Genworth’s result points to increasing levels of stress in our highly geared economy

If you want to find more signs of stress in the Australian economy, then look no further than the recent result of Genworth (GMA:ASX), our largest mortgage insurer. In its announcement, GMA noted rising delinquencies, moderating economic conditions, and increasing underemployment. The result also signals that bad debt provisions may be a headwind for banks in FY18.

Genworth reported its full year result to the end of December 2016 on 8 February. The result showed a few notable items:

- Gross written premium fell 25% yoy in CY16 and 14% in 2H16.

Gross written premium is the revenue flowing from new mortgage insurance policies written in the period. As such, it provides a better snapshot of the current demand for mortgage insurance in the Australian market.

The weakness in gross written premium is being driven by 2 factors. The first is a loss of customers. This is notably Westpac, which has decided to move more toward self-insurance. This would add to Westpac’s exposure to any mortgage bad debt cycle. The second factor is the reduction in new high LVR mortgages that are being written. This is due to a combination of APRA’s focus as well as increased risk aversion from the banks. This is offset by premium increases implemented by GMA last year.

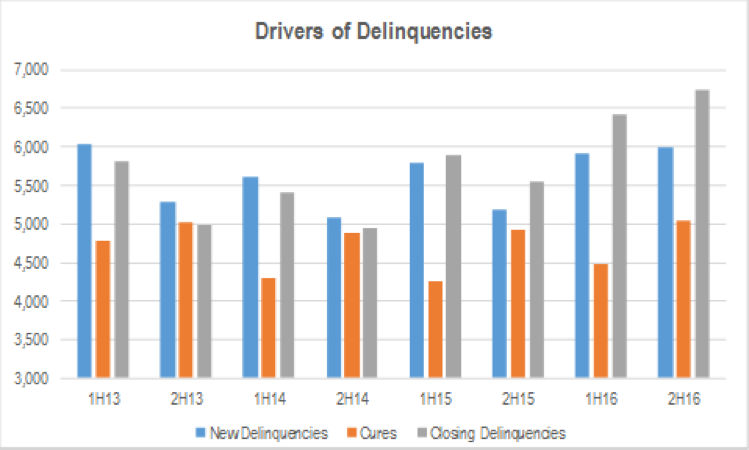

- Delinquencies remain on the rise

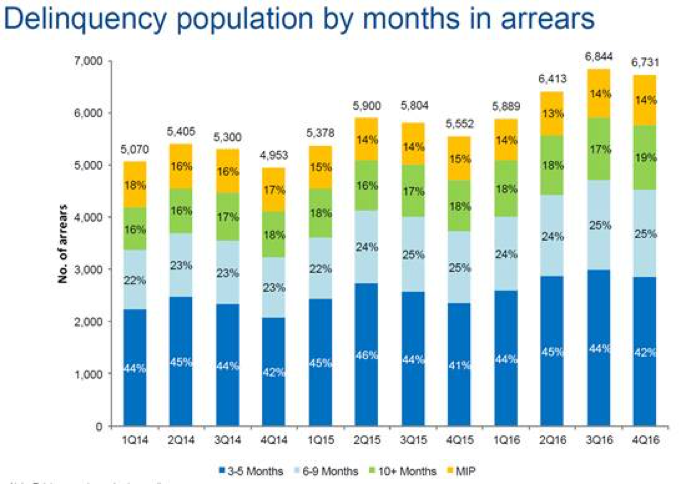

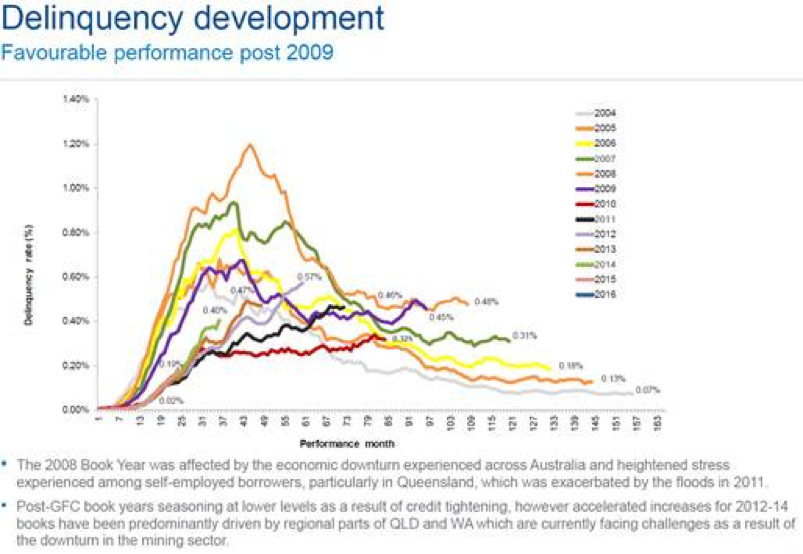

Mortgage delinquencies are defined as mortgages that are more than 90 days in arrears. Delinquency rates increased in the half with the larger jump occurring in the September quarter. The chart below shows the increase over the last 3 years, as well as delinquencies by months in arrears. This suggests that the average number of months in arrears has been increasing slightly over the last 2 years, with the percentage of delinquencies 3-5 months in arrears falling from 46% as at June 2015 to 42% now, and 10+ months increasing from 16% to 19%.

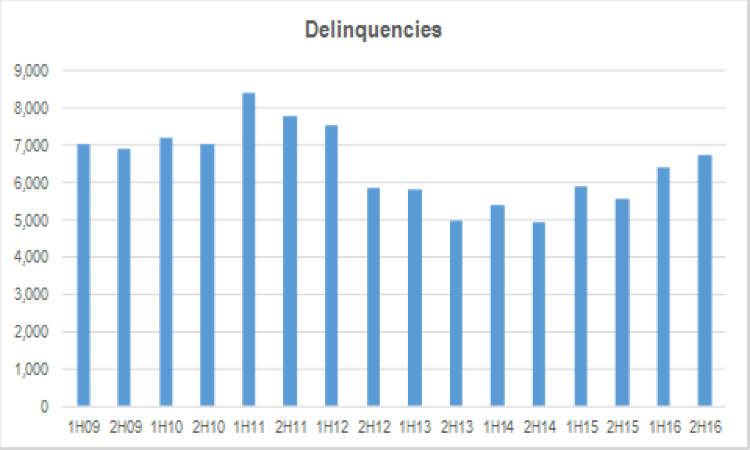

But the absolute level of delinquencies, while higher than in CY14 and CY15, is only just getting back toward the levels of early 2012, and remains well below the recent peak from mid CY11.

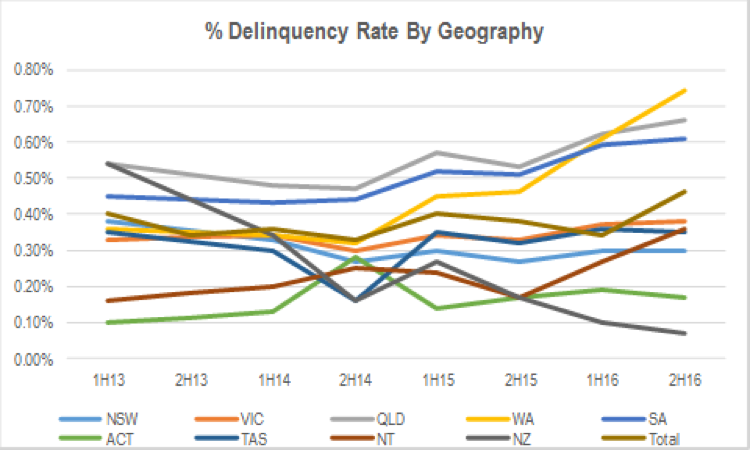

The rise in delinquencies as a percentage of the overall book is primarily being driven by increases in WA, SA and QLD. However, VIC appears to have bottomed in 2H14 and has been rising slowly since then.

Delinquencies are being driven by an acceleration in new delinquencies rather than a fall in ‘Cures’ or claims paid.

We also note that the number of calls to the National Debt Hotline has been increasing at an accelerating rate, with calls in the December quarter increasing 12% on the prior year. This indicates that stress is still increasing. As such, delinquencies are more likely to keep increasing, eventually feeding into higher loan losses.

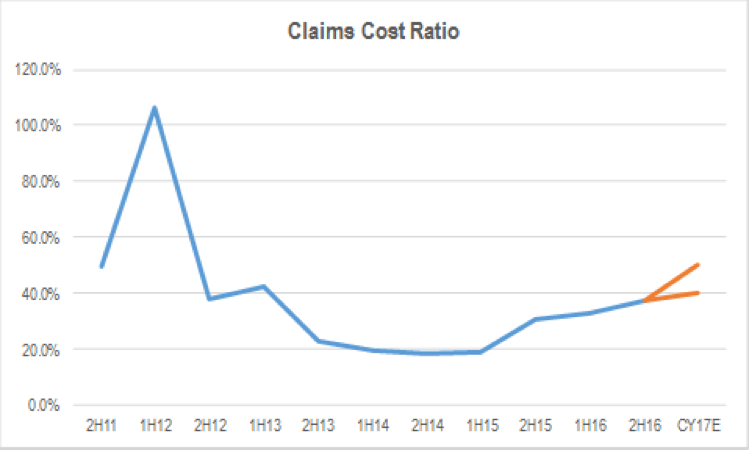

- Claims expenses have increased, resulting in rising loss ratios

GMA’s claims cost ratio has continued to rise. Of greater concern for the market has been the guidance management provided for CY17, which expects the claims cost ratio to increase to between 40% and 50%.

While this is well up on the lows of CY14, it remains well below the peaks from mid 2012.

The drivers of the increased claims cost ratio are a combination of:

- A 10-15% reduction in net premium earned. Growth in net premium earned is following gross written premium down on a lagged basis.

- Rising claims expenses.

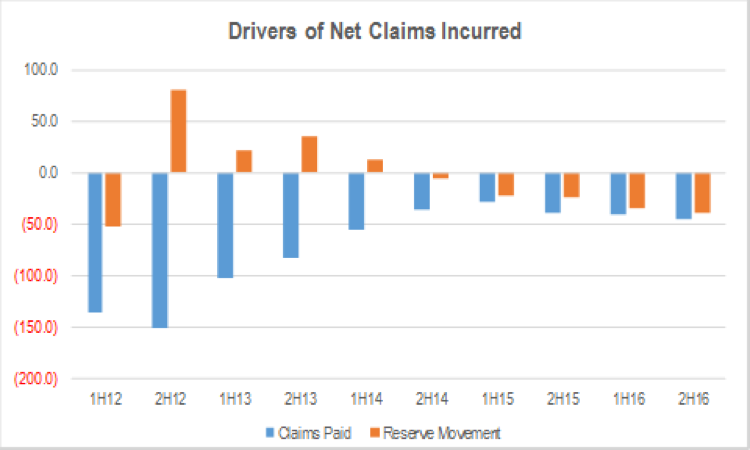

The guidance implies an increase in claims expenses of between 3% and 21% relative to CY16. Interestingly, claims paid remain well below the levels of CY12. The bigger driver of net claims incurred has been increased reserves. The movement in reserves is driven by increases in delinquencies, effectively preparing the balance sheet for what is expected to be an increased level of claims to be paid in future periods.

In the most recent spike in bad debts, the peak of claims paid occurred one year after the peak in delinquencies. So the impact on impairments of mortgage books is likely to be somewhat lagged.

- Guidance highlights an expectation that conditions will continue to deteriorate

GMA points to:

- Recent moderations in economic conditions.

- Underemployment, implying that there is more slack in the economy than is indicated by the current 5.8% unemployment rate. This reduces household wages while excess labour supply is also resulting in slowing wages growth. Both of these factors are increasing mortgage stress in certain regional economies. This is expected to result in continued increases in delinquencies from these regions.

- House price growth is expected to moderate in 2017, with Sydney and Melbourne expected to outperform the other major cities.

Any rolling over of the construction cycle in Sydney, Melbourne and Brisbane will act as an incremental drag on economic growth and labour demand. This presents an added risk to the outlook beyond CY17 as the current pipeline of residential construction projects is completed.

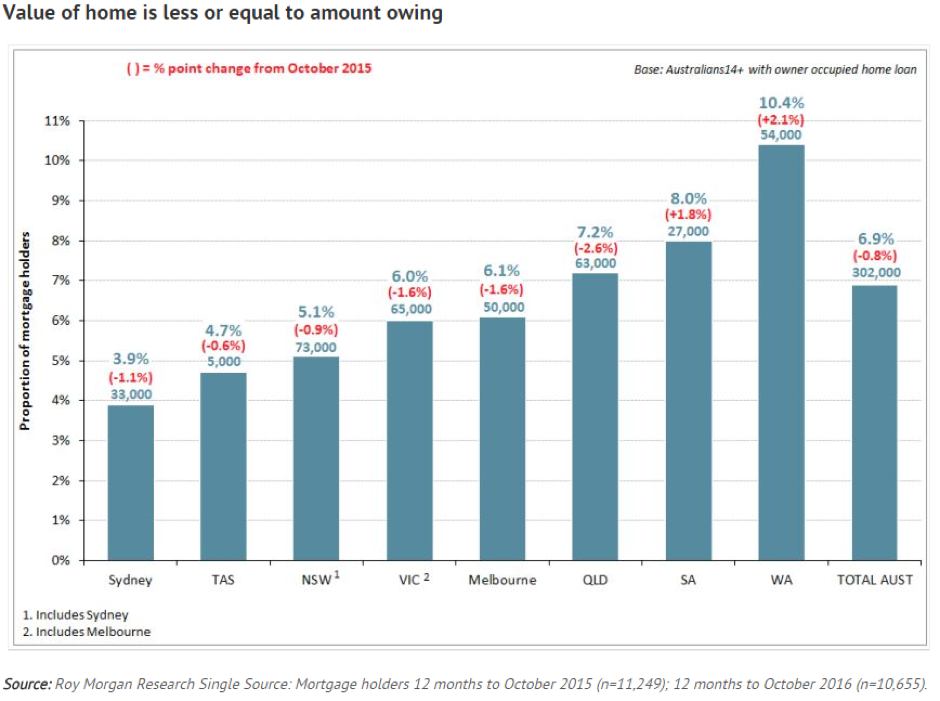

As reported by Bloomberg, a Roy Morgan report from last week suggests that 10.2% of mortgages have no equity buffer, while 8% of mortgages in SA and 7.2% in QLD have negative equity. Weak wage growth combined with falling property prices would have negative implications for more than just the banks, with debt-laden households having to significantly cut back discretionary consumption spending.

The NAB 1Q17 trading update showed that revenue growth is under pressure as lending growth slows, net interest margin is flat, and non-interest income growth remains pressured. The result was saved by strong trading revenue, and lower than expected provisions for bad debts.

The banks are cycling a year in which they bought a number of large individual institutional banking loan write-offs to account (New Zealand dairy, Slater & Gordon, Arrium, Peabody, McAleese etc). So as these items drop out of the provisioning (and in some cases like New Zealand dairy, could be partially written back), bad debt provisions are likely to fall. This is despite the underlying level of provisioning increasing on the back of increasing levels of stress in a highly geared economy. This will provide some accounting benefits in FY17, but it is likely to be temporary, with bad debt provision expenses likely to return to being a headwind to earnings growth for the banks in FY18.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY