Satyajit Das says it’s time to think about future generations

When Satyajit Das talks, it pays to listen. Das is a big thinker, and the author of six books including Traders, Guns & Money and Extreme Money, in which he covers subjects like global indebtedness, over-exploitation of scarce resources and climate change with incredible wisdom and expertise.

Yesterday I attended a presentation by Das. In it, he expressed his concern about the way problems and costs are pushed into the future to feed current consumption and lifestyles, a process that robs the generations to come.

The subject of unfunded liabilities is a case in point where many “old economy” companies and virtually every government fails to acknowledge the extent to which extremely low interest rates, the expectation of more sober investment returns and poor demographics are damaging their (true) balance sheets.

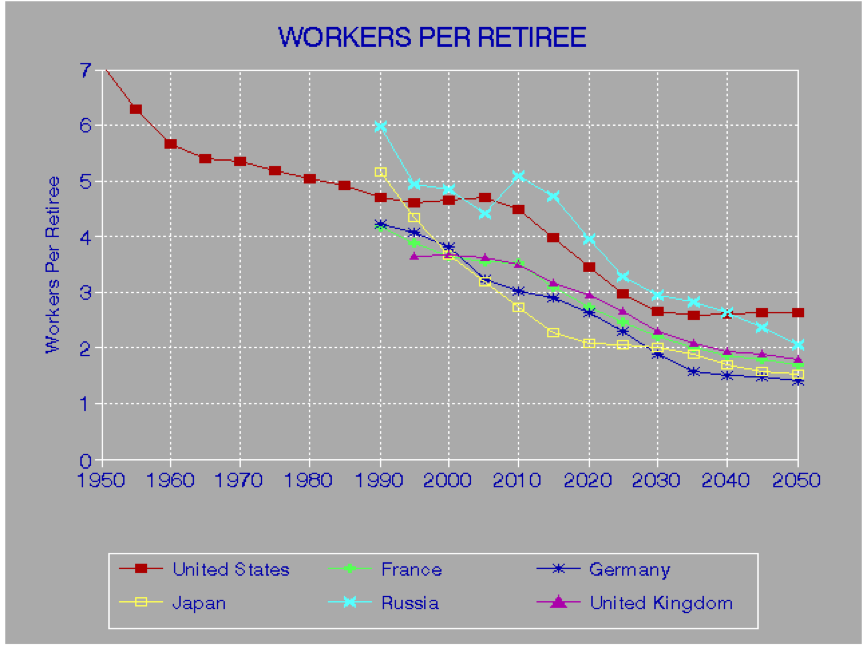

As a simple example, the once great General Motors was presented. In 1962, General Motors had 464,000 employees and 40,000 retirees on its books, a ratio of 11.6 to one. Fast-forward to the year 2000 and General Motors’ business had become a retirement operation with a car production sideline; employees numbered 141,000 while retirees numbered 453,000, a ratio of 0.31 to one.

Now think this through for most Western governments where, by the year 2050, the number of workers relative to the number of retirees is heading towards two to one – in Japan and Germany this is forecast to be closer to 1.5 to one – and the vast majority of those retirees are massively underfunded for their retirement and healthcare requirements. The call on governments across the Western world will be extreme, and these liabilities will place enormous pressure on their finances over the longer term.

As a gen-Xer lucky enough to be financially stable I cannot understand why the younger generations are not onto this issue and demanding that the older generations stop this insane experiment from which the only beneficiaries are those that are selling into the boom market.

Thanks Luke. The title of the presentation by Satyajit Das was “We are eating our children”. Telling!

Roger, this is not news – Robert Kiyosaki pointed out long ago in “Rich Dad’s Prophecy” that most people (especially the Baby Boomers) are or will be underfunded for their retirement (because they either believe(d) the Government would look after them with a pension or don’t / didn’t save for their own retirement).

People are waking up to the fact that the State pension won’t be around when they retire and if it is, it won’t be enough.

We talk about ‘self funded retiree’ like it’s a badge of honour, but every one of Generation X (and anyone else after them) will be the ‘real’ self-funded retirees by necessity – if they want a decent standard of living that’s not living in poverty (and assumes you’ve paid your house off), because there’s just not enough money to go around.

The choices are either (a) raise taxes or (b) slash the pension, both of which are political suicide. I believe that the last generation to think about future generations were the “builders” (pre-World War).

Thank you for your comment Chris; and this makes the objective of reducing the budget deficit increasingly difficult.

I read Das’ book the Banquet of Consequences. Very interesting reading for anyone interested in where we have come from and where we are going.

Daunting prospects, David.

How exactly then is house price growth and, taking it further, current nominal values sustainable in view of this future? Throw in prolonged deflation and an eventual big decline is a foregone conclusion, no?

When Das started touching on flattening yields on the 3.4 billion acres of the World’s arable land, the “casualised” economy (from a labour viewpoint) and clean water scarcity issues, the global indebtedness and western world demographic stories seemed to pale into insignificance.