Why the rise in bond rates has hammered some good businesses

A move up in bond rates, like we’ve seen over the last two months, inevitably feeds into the valuations of growth stocks. Add in any concerns about the near term outlook and the share price movement can be really extreme.

One of the key determinants of any valuation is the investor’s risk adjusted required rate of return. Perceptions of the required rate of return, or the cost of capital, have been heavily distorted by increasingly aggressive central bank policies designed to reflate the major global economies over what has become an extremely long period of intervention.

Falling government bond rates have seen many investors lower their target required rate of return along the risk curve. This has a varying impact on the market’s estimate of value across companies.

With the deflationary impact of falling commodity prices now reversing, and increasing concerns about risk, we have seen a shift in market momentum around forward inflation expectations and government bond yields since June.

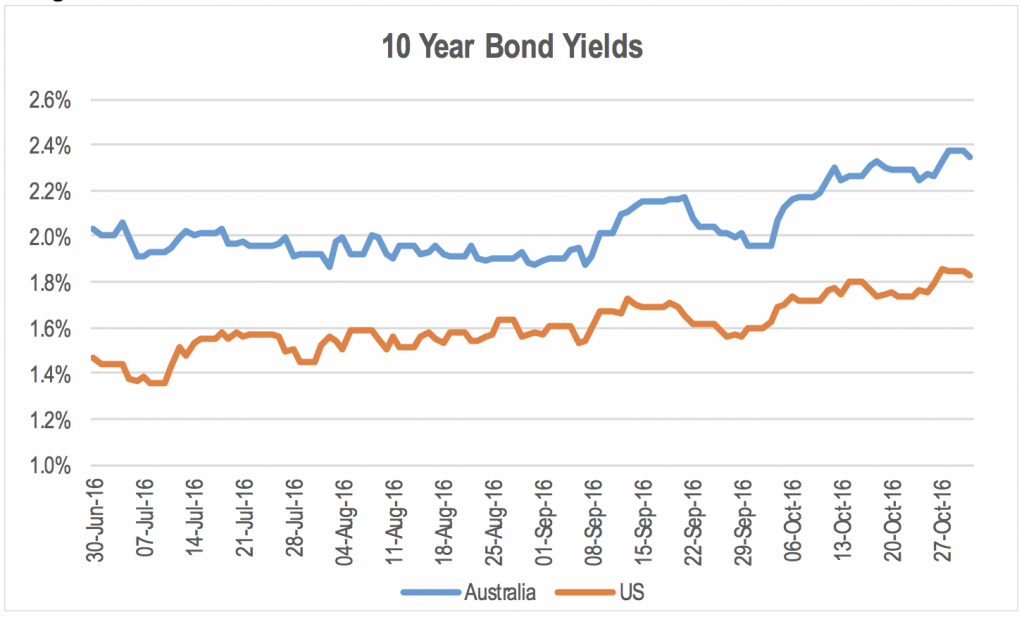

Long bond rates in the US and Australia continued to rise in October as shown in the chart below.

While the 50 basis point move up in yields from the lows in July and August might not seem significant, investors employ these 10 year bond rates as proxies for the risk free rate of return. This forms the basis of the discount rate applied to cash flows when estimating the intrinsic value of a company.

Valuations are sensitive to changes in the discount rate adopted. This is especially the case for quality and high growth companies we prefer, given that the compounding of earnings over time results in significantly larger cash flow being generated from longer-term forecasts.

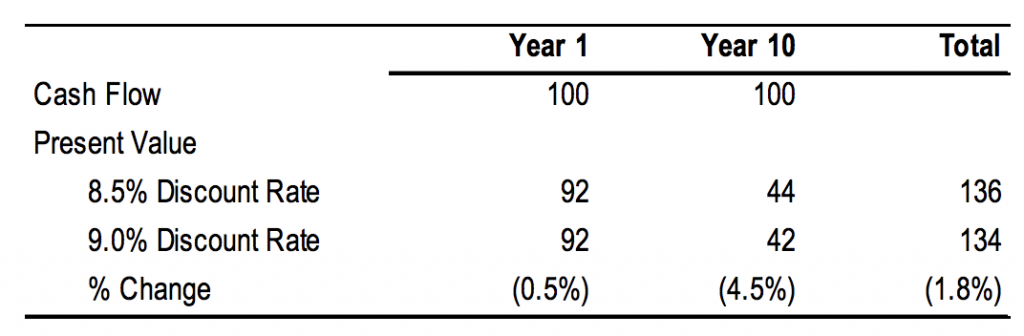

To demonstrate the relative impact a small change in the discount rate has on the present values of near term versus long term cash flows, we provide a simple example below. The table shows the present value of A$100 of cash flow in year 1 and year 10 using both an 8.5% and a 9% discount rate.

The increase in the discount rate impacts the present value of the cash flow in year 10 by 9 times as much as the cash flow in year 1.

With growth companies generating far more of their value from larger, longer dated cash flows, their valuations are more sensitive to changes in discount rates than low growth companies.

The valuation of stocks with lower discount rates are also more impacted by a given increase in discount rates than companies with higher discount rates. Hence those companies that are perceived to be defensive tend to more impacted by an increase in the risk free rate than cyclical companies.

This demonstrates that adjusting your required rate of return on the basis of movements in bond yields or other so called ‘risk-free’ assets can be a dangerous investment practice as it will tend to push a portfolio toward high duration companies at exactly the wrong time of the interest rate cycle.

While the equity market can be slow to react to changes in bond rates, a move up in rates over a period of time like we have seen over the last two months will inevitably feed its way into valuations. The sensitivity of valuations to changes in discount rates means that share prices can be extremely volatile when there is a material change in bond rates. Growth and low discount rates stocks become particularly volatile during these periods. If some concerns about the near term outlook for earnings is added to the mix, the results are particularly extreme.

And this is what we witnessed in the month of October, with companies like Blackmores, REA Group, Healthscope, Aconex, Car Sales, Bapcor, Altium, TradeMe, Link, Bellamy’s, all down over 10% in the month. And as we have previously warned, so called ‘defensive’ companies such as those in the infrastructure and property sectors, including Transurban, Auckland Airport, Sydney Airport, Mirvac Group, Stockland and Vicinity Centres, were also impacted.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Good afternoon Stuart

Rising Bond rates are not the only reason Growth stocks have disappointed of late.

When you see growth stocks trade on a PEG ratio well beyond one warning bells should

be ringing. There also appears to be a smidgeon of evidence of a rotation out of growth

stocks towards value stocks as earnings growth is hard to come by and the value stocks

generally offer a safer return with lower risk but not at a significant return difference to growth stocks when they are trading at inflated valuations.

I’m generally not a fan of high growth stocks because they have a tendency to factor in

too much blue sky and prices usually run well ahead of valuations and eventually correct, so timing selling is critical to be successful with them – a buy and hold strategy can lead to high losses that will take considerable time to make up.

Growth stocks are only worthwhile if they can be acquired at a reasonable price and the recent falls may just offer that opportunity.