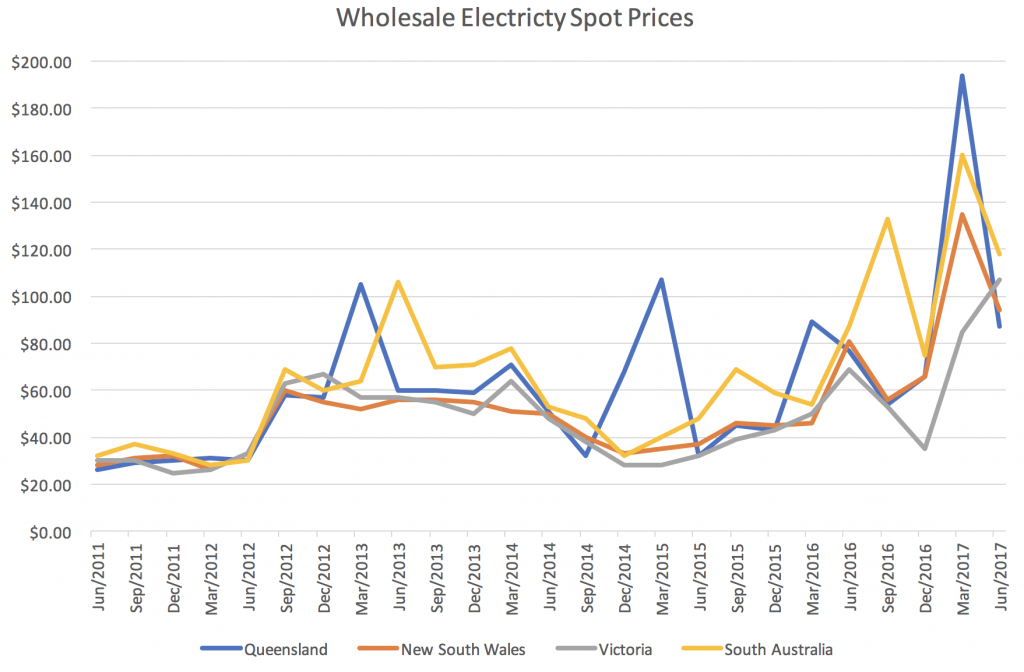

We provided many warnings in recent years about this issue, but it wasn’t until blackouts occurred that the wider public appreciated the gravity of the situation.

It may seem like the industry has changed quickly because prices have risen sharply, but it was actually a long-term structural trend which wasn’t appreciated by the wider market. If there is a material disconnect between the underlying industry growth rates and the return profile of the companies within that industry, then it could present an interesting investment opportunity.

(Source: AEMO, National Gas Forecasting Report, December 2016)

(Sources: Australian Energy Regulator)

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Seems Ben you missed Tassie of your graph, think we will cut the cable and drift over to NZ its probably warmer there! Yep I think most Aussies missed the chance on home gas and alas the governments only have themselves to blame. I admit to being an Origen shareholder!