Is Apple still cheap?

As Apple’s share price summits new all-time highs and its market capitalization of nearly $550 billion exceeds that of all the remaining S&P500 retailers in the United States, some investors thought it high time I update my view of Apple and my intrinsic value estimate.

As Apple’s share price summits new all-time highs and its market capitalization of nearly $550 billion exceeds that of all the remaining S&P500 retailers in the United States, some investors thought it high time I update my view of Apple and my intrinsic value estimate.

Apple was first reviewed here (http://rogermontgomery.com/is-apple-an-a1/) at the Insights Blog on 12 July 2010. The share price was $254.30 and my IV estimate was $262.56 for 2010 and $305.03 for 2011. Many investors were surprised to see how quickly Apple rose from $400 to $500 a share — it took just 34 trading days — but the climb to $600 took place in just 23 days. So with the share price rising to over $600 and some analysts believing Apple’s market cap could top US$1 trillion, while other commentators (read conspiracy theorists) suggest it is one of the stocks targeted by the US Federal Reserve for some irrational exuberance of their own, I thought it worth taking another look.

Of all the views and stats I have read, there is one question I am left asking; What if everyone who has an ipad/iphone/ipod decides they’re happy with the one they’ve got?

In London this year at the Regent Street Apple store, there’s usually plenty of excitement on launch days. But 30 minutes after the Apple store opened its doors to let the hard-core queuers in, the queue was empty. Less than 400 people waited outside the store, which was 250 less than for last year’s iPad 2 launch. In Sydney there was virtually no queue.

A survey of queuers by Hudson Square Research at locations in Connecticut, New York found shorter lines than for the iPhone 4s or the iPad 2. They counted roughly 550 people on line at five locations vs. 2,300 people counted in their iPad 2 survey last year. Interestingly, all but three people surveyed already owned an iPad, whereas 69% of respondents in last year’s survey did not already have the iPad1. Further, half of the current iPad owners had the iPad1 and the other half the iPad2.

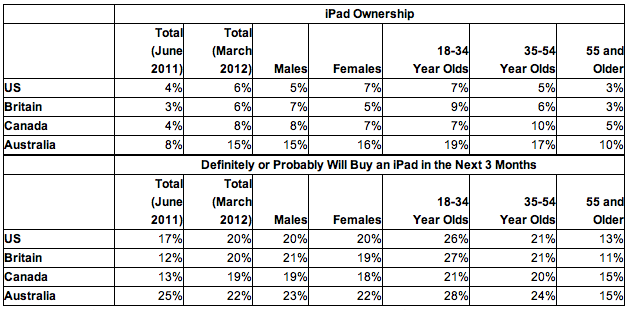

But a survey (see table below) this year by Visioncritical – an IT research firm – ownership and purchase intention numbers continue to grow – even in countries where the iPad dominates. Indeed in the weekend before last Apple shipped over 3 million units of the iPad3.

New markets and improving affordability may still drive increasing sales, but off the back of a much larger base, getting the same growth may become increasingly difficult.

Earlier this month the WSJ reported Deutsche Bank’s analyst Chris Whitmore, was taking Apple off a list of short-term recommendations of stocks to buy. The columns went on to observe;

“Mr. Whitmore’s skepticism about the pace of Apple’s advance is one that many on Wall Street share, but one that few are willing to articulate. Previous bearish calls on Apple have been proven wrong time and again.

“And yet, worries are creeping in at the seemingly parabolic rise of Apple in recent weeks. If anything, Apple’s share price has been accelerating in recent months — defying a belief that the stock’s large size alone would limit its ability to zip higher.”

The best insights I have seen relate to the narrowing market share dominance and observed margin compression Apple is experiencing as result of competition – especially Google’s Android. This effect on margins is hidden by the fact that the mobile market is growing so wide, fast and deep that it conceals margin compression behind massive unit sales as noted above.

One analyst, Reggie Middeltone notes; “Android has moved to over 44% market share in tablets from less than 3% in less than a year and a half. That’s amazing and much faster growth than it exhibited in smartphones – a category in which Android literally dominated in worldwide and US smartphone growth (as well as installed base re: US) in just a few short years. Apple dropped from just over 96% to just under 55% in the same time frame. Again, as with the smartphones, the Android tablet tech is superior to that of iOS products and as iOS normalizes the difference, margins will suffer. Margins will drop (is dropping) faster for tablets because prices are coming down as fast as tech is increasing.”

This is also evident as the average selling price of the iPad has dropped from $654 in 3Q-11 to $599 in 1Q-12.

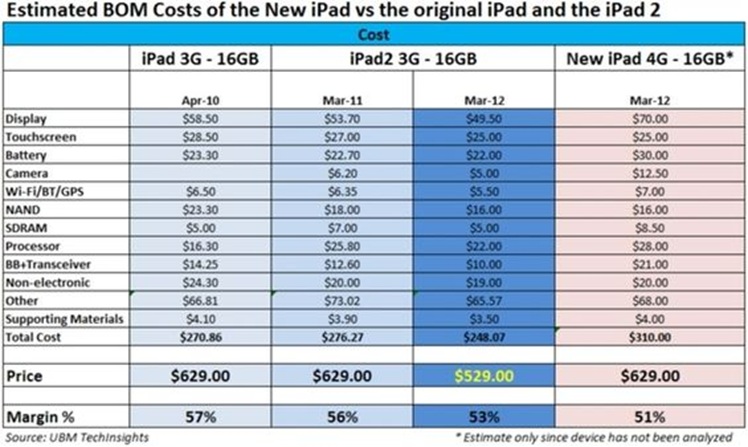

UBM Techinsights (see table below) also observes that manufacturing and input costs for the new iPad is rising as Apple inserts more technology advances to take the fight to Android devices.

The end result must be lower margins. At present however lower margins aren’t showing up in the reported numbers. This could be because Apple is believed to have moved large quantities of depreciated iPhones to consumers at full price in the most recent quarter. iPhones represented just over half of the company’s revenue in the most recent quarterly results. But with greater competition from Android, Apple is expected to have to either spend up on R&D or discount the price of their products – either way it equals margin reduction. As an aside, to win the market share race (temporarily) one would expect the iPhone 5 will be spectacular. Despite dropping my iPhone in the pool last year, and saving it by dunking it in rice overnight, I am holding out for the iPhone 5.

Back to the story. 1) They are losing market share to Android devices. 2) margins are coming down. 3) The market is growing and so profits are growing. 4) Thus the share price is surging. 5) But in order to sustain the trajectory, two key products are being relied on – the iPhone and iPad.

Valuation:

Followers of the Buffettology approach to valuation (there’s a couple of valuation tools out there for which investors pay thousands for this less than robust methodology) would simply take the $35.12 of trailing 12 months earnings, grow it by the analysts projected 13% per annum for five years to arrive at earnings per share in the fifth year of $64.72 and multiplying this by the current P/E of nearly 17 times provides a future price (not a valuation) of $1100.00. Discounting this back by, say, 15% produces a target price of $547.01. Of course the neatness of this number belies the fact that its just a price based on an assumed P/E (don’t bother debating this point). If we use a more conservative P/E of 12 times, then we end up with $386.13.

Apples equity per share is $96 and it’s earning a 37 per cent return on this equity. The current price is six times book value for a book that earns just under 40%. Simple observation tells me that’s not so compelling from a value investing perspective. And now the company will be paying out a 30 per cent portion of that return on equity as dividends ($10.60 in the first year). This must reduce the valuation. Using $96 of equity per share, a 37 per cent return on equity, an 11 per cent required return and a 30 per cent pay out ratio, I get a very-rough-back-of-the-envelope estimated valuation of $481.69.

And those who love charts will look at the vertical share price and its eerie similarity to other blow offs that ended badly such as Google’s price action at the end of calendar 2007.

As a value investor, you should be comfortable with the fact that you will be early to buy and early to sell. My view will change the second Apple releases some new device that redefines breathing, living and spirituality but until then it appears there’s pressure on the business and possibly the share price because it may be higher than a rational estimate of intrinsic value. Seek and take personal professional advice before engaging in any securities transactions.

Posted by Roger Montgomery, Value.able author, Skaffold Chairman and Fund Manager, 27 March 2012.

Another issue not mentioned so far is the change in naming convention of the iPad2 to simply the “iPad”, implies that revolutionary advances are no longer expected from here on out.

Having established and now dominated the personal electronic tablet market globally, AAPL is settling into annual updates, which the average consumer will buy regardless of any specification changes.

Aficionados will know the excruciatingly technical details and care, but the greater public will not care whether it’s the 2011 or 2012 vintage iPad just as they don’t worry about what generation of iPod they can currently buy in the shops (See wiki for a history of these updates. http://en.wikipedia.org/wiki/IPod).

Roger, there is no risk anyone will buy only one Apple product for life. Although AAPL has a great reputation for design excellence. However, the dark side of this obsession with design is badly engineered and unreliable products with short life spans. The original Mac was unreliable because Steve Jobs wanted a silent computer and insisted on a fanless design meant that it would overheat!. Apple is also notorious for designing in Planned obsolescence. The original iPod did not have user replaceable batteries, so once the battery failed you tossed it away and bought the current model (echoes of the new iPad strategy), this “design feature” only changed after a lawsuit. An interesting current parallel is Telstra forces users to a 24 month iPhone contract yet the Apple standard warranty is a maximum of 12 months.

In addition, these things run in cycles. Apples great successes have been pioneering new categories and introducing breakthrough products (e.g. Personal Computer = Apple I/II, Smart Phones = iPhone, Tablet Computers = iPad) and its greatest failures have been linked with poor quality, mediocre products and line improvements(e.g. Personal Computer = Lisa, Apple III, Macintosh 1, Apple Newton PDA).

The great success of Apple can be compared to the rise and fall of Disney under the stewardship of Michael Eisner (Entrepreneurial and Mercurial CEO) and his no.2 Frank Wells (stalwart, diplomatic COO).

In essence, Michael Eisner turned the faded Disney brand into an entertainment powerhouse with support of Frank Wells until his death in a helicopter crash in 1994. Without Frank’s moderating influence, Eisner’s unfettered ego caused Disney’s winning management team to self destruct and Eisner eventually being ousted from the company.

As this is the reverse of the Disney situation, a downfall is not as likely to be given Tim Cook is a great operations person ensuring a steady hand in the short term. He is much better suited than Steve Jobs in handling Apples immediate problems (i.e. Illegal labour practices of its supply chain partners, ‘iPad’ Brand ownership in Mainland China).

However, in the longer run success is never certain, especially with the Growing threat from “Frenemies” like Google (Complementary Services) and Samsung (Key Component supplier) who are now competing head on with Apple’s two main product lines (Smart Phones and Electronic Tablets).

Last time, Apple was nearly bankrupted when the Management team fumbled the transition from the legendary but dated Apple II line to the costly and unreliable Macintosh Line. The result was near collapse and ceding leadership of the computer industry to Microsoft/Intel “Wintel” alliance for over a decade.

With Steve Jobs gone, the design obsession will fade rapidly lessening the chance of Apple pioneering another industry changing and highly profitable product to justify the exponential rise in its stock price.

Fantastic contribution Keith. I really appreciate the historical perspective. Thank you again.

Although Apple is not growing market share as quickly as Android, it is in fact increasing both revenue and profit share in the mobile industry even against Samsung. And while cost of components may be increasing as a percentage of retail price, it doesn’t take into account economy of scale (they are selling alot more ipad3s than the original ipad) and R&D costs.

Sometimes it gets missed, but one of Apple’s key advantages is their supply chain. While their competitors provide a very diverse offering a devices each requiring different components (just count the number Samsung and HTC phones on the market), Apple provides a very concentrated offering. Along with the sheer number of units selling, they’re able to build an incredible supply chain that’s unrivalled. This is hinted by who was hired as the new CEO – not a designer or techie, but a supply chain guy. And of course they don’t chase the low-end.

Personally I think there’s plenty of legs in both the phone and tablet market for Apple. Recently I gave my original ipad to my mother-in-law and was truly enlightened on what the post-PC era means outside my highly-tech-literate bubble.

Absolutely brilliant Michael, well done. Its a similar force to that being endured by Gerry Harvey’s plasma TV business and perhaps next year, BHP and RIO’s iron ore business. Provided they can sell more volume to offset the declining margins they’ll be fine…and then the economics of enough/law of large numbers starts to inhibit the continuity.

I bought Apple ETFs after Roger’s last article on how cheap Apple was at the time and it was every bit true. I didn’t really understand the product I was buying because it was advertised by Commsec and I assumed it was just like owning the real thing with a buy/sell spread. It turned out the ETF was run by Royal Bank of Scotland and it was a raw deal because there was a clause saying that they were entitled to your dividends. I couldn’t stomach such terms, so I sold it and had to fore go much of the rise. The point of my story is do not buy the ETFs – buy the real thing on the US Stock Exchange if you want to own it. I just couldn’t be bothered with fiddling with the international tax consequences, but I would like to learn a bit more about it in the future. Can anyone please explain what the tax obligations are of holding US stocks? Obviously I will do my own research to verify your comments.

Great questions David. I found this: “It’s true that when you receive dividends on an overseas share, your dividend is generally subject to a with-holding tax by the host country’s revenue office. In general that’s around 15% of the dividends, but it can be as much as 30%. Earn a $100 dividend from your shares in Walmart (WMT:NYSE) for instance, and the US Internal Revenue Service will clip $15 off that for themselves. Meanwhile here in Australia you are again taxed on everything you’ve earned – whether it’s from Australian shares or shares in companies based in the Czech Republic.

But in real life it’s not as dire as it sounds. There are investors all over the world investing in foreign companies, and most major economies have developed international tax treaties to ensure that investors aren’t subject to double taxation. Australia has tax treaties with 43 of our major trading partners. The list is on the ATO’s website here:

ATO tax treaties

As you can see, the list covers most of the countries you’re likely to be investing in: the UK, the US, Japan, Hong Kong (under China) and Singapore. Even the BRIC countries are represented. Those countries we don’t have a tax treaty with generally withhold around 30% tax.

What this means is that you get credit for any tax already paid (or withheld) on overseas dividends when you put in your tax return. The end result, points out Mark Morris, senior tax counsel with CPA Australia, is that you pay no more tax on a dividend on an international share than you would on an Australian share.

Here’s an example:

Kevin Costello, an Australian resident on the highest tax bracket, holds shares in UK company Blair Enterprises Ltd. The amount of the dividend he receives on December 1 2007 is equivalent to A$100. Blair Enterprises Ltd remits A$15 of this amount to the UK Inland Revenue and pays the $85 balance to Kevin. When he prepares his income tax return, Kevin includes the entire ‘grossed up’ $100 dividend in his taxable income for the year ended 30 June 2008. However, he will be able to reduce his $46.50 tax liability on the dividend by his A$15 withholding tax credit, making the net amount of tax payable on the dividend A$31.50

If you have a DIY super fund, which is subject to a 15% tax, your tax payable on the overseas dividend is neutralised by the 15% already withheld from your dividend payout by the overseas revenue office. If you’re on the lowest tax rate you’ll need to pay only the extra 2% or so for the medicare levy.

Capital gains (or losses) on overseas shares are taxed here in Australia rather than in the host country, so it makes no difference to you tax-wise. The same rules apply on overseas and domestic shares in that you need to hold them for more than 12 months to get the 50% discount, and if you’re a frequent trader your capital gains will be taxed as income (get advice on how this works from a tax expert.) DIY super funds work the same way as individual investors.

Of course what you won’t get when you invest overseas is the benefits of our imputation system. Which leads us to our reader’s second concern. Many Australia companies attach franking credits to their dividends, which reflect the fact that tax has already been paid on the earnings by the company at its company rate of 30%. As an investor you can use those franking credits to offset against your tax payable on any other income, or even to get a rebate if your tax rate is lower than 30% – say if you have a self-managed super fund, or you’re on the lowest tax rate. The end result is that a franking credit on a fully franked dividend can add as much as a percentage point to a dividend earning. (Other countries have similar franking credit systems, but as an off-shore investor you won’t benefit from them.)

Take our example of Kevin Costello. As Morris explains it, if our Kevin received a fully franked dividend on his Australian shares on December 1 2007 he would receive a credit of A$30 and A$70 of net dividend. When he lodges his income tax return for 30 June 2008 he would include a ‘grossed up’ dividend of A$100 and obtain a credit for A$30 to offset against his tax payable of $46.50. That means he would only have to pay top up tax of A$16.50.

But not all dividends on Australian shares are fully franked, and many are not franked at all. On an unfranked dividend our Kevin would have to pay tax of A$46.50 on the A$100 dividend received, more than if he’d invested in overseas shares.

The point is that you shouldn’t make an investment decision because of tax anyway. Choosing to invest overseas is a strategy decision, made because you believe you need to diversify outside of the small world of the Australian sharemarket, or because you’ve identified particular growth opportunities offshore. While it’s worth knowing how the tax rules work on international shares – and as we’ve seen they’re not as complex as they first might seem – tax is certainly no reason to hold back from investing offshore.”

Cheers Roger – this is good information regarding overseas investing and tax obligations. I agree that the choice to invest has to be a strategic one – I am finding the ASX fairly short of good opportunities as the only things worth looking at right now are a few small niche industrials, mining services companies and a few undervalued gold or mineral sands mining companies. We do not have a lot of the big companies like Apple, McDonalds, Exxon Mobil, Johnson&Johnson etc to invest in, so I was thinking that some diversification may be beneficial. I am also weighing that up against the fact that on average Australian equities have historically outperformed their peers in developed economies in the US and Europe, but many of our mature companies have looked pretty sick over the last decade. I think I have the Australian taxation side sorted out, but the main thing that concerns me is not knowing which overseas forms I am required to complete as part of my compliance obligations for foreign jurisdictions. I used to inadvertently get some fairly exotic forms from the US when I owned Babcock & Brown Infrastructure, so perhaps this lack of familiarity is what is scaring me off.

SMSF’s in the the retirement phase paying a pension; pay no tax,

All Australian franking credits are refunded by the tax office

Withholding tax incurred overseas cannot be used.

For entities paying Withholding tax in overseas countries (with tax treaties) The tax is treated much like an “offset” It can only be deducted from your tax payable, A person paying no tax before making allowance for overseas tax credits will generally not be able to offset them. Nor can they be carried forward to future years

DO NOT REGARD THIS AS TAX ADVICE

IT IS ONLY MY UNDERSTANDING HOW IT GENERALLY WORKS

GET YOUR ADVICE FROM AN TAX ACCOUNTANT SPECIALISING IN THIS AREA

You raise a good point in that I can get the benefits of franking credits here, but I cannot use the witholding tax paid. As I am only 30, my understanding is that I will still have to pay 15% tax within my SMSF, so the net effect is the same percentage as the US witholding tax – no advantage or disadvantage in choice of tax jurisdiction. I am pretty keen to get that SMSF up and running soon.

According to the Value*able tables, Apple shares are worth $692:

= $96 x [ (0.3 x 3.36) x (0.7 x 8.87) ]

I can’t figure out where I went wrong??

Thanks

Hi Trent,

I didin’t use the tables, just a quick back of the envelope. Would anyone like to give Trent a hand?

Samsung are already ahead of Apple in the ideas department, and their product is superior. Apple needs to make hay while the sun is shining, because sunset is on the way.

Peter

That might be true, but Apple is doing whatever it can to corner the market. Apple has replaced Sony for product placement in virtually ever movie and tv show I have seen for a number of years and it is only increasing in prominance. They have also created a fairly wide moat through the network effect. I have not heard of people camping out or fighting at any of Samsung’s product launches. Some aspects of iTunes have been accused of being anti-competitive by some and my partner and I have compared our iPad to Android and noticed that a wide range of applications and downloadable content are absent in Android. Apple also makes profit from its digital distribution channel – iTunes, whereas Samsung doesn’t. Its the same thing with portable audio devices – there are probably better ones available than the iPod, but more iPods are sold and at a greater premium than their rivals. Just look at all the Apple accessories at JB Hifi. It has a strong degree of brand loyalty and people in the US would rather support an American brand right now than a Korean one. Apple is not behind in technology, they just choose to drip feed it into the market so that they can always report better features when they bring the new “must-have” model out. For example, I’m fairly sure that the iPad 2 had a 0.9 megapixel camera – this is so poor that you couldn’t even buy a camera with such a low resolution at the bargain bin at Harvey Norman. Its all about a constant stream of revenue – if they made the best model they could right now, no-one would ever pay a premium to upgrade. On the other hand, Samsung has to provide more costly features at a lower price to attract any interest and still they lag in sales. I do not see the status quo changing for quite a while based on this evidence.

Hi David,

I reckon the same competitive forces are leveling each participant’s requirement to pack in more for less. The momentum right now does seem behind Apple but the loss of market share suggests that could be changing.

Nice Maths Roger,

I had a big chuckle to myself when the announced dividend put a rocket under the share price.

Cheers

Thought provoking. $480 with a 30% or 70% payout? I get a the same valuation with a much greater payout.

Thats a 30% payout Christian.

Hi Roger, can you help me get my head around this further please. ‘Using $96 of equity per share, a 37 per cent return on equity, an 11 per cent required return and a 30 per cent pay out ratio, I get a very-rough-back-of-the-envelope estimated valuation of $481.69.’??

So I divide 37% by 11% to give me approx 3.36 income multiplier, and 9 growth multiplier. So a)$96 x 3.36 = $322 if all paid out, and b)$96 x 9 = $864 if nil paid out. Your final proportions are reversed to mine and I’m unsure why? I thought a) $322 x 30% payout amount (so $96), and plus b)$864 x 70% ($604) retained would give me the combined IV value of $700.

If I reverse the percentages I get your said valuation figure but I can’t understand why it makes sense to reverse these? Hope that makes sense, real keen on your thoughts. Cheers, C.

Read the section in Value.able on implied growth rates…do you believe that Apples earnings will keep growing by 37% x 70% =26% annually?

You’ve lost me know, if you could help me further I’d appreciate it. Seems there’s a few of us not getting it (see Trent above). You or anyone else care to help please?

Hi Craig,

Think about the implications of [70% X ROE] earnings growth per annum implied. Reasonable? See the section on implied growth rates in Value.able. I sincerely hope Value.able helps.

Thanks for this post Roger. It’s interesting how the dividend brings down the current value but in the long run probably maximises shareholder value?

Hi Will,

Not sure I agree with your assertion there. If dividends maximise shareholder value in the long run, someone should have told Warren Buffett 45 years ago when he suspended the dividend and the shares were trading at $18. In 2007 they traded at $140,000 each.

I think Apple is poised to be something like the “old Navitas” or See’s candy, where it will maxout its productive tangible assets and can do full dividend payouts whilst still moderately increasing profit over time.

There is no reason to hold cash in the business if there is nothing to buy and your rivals are mediocre.

I am generally interested in technology and have a macbook air as well as an Android phone.

In addition to your concerns regarding Android, the tech savvy sector is starting to see Apple as the “new evil Microsoft” (yes, Microsoft was seen as an “evil” company by many in the last decade after they bank rolled SCO to sue Novell for selling Linux).

Anyone who visits slashdot (news for nerds, stuff that matters) or any of the other tech websites would see there are quite a lot of articles about Apple’s current litigation path against Google/Android. If you read the comments, these “nerds” are not happy about it one bit. This may seem like the most profitable course but it runs at the expense of some tech heads approval (including myself!)

On this blog we are more interested in the profitability of the company, I think I raise a small point that is worth keeping in the back of your mind. After Samsung was able to sell the Galaxy 10.1 in Australia, they advertised it as “the tablet Apple didn’t want you to have.”

Of course, I find it interesting that Nokia’s current path is apparently more foolish than any of the other smart phone manufacturers.

Cheers,

Luke

Very clever job by Samsung. They only need to shout it louder as I for one hadn’t heard it. I am not embedded in IT they way you are but I can see they are no longer the ‘alternative’ or the ‘underdog’.

Very interesting post Roger. I share some similar thoughts. There is very real risk for this company that people will simply say “i am happy with my current iphone/ipad”. This is especially true as if they cannot find any type of addition that will get people excited. My iPhone 4 came out the same time as the iPhone 4s, it appears to be exactly the same excpet the Siri application. It would be good but it isn’t a deal breaker that i have to physically do things on my phone rather than asking siri to do it.

I am going to find it very interesting to see what the new management at Apple do now that Steve Jobs has passed. The announcement of a dividend is already a great point of different. Yes they have an enormous cash hoard and more than they will ever need but they had this under Jobs as well. It will be interesting to see whether they have the ability to be innovative and keep Apple’s edge and brand in tact or whether more effort goes into stock price maximisation related efforts.

That table you put up about the costs and price of the iPad is a really interesting one. It will only cost more and more to develop future models and keep market share so they have to either sacrifice margin or decide against the $629 price.

As much as i like Apple, the amount of stories floating about in news about people making a fortune of apple stock causes my warning alarm to start ringing. I don’t think it takes much effort to argue that the current share price is expensive. Just like a lot of these types of companies, people are obviously pricing in some extremley profitable times ahead, however my instict tells me that it is the other way around. Unless they can come back with something new that revolutionises that aprticular segment (and apple has the runs on the board for that so who knows they may do so), i just can’t see them being able to sustain their current growth.

Perhaps that is why they are paying out dividends, they just personally cannot any more see any use for their cash hoard.

One final note, i am no expert on the psche of the american markets but i know here that when a company decides to start paying dividends than that has a meaningful impact on the focus of the company. A new type of shareholder comes ine (one seeking income over growth or at least more concerned with income) and they have a tendency to want this income to continue. I fear that the future of apple now will take on the path of many a listed company where instead of focusing on the business they get distracted by the sharemarket noise and start acting in ways that appease the market rather than doing whats best for the business.

All in all though, it still is a phenomenol company and the above is speculation and random thoughts. I would not be buying at this price anyway so i am happy to just sit from the sidelines and watch.

hi all i am surprised there has been no mention of blackberry maker RIMM i have been buying their stock recently average price just under $14.00 a share. and around net assets on a low p/e plenty of talk that they products are outdated but they have a suite of new products coming on the way.

Hi Chris,

You trying to take over Fairfax and Prem Watsa’s job? See below…

“Fairfax Financial Holdings Ltd. (FFH), run by one ofCanada’s best known value investors, Prem Watsa, substantially increased their stake in Research In Motion Ltd. (RIM). Watsa joined the RIM’s board on January 22, this year, and was named a director, in a major management revamp, that saw the replacement of co-Chief Executive Officers Jim Balsillie and Mike Lazaridis with former operating chief Thorsten Heins. According to a regulatory filing today,Fairfaxcurrently owns 26.85 million RIM shares, up from 11.8 million shares in September. Based on yesterday’s closing price, the company’s stake of 5.12 percent is worth about $437 million. According to filings with US securities regulators, 6,499,500 shares of RIM were bought by Watsa, Fairfax, and other related companies on Wednesday and a further 7,550,700 shares on Thursday. Primecap Management Co., with a stake of 5.5 percent is the largest shareholder in RIM. Lazaridis and Balsillie own 5.4 percent and 5.1 percent, respectively, in the company.

According toFairfax, since RIM is trading at less than book value and has free cash flow and a still growing subscriber base, it is an attractive investment. In an interview last week, Watsa suggested that he was looking at buying more shares of RIM, and was confident of RIM’s ability to compete in future and increase its market-share. Analysts viewed the development as a vote of confidence in the current trajectory of the company.

RIM had a miserable last year, in which its stock lost three-quarters of its value. This was in addition to a series of mishaps, like the black-out in October and the disappointing launch of its tablet computer, which hurt the company. Its share of the smartphone market was down to 11 percent in the third quarter of 2011, from 21 percent two years earlier. Steady market-share loss to Apple Inc. (AAPL)’s iPhone and devices that run on Google’s Android platform, has forced the company to rebuild its product line. The situation in US is worse. RIM’sU.S.market share of smartphones dropped from 44 percent in 2009 to 10 percent in 2011. The company was hopeful that the growing sales in the emerging economies would offset the slide in US, but according to many analysts, it is just a matter of time before the company begins to lose market share internationally.

RIM’s stock fell as low as $14.77 this week, in a sign that the market did not take theFairfaxnews positively.

Prem might plan on going activist, although this is not his usual investment style.”