Quality Inversion

The Australian equity market has been unfriendly to our style of investing recently. We knew before we stepped onto the field that there would be years when we generated very large excess returns and years when we would suffer, but even when you know they will happen, the bad years are always painful when they occur.

It can be a challenge during these times for an investor to sustain confidence in the philosophy and approach they have chosen to back. History is littered with examples of investors who lost faith in a sound investment approach following a run of bad results, just in time to miss out on a strong recovery when conditions turned. Indeed, academic research suggests that this type of behaviour is one of the greatest barriers to long run investor success.

With this in mind, it’s helpful to look behind the recent market dynamics. Understanding the drivers can help us work out if we should be concerned about whether we are on the right path.

There are many ways to cut the numbers, but for an investor whose philosophy begins with business quality, a helpful way to analyse the data is along quality lines. We did this analysis recently for the Montgomery Alpha Plus fund, which launched in August, but the conclusions apply to all our domestic funds.

Being somewhat obsessed with quality, we maintain a database covering the entire ASX300, in which we score every business in terms of its pricing power, barriers to entry, industry structure, switching costs, and a host of other factors. This allows us to calculate an aggregate quality score for every business we may be interested in and, using that, we can sort the market in order from best to worst. In doing this sort we are trying to rank businesses in terms of their ability to create shareholder value by investing incremental capital at rates of return above the cost of capital. This is how we think of business quality.

The underlying rationale for this is reasonably self-evident. Over long periods of time, a business that has the ability to create genuine value for its shareholders should be able to generate good investment returns by the accumulation of that value. A business that destroys shareholder value by investing at unsatisfactory rates of return is likely to do the opposite.

This is, however, a long-term dynamic. Value creation like this only reveals itself over a number of years as the business reports growing shareholder equity while sustaining a high return on that growing equity. Over shorter periods of time, the share prices for good businesses can suffer and bad businesses can surge.

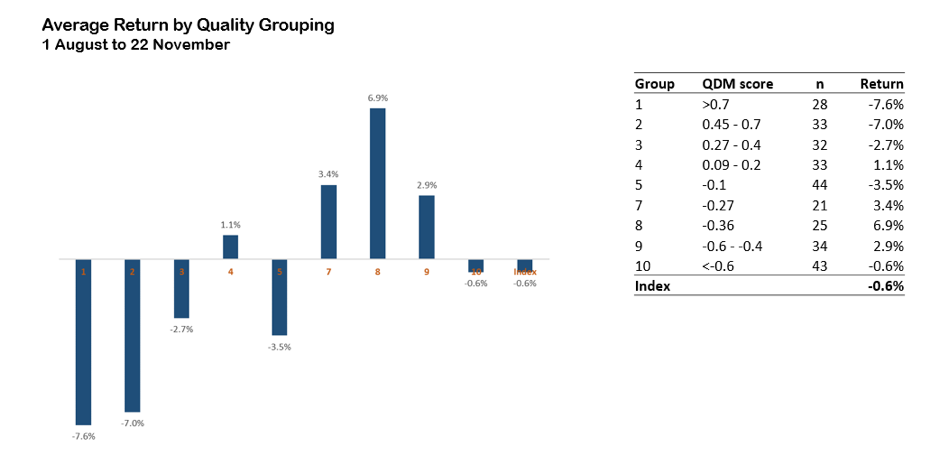

When we study the quality data for the Australian market for the period since the inception of the Alpha Plus Fund, we find that the expected relationship between quality and returns has been completely inverted. As shown below, the businesses with the highest quality scores (at the left of the chart) have delivered the worst returns, while the strongest returns have been found towards the low end of the quality scale.

To bring this data to life, let’s look at an example from the lower-quality end of the spectrum: Sims Metal Management (SGM) is a metal recycler with a market capitalisation of around $2.5 billion. Some relevant facts about SGM include:

- For every one of the last 8 years SGM has reported a return on equity below its estimated cost of equity. This effectively means that capital invested in the business has earned an inadequate return, and shareholder value has been destroyed in that process.

- Over that length of time, this value destruction has been reflected in shareholder returns. Today, the SGM share price is considerably lower than it was in early 2009. At the same time, the overall market has delivered strong post-GFC gains.

- Having regard to the nature and challenging economics of SGM’s business, we rate it as a lower-quality business. We think it lacks the attributes needed for long-term shareholder value creation.

- Since the start of August however, the SGM share price has soared. While the overall market has been broadly flat, the SGM share price has increased by some 50% (although it still sits well below its early 2009 level). The Alpha plus fund, which held a small short position in SGM, has been very much on the wrong end of this dynamic.

Investors who owned SGM during this short period look smart, and no doubt some of them are. However, unless SGM has acquired the ability to create long-term shareholder value, this recent run of success seems destined to come to an end. We can’t tell when that might happen, but experience tells us that very seldom does a bad business make the transition to being a good business, and at some point an inability to create value starts to exert its gravitational pull.

This same story appears in reverse at the higher-quality end of the market. Businesses with a demonstrated capacity to create value have been going backwards, but in most cases the ability of these businesses to create future value remains intact. It is fair to say that prices for many of these businesses had become expensive, and some pull back was warranted, but over the long run the economic appeal of these businesses will continue to work its compound magic.

Seen in this light, the most rational response to the run of weak performance seems clear. With better value now on offer in the high-quality part of the market, it is time to put some cash to work and, encouragingly, we are seeing this line of thought from quite a few clients. Inflows to our domestic funds have been strong, and we are hearing investors say that they see the recent run of weakness as an opportunity to increase exposure to the types of business we favour.

Hats off to you. It’s a genuine pleasure to be working for you.

Hi Tim,

Interesting article. I wonder if you could plot a graph of QDM&/or%return vs ave PE of each group.

Could it be that the poorer QDM groups were trading at a discount to valuation?

Regards

Joe

Hi Joe. I would agree with the idea that higher quality companies were expensive at the end of last year. This is something we had observed, and was our reason for holding relatively high levels of cash. Value for the poorer-quality companies is more difficult to assess (at least for us), but it now looks like the market is pricing in some quite ambitious growth expectations for this part of the market.

Good on you Tim. Thanks for the good work.

Kelvin

I think this article sums up the issue with the Alpha plus fund. At first I thought the idea was a great one but the more I consider it the more I am changing my mind. A market neutral fund would be great in a crash as it would preserve your capital; however, in normal market conditions a lot of poor companies are heavily shorted and so are prone to periods of rapid price appreciation, like you describe with Sims Metal. Also any unexpected good news can lead to massive rallies. So its not really market neutral at all unless all stocks are falling, otherwise it’s essentially just a risker version of a long portfolio as shorting can lead to infinite losses.

Hi James,

The theory of ‘infinite’ losses is not reflected in reality. Many more company shares have gone to zero than those that have gone to infinity.

Love your work Tim. In the short run the market is a voting machine… who would have predicted Bexit and Trump. The book makers certainly got both these voting predictions wrong. Fortunately time is Montgomerys very best friend. Keep on keeping on and sincere thanks for your efforts…