Is Myer cheap?

The plight of Myer Holdings reflects the massive changes occurring in the retail space. Myer’s share price has plummeted from around $3 back in 2013 to just 76 cents. The price now implies a 3x EV/ EBITDA multiple – which looks cheap. So, what is this price assuming? Is it screaming cheap, or a value trap?

The company’s most recent share price plunge occurred last week when Myer issued a trading update that downgraded NPAT guidance to between $66-$70m from >$69.3m. On this news, Myer fell 10% on the day (to 74c/share).

Let’s do a quick sense-check on what’s going on (to be clear, this is a back of the envelope calculation with many simplifications, not a detailed analysis/ forecast).

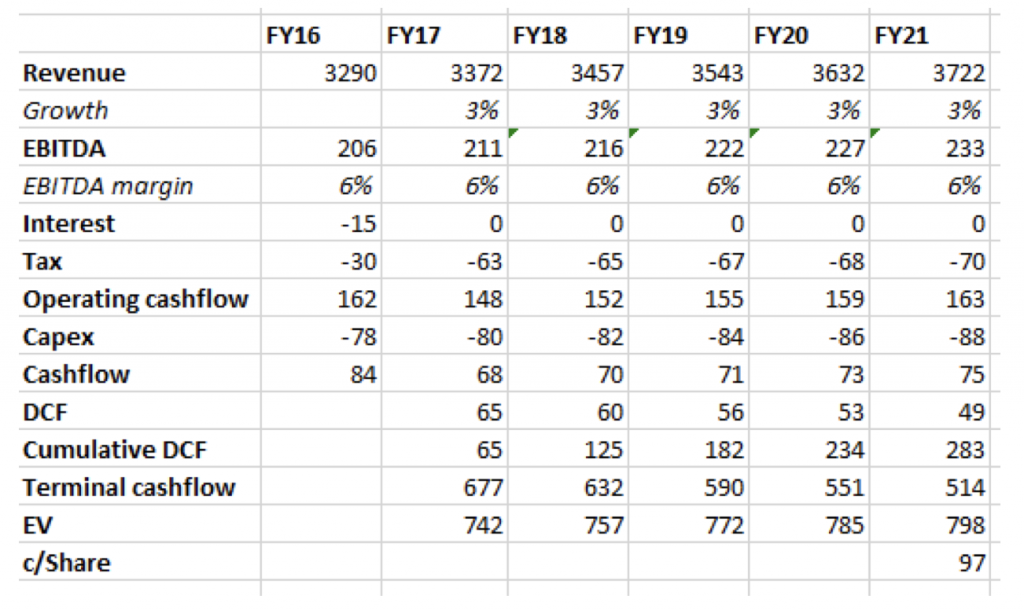

In order to value MYR, we need to make some assumptions, so let’s begin with FY16 as the base year and take the following assumptions:

- MYR grows for another 5 years before only achieving returns at the cost of capital

- We use a terminal growth rate of 2.5% and a WACC of 9.8% (in line with Bloomberg)

- We assume for 5 years MYR keeps its margins stable, grows revenues at 3% a year, pays 30% tax and no interest

- We assume capex increases in-line with revenue growth:

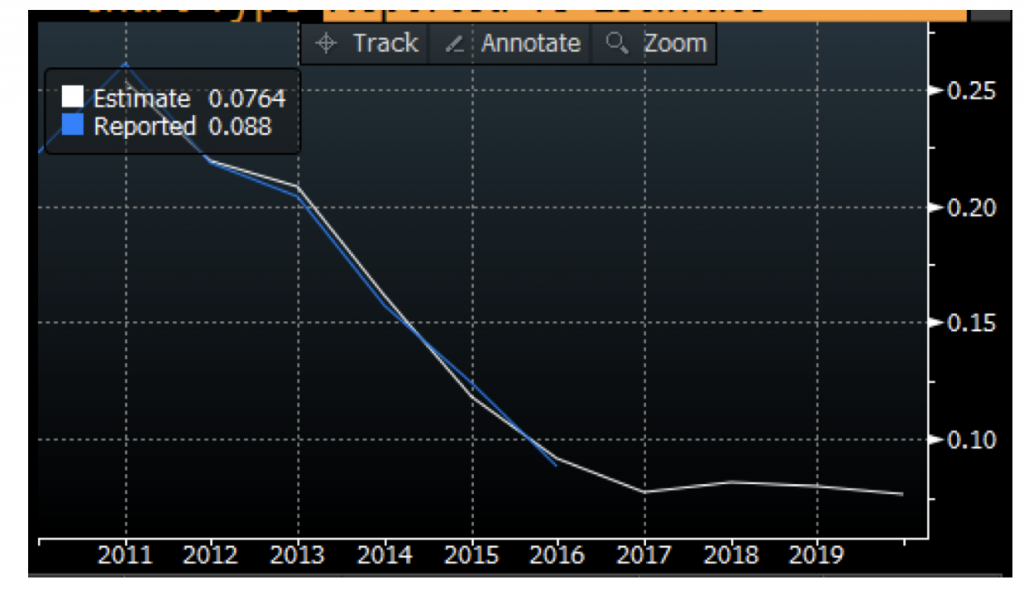

These seemingly reasonable assumptions, lead us to a valuation of 97c. BUT – are these assumptions reasonable? In the last 5 years, revenue has only risen 5% (not 13%). Margins have fallen from 10% to 6.3% (a 60% drop). This has resulted in earnings tracking in one direction:

These seemingly reasonable assumptions, lead us to a valuation of 97c. BUT – are these assumptions reasonable? In the last 5 years, revenue has only risen 5% (not 13%). Margins have fallen from 10% to 6.3% (a 60% drop). This has resulted in earnings tracking in one direction:

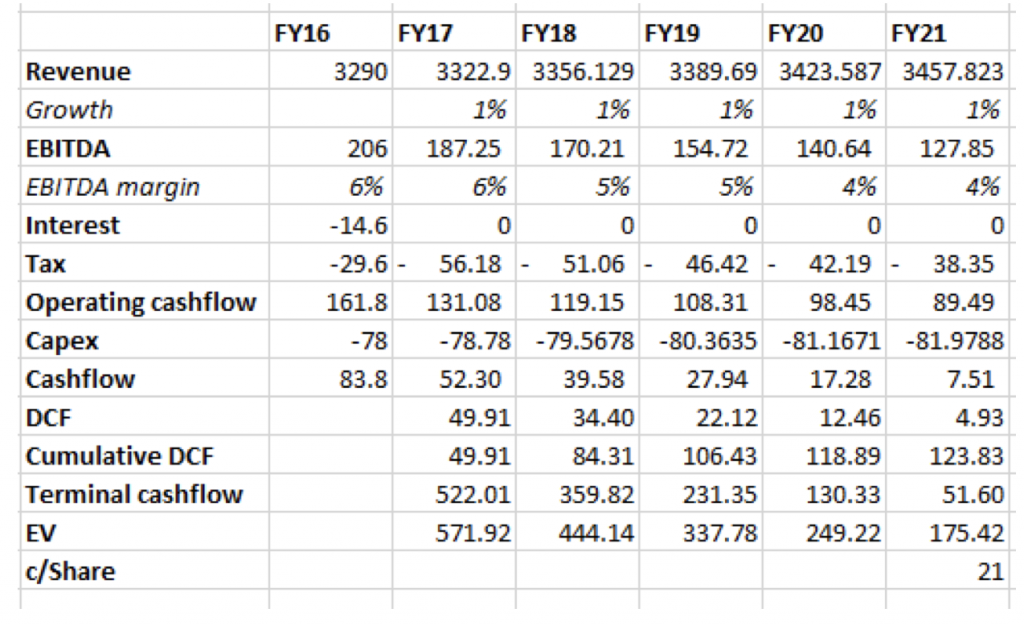

Let’s now explore what happens if Myer performs status quo in the next 5 years. Our new assumptions:

- In the next 5 years Myer performs the same way it has in the past 5 years

- Capex grows only in line with revenue growth

These numbers are certainly singing a different tune down to 21c. This is all before we’ve considered interest payments and capex.

Now clearly both scenarios are simplifying the situation and are taking ballpark assumptions (e.g. assuming interest payments go to $0). What is apparent though, is that, to be a valuable investment, Myer needs to change the status quo. For Myer to be ‘cheap’, you need to believe that the turnaround strategy (including star tactics like Katy Perry) will deliver and Myer will curb its falling margins, maintain its capex at present levels and grow revenues in a highly competitive retail market. Which may or may not be a reasonable assumption.

There was certainly a time when Myer had an economies of scale advantage that it could leverage to renegotiate rental rates, supply contracts and spread its fixed costs. There was a time when department stores were the destination of choice and would drive foot traffic. This competitive advantage, once a value driver for shareholders, has degraded with time. One may ask now whether the latest Sephora, Apple store or H&M are the bigger foot-traffic drivers.

The question now is whether the damage from new entrants (both domestic and international) along with increasing online shopping has run its course. Or will more entrants (Amazon comes to mind) and a raft of other pressures we’ve written about add further pressure.

Clearly there’s more than meets the eye.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

simon

:

hello

is ISD (ISENTIA) a value trap after todays bad news ?

rgds

simon

claude.a.staub

:

So is it screaming value or a trap??

Lisa Fedorenko

:

On a first glance, it’s not screaming value and would need to turn the business around to be cheap.