Could a regulatory change affect Crown and Star casinos?

As investors, we are always interested in companies with a barrier to competition from other firms. However, we need to be mindful that, sooner or later, the barrier can start coming down. Take the gaming industry. It seems to be well insulated from competition by government regulation. But there could be a danger in relying on such barriers to entry.

Quality is a drum we beat relentlessly at Montgomery. On a long term basis, investing in companies that can reinvest at high rates of return at a price sufficiently below their fair value generates strong investment returns. While many companies can generate a high return on capital at certain points of their lifecycle, the key is picking companies that can sustain high rates of return on incremental capital reinvestment. This generally requires some sort of barrier to entry that protects a business from open competition. This could be a brand, a scale benefit, a proprietary process or product that cannot be replicated by competitors.

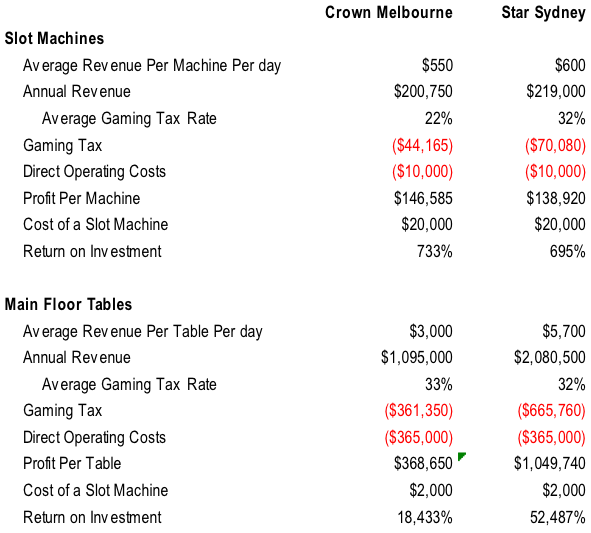

It is pretty easy to see why regulation is required to restrict a rapid expansion of gaming supply in the market. The table below maps the rough return on capital Crown and Star generate on the physical capital invested in slot machines and main floor casino tables at their Melbourne and Sydney casinos.

Clearly the economic return on an incremental slot machine or table would be an attractive incremental investment for pretty much any entertainment venue.

Governments will generally require gaming operators to pay a licence fee as well as invest a certain amount of capital in lower return infrastructure and entertainment facilities, which dilutes the return on capital from the gaming capacity, resulting in a more acceptable return for the casino on an average basis.

At the same time, governments will protect the gaming operators from competition by restricting or preventing new capacity and competitors from entering the market given the social cost of unfettered access to gaming.

While this regulatory barrier to entry can allow a gaming operator to generate a strong return on capital, there is a danger in extrapolating this return on capital into perpetuity due to the potential for governments to change regulations over time.

The gaming industry is littered with instances of changes to regulatory barriers to entry and market structures that have materially impacted the valuation of existing operators. These include the Victorian gaming market structure change announced in 2008, the special project licence granted to Crown in Sydney, the new casino licence tendering processes in QLD, and the licensing of wagering operators on low/negligible tax rates by the NT Government.

More recently we have seen both the Crown and Star Entertainment share prices negatively impacted by the Chinese Government’s latest crackdown on corruption. The arrest of Crown employees in China could have a significant impact on the ability of Australian casinos to attract Chinese customers to their VIP facilities.

While the initial focus will be on the impact on VIP revenue at the existing operations, these companies also have a significant amount of capital invested in their facilities to service this market, which will continue to require ongoing investment to remain regionally competitive.

Additionally, Crown and Star have committed to large investments in new facilities. This potentially places the companies in a bind given commitments to governments regarding these investments, which was tied to the decision to grant new licences. This spend was at least in part based on an expected volume of international VIP revenue. If this business case needs to be revised, can the casino companies adjust their capital expenditure plans to compensate without jeopardising the new licences, or will they need to press on with the investment despite the potential for a diminished return?

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY